DURING THE FIRST QUARTER OF 2024, the stock market was able to maintain its upward momentum, with the Dow Jones Industrial Average advancing by 5.6%, the Nasdaq Composite rising 9.1%, and the S&P 500 notching a double-digit gain of 10.2%, leading the three major stock indexes. Underneath the surface, there was a noticeable expansion in market participation beyond just mega-cap technology stocks, marking a positive shift from the narrow market leadership that characterized much of 2023.

The impressive performance was fueled by solid fourth-quarter company earnings, sustained optimism surrounding artificial intelligence, positive economic data driven by a resilient labor market, strengthening consumer confidence, and the hopeful expectation that the Federal Reserve will successfully execute a soft landing.

While equity investors celebrated the strong economic data, fixed income investors faced a more challenging period. Persistent inflationary pressures, resilient economic activity, and the Federal Reserve’s slight retreat from its dovish stance in December all contributed to negative returns for bonds. This shift in the macroeconomic landscape was also evident in market expectations for interest rate adjustments, with the implied number of anticipated rate cuts for 2024 decreasing from six to seven cuts at the end of 2023 to no more than three cuts in total, beginning this summer at the earliest. Current market pricing is now more closely aligned with the Fed’s latest projections. As hopes for aggressive rate cuts diminished, yields climbed, resulting in negative returns across most bond indexes.

The first quarter saw gains across all but one sector, affirming the broad-based nature of the rally. Energy was the top performer, propelled by the rise in oil prices fueled by heightened geopolitical tensions. Interest rate sensitive asset classes, such as utilities and real estate, suffered as they were adversely affected by the rise in rates, with the real estate sector recording losses in the quarter.

As April draws to an end, stocks have given back some of the gains, with the S&P 500 dropping just over 5% from its March 28th high. However, investors must remember that as painful as market pullbacks are, they are very common.

A “pullback” is defined as a decline between 5-10% and a “correction” is a decline between 10-20%. Pullbacks happen roughly 3-4 times per year and corrections take place on average about once per year. Sometimes the market just needs a period of consolidation to absorb significant gains before it can take the next leg up.

With that being said, it would not be surprising to see further downside after the incredible rally stocks have had over the last six months. We expect the market to bounce around for a while, possibly into the summer months, and we will use weakness to look for buying opportunities as we believe the bull market which started last October will continue. We also expect strong performance at the tail end of the year, which is what typically happens in election years. We will expand on the upcoming election and market implications in next quarter’s The Viewpoint.

What has caused the market to take breather recently? Primarily, it can be attributed to the escalating geopolitical uncertainty caused by the Israel-Iran conflict, fear over the stubborn inflation, and the realization that the Federal Reserve is going to take longer to cut rates than investors had been anticipating.

These factors helped push the Volatility Index (VIX) up to 19.2, its highest close since last October. Is this extreme? Not at all. The average VIX level since 1990 is 19.5.

Since the Israel-Hamas conflict began in October, tensions have brewed as key actors react to the evolving situation. Earlier in April, Iran launched a significant drone and missile attack against Israel in retaliation for a strike on its consulate base in Syria. The world held its breath, awaiting Israel’s response, which turned out to be a limited strike on a military target in the Iranian city of Isfahan. Iran appeared to downplay the incident, with a top official stating no immediate plans for retaliation. The events mark a clear escalation of tensions in the region, but it’s worth noting that these attacks seem calculated to avoid intensifying the conflict while still demonstrating resolve.

There are a couple notable risks associated with this situation. Firstly, there’s the evident risk of a broader conflict. Given that the Middle East contributes roughly one third of global oil production, if other regional players choose sides, it could complicate the energy supply landscape. While recent events have already caused oil prices to rise, a further escalation in the conflict could lead to a substantial spike in prices. This brings us to the second risk of transit disruption. The Strait of Hormuz facilitates almost 20% of global oil supply and a significant portion of all shipping volumes. Iran’s proximity to this crucial channel poses a risk of disrupting supply on a global scale. Although these risks could significantly impact energy supply, they appear to be contained for the time being.

Geopolitical upheaval is nothing new, and while this current conflict remains uncertain and carries heightened risks, the likelihood of a wider conflict seems low for now. During times of war, investors often react excessively, leading to initial stock market downturns. In such situations, it’s crucial for investors to keep three things in mind.

