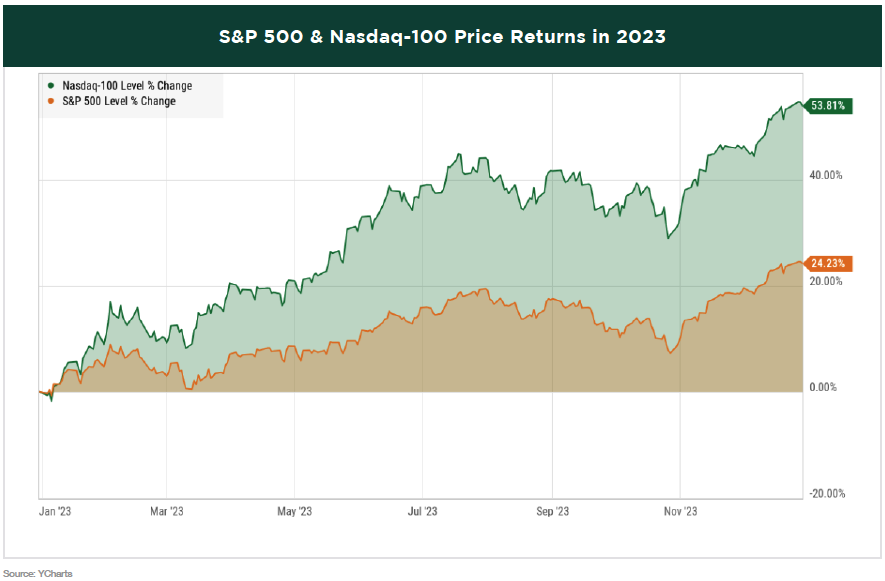

HISTORY WILL LOOK BACK ON 2023 as being an outstanding year for the stock market. While it certainly proved to be an exceptional year for popular market cap-weighted indexes such as the S&P 500 and the Nasdaq, the same cannot be said for equal-weighted indexes and many broader market constituents. This disparity stems from 2023 having the highest market concentration on record. Consequently, a handful of select stocks accounted for a significant portion of the index gains, masking the underperformance of lesser-weighted companies.

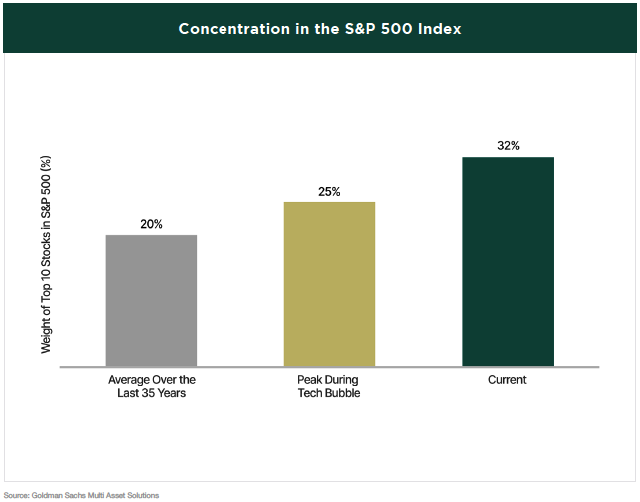

Over the last 35 years, the average weight of the top ten stocks in the S&P 500 index has been 20%. During the dot-com bubble, the combined weight of the top ten stocks peaked at 25%. At present, the figure stands at 32%. In both cases, the top names in the index were technology and internet companies.

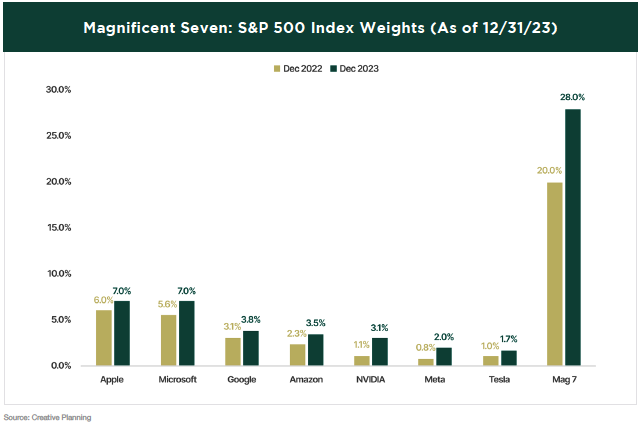

Of these ten stocks, the seven biggest, dubbed the “Magnificent Seven,” saw their market share grow significantly over the course of the year.

