THE PAST YEAR WAS ONE FOR THE RECORD BOOKS. Unfortunately, for the most part those were record losses, resulting in the worst returns going back many years.

After the first trading day of 2022, when the S&P 500 hit an all-time high, the s tock market stumbled and was never able to recover. The macro picture was shaping up to be the polar opposite of 2021, which provided record corporate earnings, record housing appreciation, minimal inflation worries, an easy Fed, and a smooth ride higher in the stock market with little volatility. All of these factors created an “easy money” environment for investors.

However, in January 2022, investors quickly realized that the stock market may very well have gotten ahead of itself, and the good times of easy money were gone. Rising inflation levels became the primary focus, which in turn led to investors bracing themselves for rising rates, as a behind-the-curve Fed would have to fight to contain the inflation it had partly unleashed with its excessively easy monetary policy.

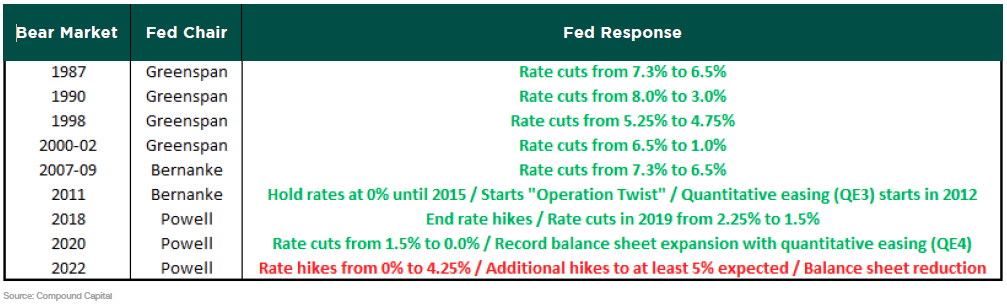

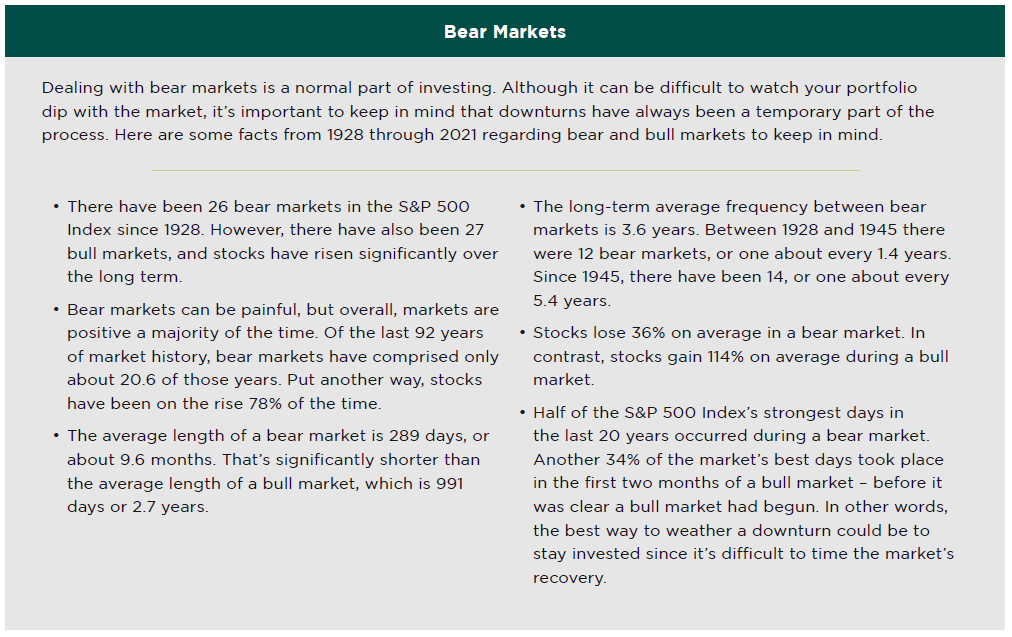

The S&P 500 quickly suffered a 12% correction in January and a bear market was confirmed in June once the index had declined 20%. In the past, when similar economic turmoil occurred, the Fed would invariably respond with rate cuts, quantitative easing, or some other signal that help was on its way. What made this time different though is that the Fed couldn’t cut rates since rates were sitting at a record low of 0%, which has been the case since the Fed cut rates in 2020

to help stimulate the economy during the height of the pandemic.