- Uncertainty prevails, and no one can predict the future regarding the outcome of the

- Excessive exposure to crisis-related information tends to amplify fears and focus on worst-case

- Even if predictions materialize, market reactions remain

Throughout history, despite initial market retreats due to investor fear and selling, these downturns have typically been brief and presented buying opportunities. Those who panic and sell often miss out on potential returns as they delay re- entering the market.

Rising energy prices are one of the factors fueling inflation’s unfavorable trajectory this year. The Consumer Price Index (CPI), the primary measure for tracking inflation, rose to 3.48% year-over-year in March from 3.15% in February and 3.09% in January. This marked the highest headline reading since last September.

The U.S inflation rate has now been above 3% for 36 consecutive months, the longest period of high inflation since the late 1980s/early 1990s.

Core CPI, which excludes food and energy, moved up to 3.80% year-over-year from 3.76% in February, the first uptick in core inflation since March 2023.

While the Federal Reserve has made significant strides in slowing down inflation since its peak levels in June 2022, the recent trend is somewhat concerning, reigniting fears that reaching the “last mile” to bring inflation back to the Fed’s target of 2% might prove more challenging. It’s remarkable that the economy has weathered the swift pace of interest rate hikes implemented by the Fed so far. Few anticipated that our economy would not only endure but remain robust after experiencing 525 basis points worth of rate hikes in less than 18 months. Looking at past rate hike cycles, historical precedent suggests that our economy should have shown more signs of strain by now. However, the unprecedented nature of the once-in-a-century pandemic, coupled with the injection of five trillion dollars of government stimulus funds toward individuals, businesses, states, schools, and healthcare providers, among others, made it impossible to accurately predict how the economy would respond.

The pandemic brought about a profound disruption in the labor market, as tens of millions of individuals voluntarily exited their jobs, resulting in a lingering shortage of workers that can still be felt in some industries even now.

Additionally, the shift to remote work has transformed the dynamics of the workplace, potentially altering it permanently. Ultimately, we find ourselves in uncharted territory, as the changes wrought by the pandemic over the past four years are unprecedented, leaving us uncertain about the long-term impacts.

Nevertheless, the current strength of the labor market stands out as the primary factor behind the economy’s remarkable resilience. In March, over 300,000 jobs were added in the U.S., significantly surpassing the consensus estimate of 200,000.

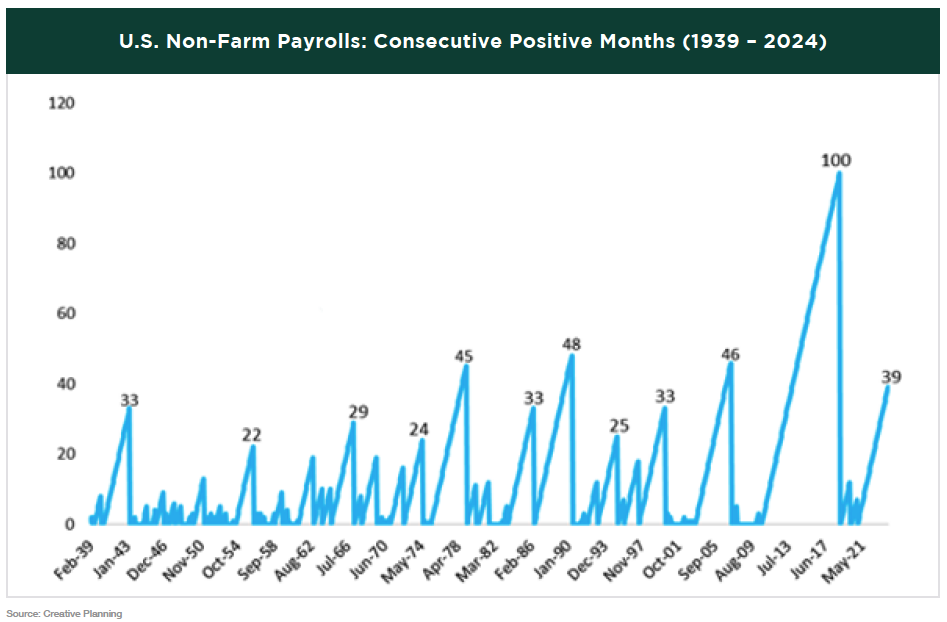

For 39 consecutive months, we’ve experienced job growth, a scenario that would have seemed unimaginable if one had been told that the Federal Reserve would raise rates from 0% to over 5% in less than two years. Typically, such rate hikes would prompt companies to scale back their hiring and even necessitate laying off some of their workforce as business conditions tighten.