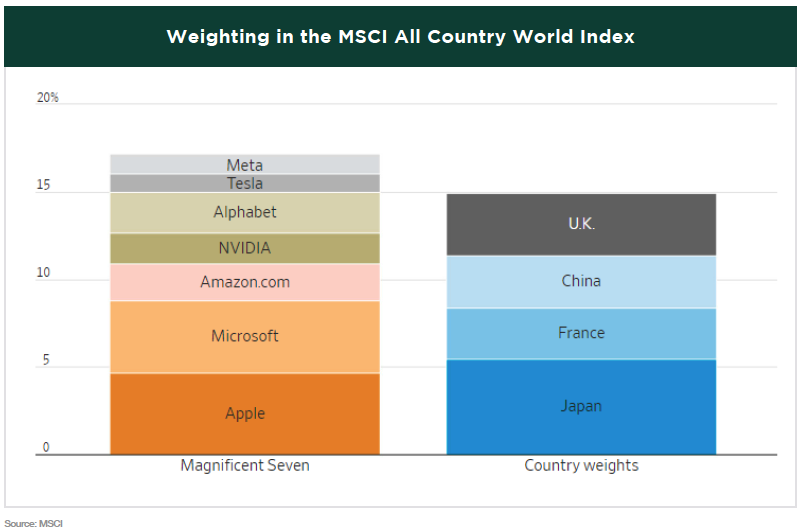

The influence of the big tech stocks is massive on a global scale, too. Within the MSCI All Country World Index—a benchmark that claims to cover about 85% of the global investible equity market—the combined weighting of the Magnificent Seven is larger than the combined stocks from Japan, France, China, and the U.K.

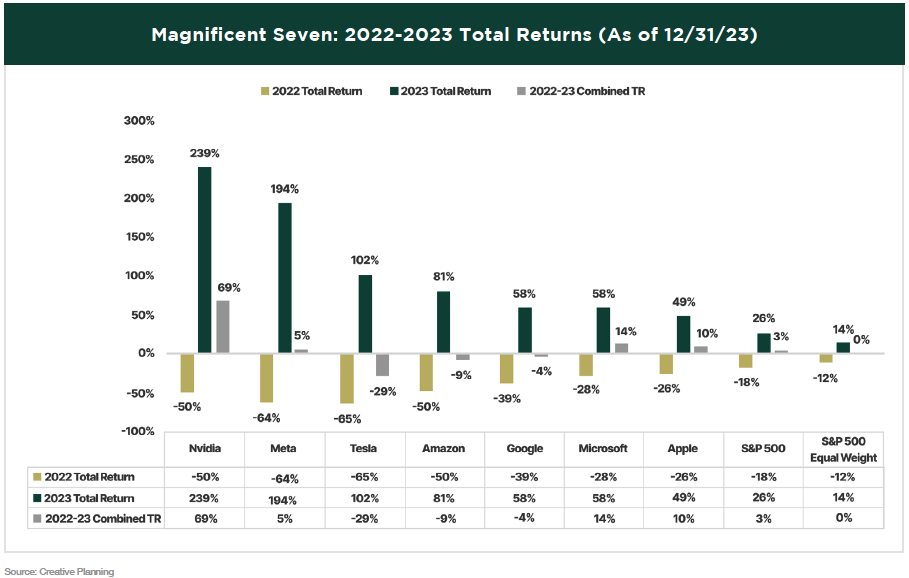

All seven stocks recovered from brutal declines in 2022 to outperform the S&P 500 in 2023 by an enormous margin (Apple was the lowest performer of the group with a gain of 49%).