Thus, the pattern that had existed in the previous eight bear markets was now broken, and stock investors, as well as bond investors, would soon learn that times were about to get tough.

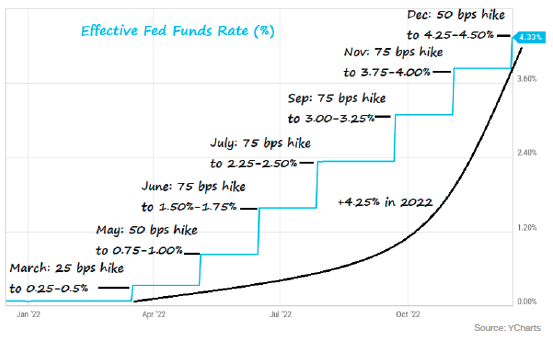

A rising interest rate environment isn’t friendly to the majority of the equity market. There are several reasons for this, but the most basic explanation is because the value of a company’s future earnings decline, which in turn leads to less demand for the stock, and therefore a decrease in price. This effect gets amplified for companies that haven’t even started turning a profit yet, which is the case for many younger, high growth companies. Many of these types of businesses borrow money to maintain a high growth rate on the top and bottom line. As interest rates rise, they will borrow less money, and the result is that their earnings will grow at a slower rate than investors anticipate. Because the Fed increased rates throughout the year at a record pace, including an unprecedented four 75-bps hikes

in a row, investors were frequently and significantly reducing the valuation levels for a majority of the stock market.

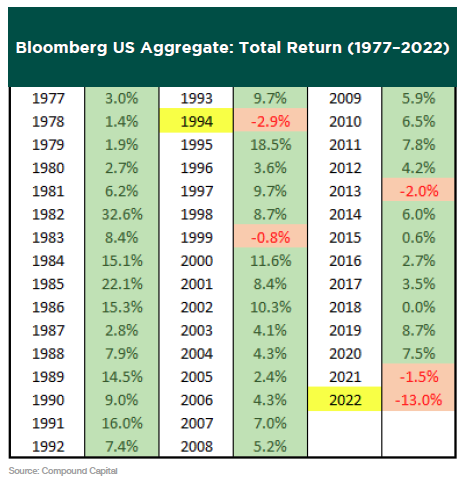

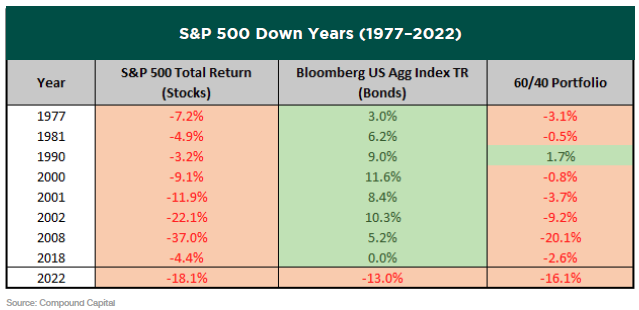

Not only are rising rates a negative for the stock market, but the bond market is adversely impacted as well. This is because rising interest rates cause bond prices to fall and bond yields to rise. So, with interest rates starting the year at 0%, bond yields were minimal. As the Fed raised rates, bond prices declined, and the marginal yield they offered couldn’t cushion the blow. This led to a 13% loss for the widely followed Bloomberg U.S. Aggregate Bond Index, which was more than 4x larger than the previous worst year in 1994.

With both the stock and bond market getting hurt from the Fed trying to fight inflation, we witnessed a rare occurrence last year in which both stocks and bonds moved down together. The last eight years when stocks finished lower, bonds rose, softening the blow. That wasn’t the case in 2022 and holding the typical balanced 60/40 portfolio didn’t do investors any favors.

RECESSION LOOMING?