It’s unlikely that the Fed would openly acknowledge it, but they may indeed require more individuals to start losing their jobs. This would help facilitate their objective of slowing down the economy sufficiently to curb inflation. One of the key reasons for the economy’s ongoing strength is its heavy reliance on consumer spending, which accounts for approximately 70% of economic activity. As long as people continue to spend, the economy is likely to remain healthy, and individuals will keep spending as long as they are employed. Essentially, the Fed needs the unemployment rate to rise. Currently, we’re still at a historically low unemployment rate of 3.8%, which decreased from 3.9% the previous month.

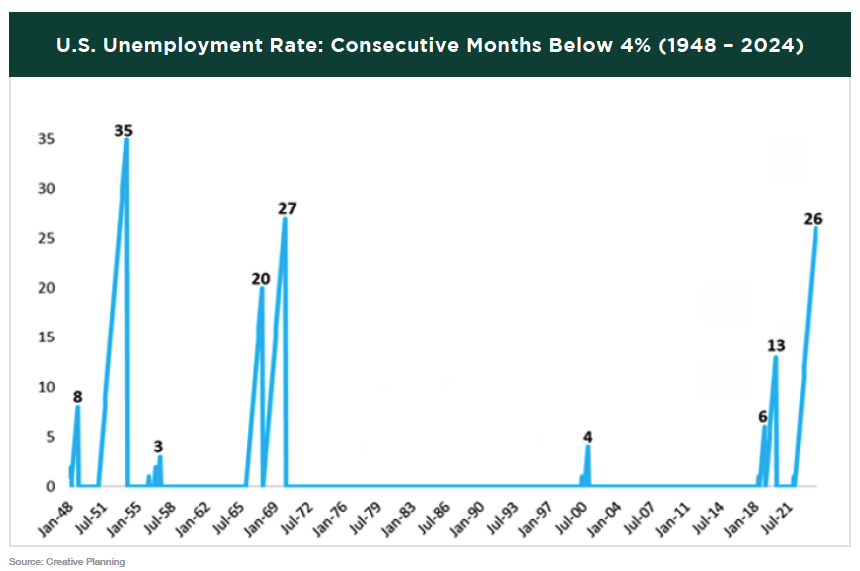

The unemployment rate has now remained below 4% for 26 consecutive months, marking the longest streak since the late 1960s.

Recently, the strong economic data and rising inflation have driven interest rates across the yield curve to their highest levels since last November. This development spells trouble for both the stock and bond markets and is currently

our primary concern. Last summer, as yields climbed, we observed a market selloff, and there’s a looming fear that a similar fate awaits if rates don’t reverse course soon. Moreover, the longer rates remain elevated, the greater the risk of a significant disruption. We had a glimpse of this impact last year with the mini bank crisis, which briefly sent panic throughout the stock market. Fortunately, that incident was managed, but there’s no guarantee of a similar outcome in the future.

In summary, despite a strong start to the year for stocks, April has seen a partial retreat from the gains made in the first quarter. Whether this downturn represents a healthy pullback or becomes something more severe remains to be seen. Keep in mind, pullbacks happen on average 3-4 times per year, but they can still be distressing when you’re in the midst of one. While the Israel-Iran conflict warrants monitoring, we anticipate minimal market impact unless the situation escalates significantly. The Federal Reserve continues to grapple with recent inflationary pressures, and we do not anticipate any rate cuts until the second half of the year if they occur at all. If the economy and labor market maintain their strength, there’s a decent possibility that no rate cuts will materialize this year.

Traditionally, when stocks begin a year as they did this year, the chances are quite favorable that the equity market will see gains over the next 6-12 months. While we generally refrain from making predictions, the investment team at Greystone is anticipating a volatile market leading into the summer months, with a strong likelihood of a solid finish to this election year.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT

GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.