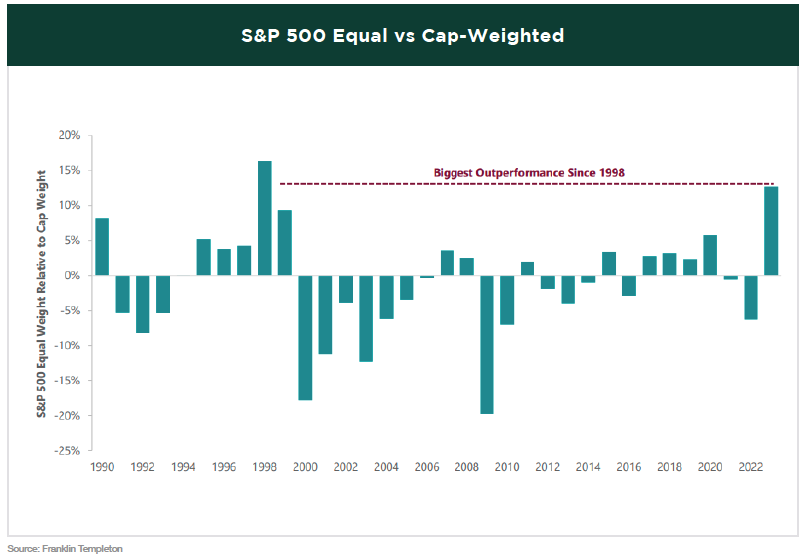

Since these remarkable performances came from the biggest companies, they had an outsized impact on the S&P 500, leading the cap-weighted index to outpace the equal-weighted version by over 12%, the largest gap since 1998.

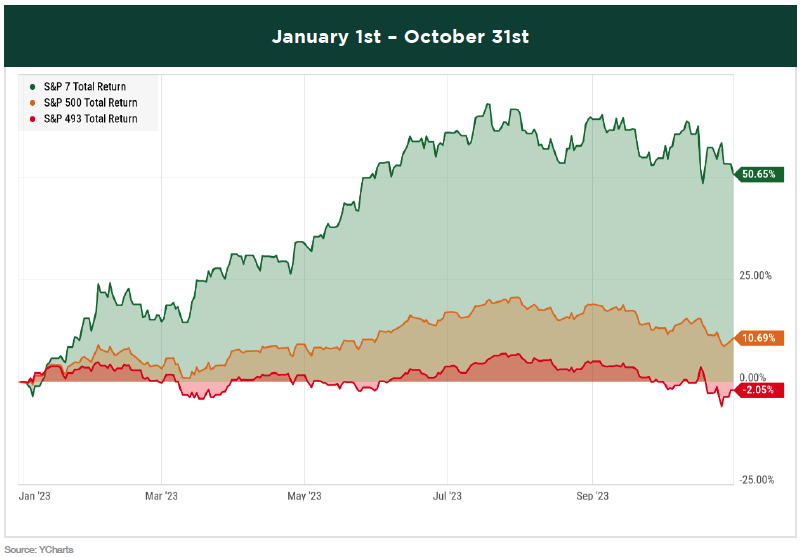

To further emphasize just how narrow the market was, through the first ten months of the year, the Magnificent Seven were responsible for the entirety of the S&P 500’s gains. Put differently, if these seven stocks were removed from the index, the remaining 493 stocks would have had a negative year-to-date return going into November.