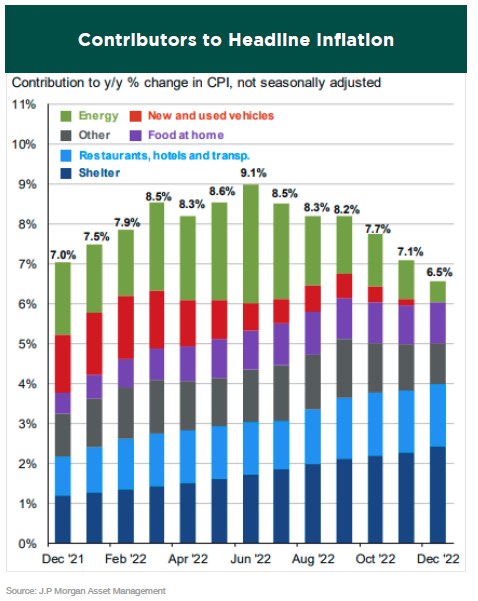

While the story last year was about inflation peaking, the 2023 narrative is shifting toward how quickly inflation can cool, and furthermore, how much cooling will be sufficient to get the Fed to pause its rate-hiking campaign. The good news is we have been seeing inflation readings trend down over the last six months since peaking in June. While it seems that inflation has likely topped out, and price increases for some types of goods have slowed considerably, price increases for

services remain high, in large part due to continued increases in the pace of shelter inflation.

There is still a long way to go before inflation gets back down to the Fed’s target goal of 2%. In fact, we at Greystone don’t think we will get to that level for a couple of years. However, the recent progress is a good start, but we don’t believe it is enough to allow the Fed to pause raising rates just yet, and therefore we think there is still going to be plenty of market volatility for at least the first half of this year. With the worst of inflation and restrictive Fed monetary policy behind us, the question on everyone’s mind is whether or not we are going to enter a recession, or if in fact we are already in a recession? And if a recession does occur, how severe will it be?

Greystone isn’t ready to give a prediction just yet. While we are encouraged by recent trends, there are just too many unknowns to give a confident projection. What we can do is look at history to get an accurate picture of what the Fed is up against.

The majority of economists believe a recession is likely to occur at some point later this year. Let’s look at some of the reasons that would support this.

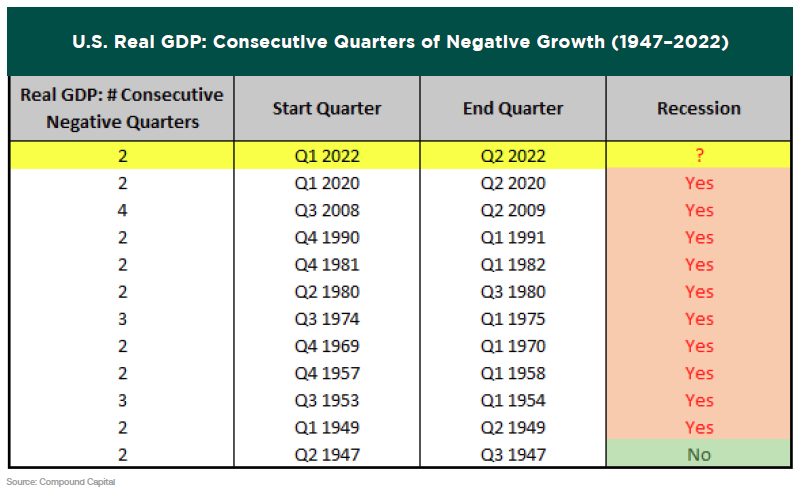

In the first and second quarter of 2022, there was negative growth in real GDP. The last 10 times real GDP fell in consecutive quarters, a recession had been declared by the National Bureau of Economic Research (NBER). With that being said, as of now, there still hasn’t been an announcement, suggesting it’s possible this may be the first time since 1947 that consecutive declines in real output did not rise to the level of an “official” recession.

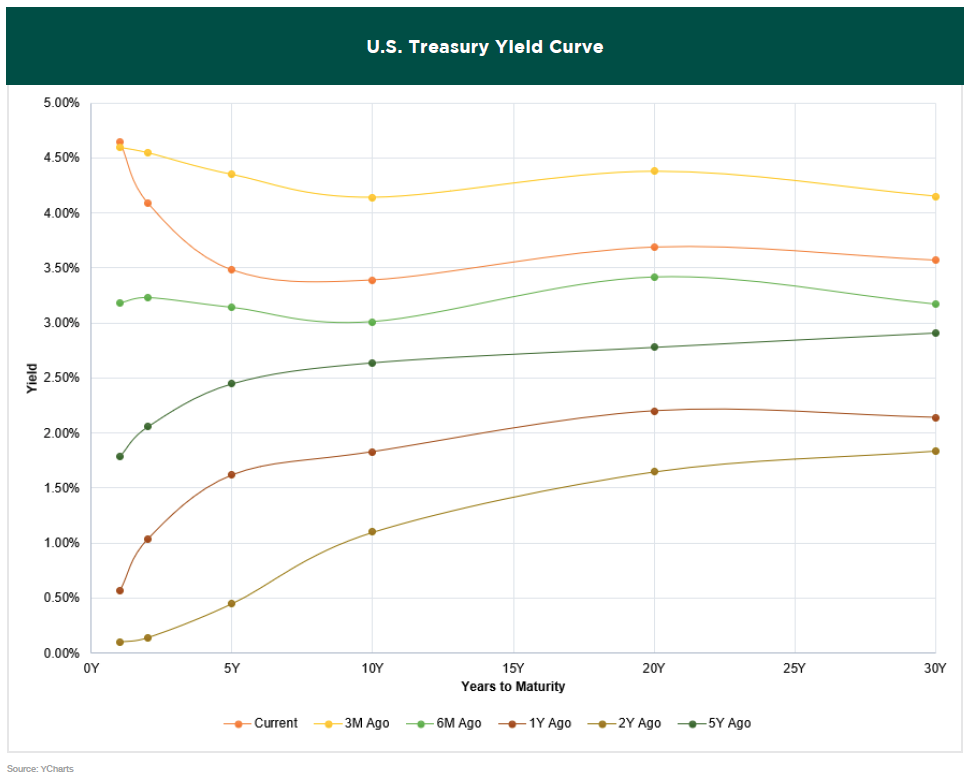

The current yield curve is one of the most inverted in history. In normal economic conditions, investors are rewarded with higher interest rates for holding bonds over longer time periods, resulting in an upward sloping yield curve. This is because these longer returns factor in the risk of inflation or default over time. A yield curve inverts when long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds and into long-term ones. This suggests that the market as a whole is becoming more pessimistic about the economic prospects for the near future.

The following chart shows how the yield curve has changed over time. The orange line is the current yield curve.

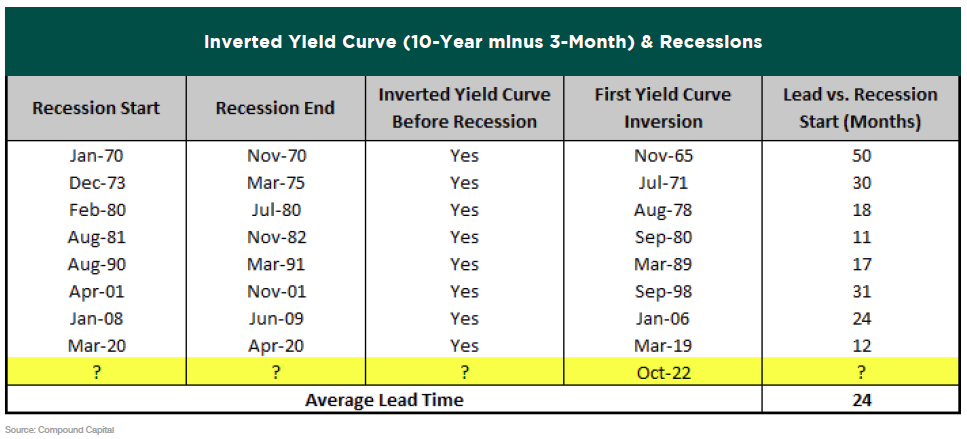

An inverted yield curve has historically been a great predictor of an upcoming recession. In fact, the last 8 recessions in the U.S. were all preceded by this omen, though the lead time has shown considerable variation.