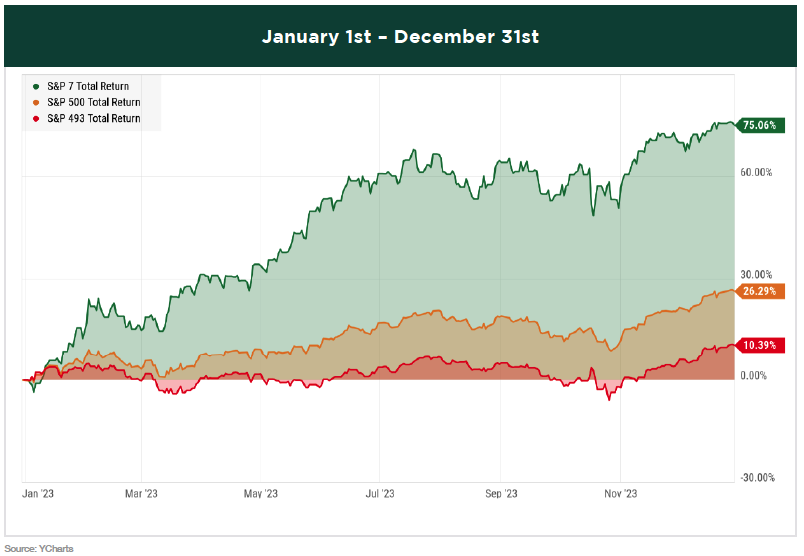

However, on November 1st, Federal Reserve Chair Jerome Powell essentially indicated that the rate hike cycle had concluded, sparking a vigorous market rally that extended into year-end. Moreover, we witnessed broad market participation, which was encouraging for the market’s overall health. Additionally, bonds joined the rally as yields declined, thereby helping the aggregate bond index avoid its third consecutive year of negative performance.

As 2023 drew to a close, the market appeared healthier than it had been throughout the year. Nonetheless, despite the recent increase in market participation, the overwhelming influence the Magnificent Seven had on index returns is astonishing, with these stocks contributing 70% of the S&P 500’s gains in 2023.

The impact of these seven stocks on the S&P 500’s performance was significant, but it was even more pronounced for the Nasdaq-100 index, which surged 55% for the year. Whereas the Magnificent Seven accounts for nearly 30% of the S&P 500’s composition, they collectively represented 55% of the Nasdaq-100 until mid-July, at which time a mandatory rebalance from the SEC reduced their combined weight to 38%, still a substantial sum capable of significantly influencing the index’s performance.

In 2023, holding a diversified portfolio—a strategy aimed at reducing the risk of significant losses and crucial for achieving our clients’ long-term goals—was not the most effective approach if the objective was to keep pace with the market. Consequently, most active managers, who prudently invest their client’s funds with a long-term perspective, lagged their market index benchmarks for the year. By contrast, broad low-cost index funds, which merely seek to mirror the markets, did their job well. However, it’s important to note that 2023 was an atypical year, characterized by market narrowness not seen since the period just before the dot-com bubble burst in 2000.