Some counter arguments for the recession declaration are that the economy and labor market remain very strong. These points can be supported by the fact that the U.S. economy had fully recovered from the Q1-Q2 downturn by the third quarter of 2022. And while year-over-year GDP growth has slowed, it’s still positive. Regarding the job market, the unemployment rate is at a 53-year low, and there has never been a U.S. recession during full employment.

It is contradicting information like this that makes it hard to predict whether a recession is coming, or the severity of it. As the Fed continues this rate hike cycle, everyone is hoping they can achieve a soft landing, which is a slowdown in economic growth that avoids recession. And while possible, the odds aren’t in the Fed’s favor. In fact, the Fed has successfully produced a soft landing just three times in the modern era — in the mid-1960s, 1984, and 1994. This would be the best case scenario for the stock market.

A worse situation will present itself if the Fed tightens too much and raises rates too high. Some investors fear that having waited too long to begin its battle with inflation, the Fed will do just this and will break something somewhere in the global capital markets. A deep recession, plummeting corporate profits, and steep job losses often follow such a misstep. Thus, the Fed is walking a very fine line right now in order to tame inflation but also avoid this scenario.

WHAT CAN WE EXPECT IN 2023?

Throughout 2022, the investment team at Greystone got progressively more defensive in the construction of our managed strategies. With that being said, some strategies had a good head start due to their lower risk, value-tilted allocation already in place to start the year.

Other strategies, specifically the ones we manage tilted more towards growth, got hit harder in 2022, particularly in the first couple of months when the market environment was rapidly changing. But that is just the nature of a portfolio that has higher volatility embedded in it. When we eventually enter a new bull market, the holdings in these types of strategies will most likely lead the way higher.

So when will we come out of this bear market? Nobody has the answer to that, but we can at least provide our current mindset into what we expect. Just because it’s a new year, it doesn’t mean the market is suddenly going to behave radically different and change course for the better. We are still in this rate hike cycle, albeit nearing the end, and our defensive approach hasn’t changed just yet.

We will probably continue to hold onto some excess cash and overweight defensive sectors until we feel better about the market direction, although we won’t hesitate to take advantage of discounted stock prices when they present themselves, if we think the holding would be a good fit in the portfolio.

Over the next few months, we expect that stocks will remain volatile, surging on those days that positive news is reported and plunging when negative economic metrics are released. In our view, the worst of inflation is behind us. This means that the Fed can take its foot off the brakes soon, potentially relieving the upward pressure on bond yields and equity valuations. We expect to see at least a couple more rate hikes, and by the time the next quarterly Viewpoint is

released, hopefully a clearer picture will establish itself.

It ultimately all comes down to the pace that inflation is decreasing. The faster it comes down, the less the Fed will have to do, and the quicker the market can recover and get back on an upward trajectory. The longer inflation stays elevated, the more embedded it becomes in the economy, and the harder it will be to get down to the 2% target goal.

As we get closer to midyear 2023 and economic metrics begin to rebound and inflation continues to subside, we expect the markets will exit this period of volatility and will be able to begin a sustainable rally. Amid a less aggressive Fed policy, slowing economic activity, and disinflation, the backdrop for fixed income has improved and we expect bonds will play a bigger part in our balanced strategies this year.

In summary, we won’t be surprised if the market gets worse before it gets better, or at least remains in the trading range we have seen over the last few months. But we are optimistic as the year progresses, as it is pretty rare for the stock market to be down two years in a row, and the third year of a presidential cycle has historically been the best for the market. In fact, since 1950, stocks have always gone up in the year after midterms, with an average 12-month forward return of 18.6%. It’s even rarer for the bond market to have consecutive negative years, which we just experienced. However, the bond market has never been down for 3 consecutive years. Anything can happen, but we believe the odds are pretty good that this year should be a positive one for investors.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.