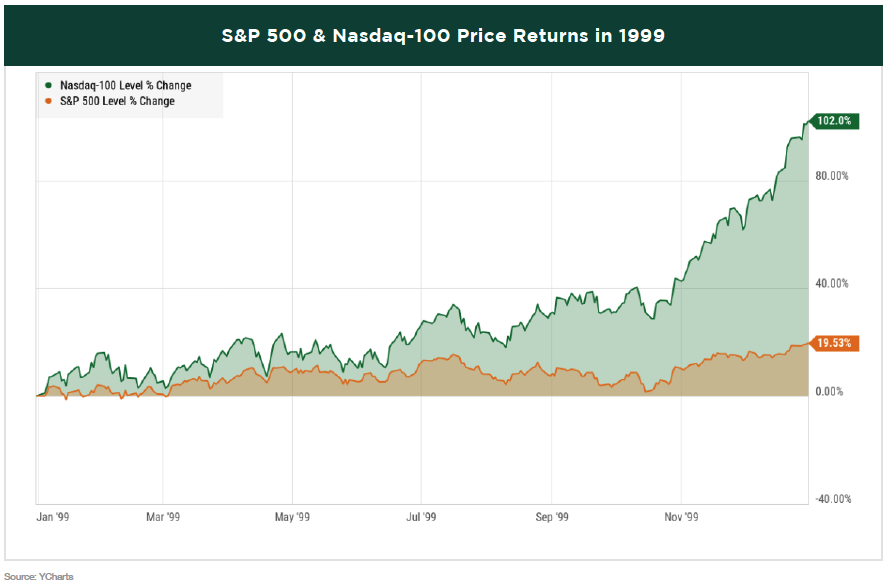

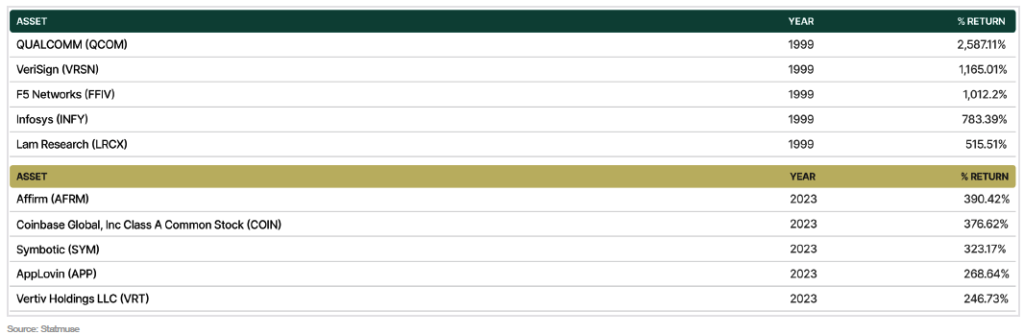

In 1999, just over half of the S&P 500 stocks posted losses for the year. Among stocks trading on the New York Stock Exchange, 64% saw declines averaging 28%. On the Nasdaq, 50% of stocks retreated an average of 32%. But you wouldn’t know it by looking at the index performance of the S&P 500 and the tech-heavy Nasdaq-100 that year.

While the late 90s tech rally and market concentration were fueled by the widespread adoption of the internet, the current tech rally and market concentration are attributed to the adoption of Artificial Intelligence (AI). However, although significant, the discrepancy in index returns last year is not nearly as stark as it was during the late 90s tech boom.

25 years ago, money managers faced a dilemma similar to what they encounter today. Should they abandon their discipline and significantly increase the portfolio weight of a few positions in an effort to match their index benchmarks? Or should they adhere to their discipline, knowing that over the long term, it’s the best approach to safeguard their clients’ capital and achieve their long-term financial objectives? At Greystone, we firmly believe in the latter. This isn’t to say that there won’t be good or even great returns for our clients in years like 2023, but a disciplined, long-term investment strategy is unlikely to keep up with the returns of an index that misrepresents the broader market in such times.

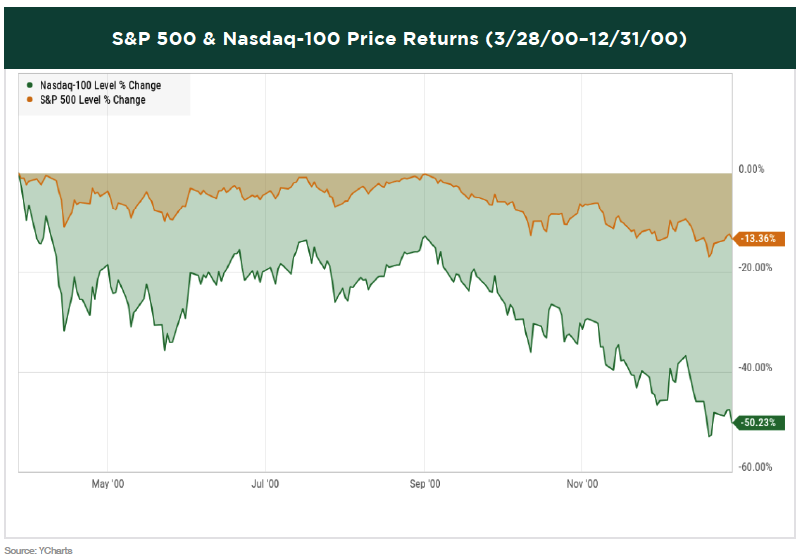

Investors undoubtedly felt euphoric as they raked in profits at the turn of the century. However, those who concentrated their investments solely in the booming tech stocks and neglected to diversify or liquidate their holdings in time likely faced substantial losses when the bubble burst in March of 2000. As that year began, the market continued its climb higher, but once the correction was underway, it proved relentless. From late March through the year’s end, the Nasdaq lost half of its value, whereas the more diversified S&P 500 retreated just over 13%, faring much better than its tech- heavy counterpart.

Over the subsequent two years, the market continued its slide, resulting in the S&P 500 to ultimately decline over 50% from its peak in 2020, while the Nasdaq-100 plummeted by over 80%.

While there are parallels between the late 90s and the present, it doesn’t mean we are going to see a repeat of what happened in the stock market back then, or anything close to it. Unlike the tech bubble era, the companies comprising today’s market concentration boast substantial cash reserves, are highly profitable, and have expected growth rates and margins that are double those of the broader market. In large part, their fundamentals can support their current valuations, with many of these companies trading within their historical valuation ranges.

Furthermore, when we compare the top-performing stocks of 2023 with those of 1999, the magnitude of the highest returns last year was nowhere near the extreme levels observed back then.

Even if the hype surrounding AI persists for a few more years and this proves to be a bubble that eventually pops, we wouldn’t anticipate the broader market undergoing a crash anywhere near the scale of what occurred previously.

However, we do anticipate that some companies may face a similar fate, particularly those capitalizing on the current hype by incessantly referencing AI to their investors and touting its transformative potential for their businesses, without any evidence behind the claims. Such companies, which boast about AI but fail to effectively monetize it to drive business growth, are likely to spark a widespread exodus of investors who were initially attracted to the company’s AI narrative.

If the stock market last year was characterized by concentration, what lies ahead for investors in 2024? Thus far, it appears to be a continuation of the trends observed for much of the previous year. The bulk of capital is still flowing towards larger, safer companies with robust balance sheets, rather than smaller, uncertain prospects that may struggle in the event of an economic downturn. This poses a challenge for investors, as despite the Federal Reserve’s efforts to curb economic activity and combat historic inflation levels through the fastest rate hike cycle in history—historical precedent suggesting an impending recession—the economy has remained remarkably resilient and strong. This leaves investors puzzled as to where to allocate their funds to achieve optimal returns, with many choosing to simply park their cash into high-yielding money market accounts, or short-term Treasurys, rather than deal with the uncertainty of the stock market.

It’s a natural inclination to want to safeguard your finances during times of uncertainty. However, uncertainty is a constant when dealing with the stock market. It seems completely illogical for the stock market to be hitting all-time highs given how restrictive the current monetary policy is. It doesn’t make sense. But the market often deifies logic in the moment, and it has a tendency to inflict pain on the most investors as possible from time to time.

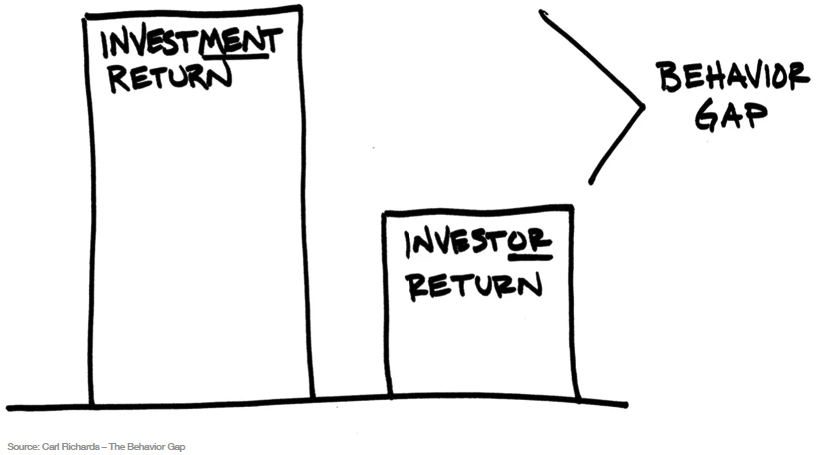

This inherent unpredictability underscores the difficulty of investing and contributes to the gap between real investor returns and average investment returns, known as the “behavior gap.” This gap arises from irrational decisions driven by a desire to avoid pain and pursue pleasure, which can result in lost capital or investing in assets when they are overpriced, thereby reducing returns.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.