Last month we highlighted some of the changes in store after the SECURE Act 2.0 was signed into law in December 2022. As part of SECURE Act 2.0, workplace savings plans will be expanded, retirement account contributions will be rewarded, and retirement tax incentives will be reshaped.

From the new legislation, retirement savings accounts will undergo numerous changes for years to come. For example, tax breaks are available for 401(k), 403(b), Roth, and IRA accounts, among others. These changes could have a significant impact on your retirement savings and personal finances.

The future impact of changes in tax rules, savings plans, Social Security benefits, and more will be felt by many Americans.

This legislation is expansive and phases in over several years. We will continue to share pieces as we unpack all that is included. For now, let’s look at some of what is to come.

Flexibility in retirement timelines.

Those who participate in tax-deferred retirement accounts, including 401(k) s and Traditional IRA’s, must begin receiving required minimum distributions (RMD) when they are 72 years old. The reason is to recoup the government’s share of gains made in the account while it was tax deferred.

Initially, the SECURE Act raised the retirement age from 70.5 to 72. However, as part of SECURE Act 2.0, the age limit will be raised again to 73 on January 1, 2023, and 75 on January 1, 2033.

Also worth noting, SECURE Act 2.0 will reduce the penalty for not taking RMDs from 50% of the amount that should have been distributed to 25%, or 10% if the mistake is corrected promptly.

Enrollment will be required automatically.

With some exceptions for small businesses, workers will be automatically enrolled into newly created 401(k) and 403(b) plans in 2025. A person’s automatic enrollment will begin between 3% and 10% of their pay scale. Additionally, the savings rate will be increased by 1% each year until it reaches 10% to 15%.

An increase in retirement plan contributions.

2023 will be the first year in which retirement savings vehicles (IRAs, 401(k)’s, etc.) receive inflation-adjusted contribution limits.

A person 50 or older can now put $7,500 into an IRA in 2023. For people under 50, the limit has been raised to $6,500 from $6,000 last year.

There is a maximum contribution of $30,000 you can make to a workplace retirement plan such as a 401(k), 403(b) for workers aged 50 or older, while workers under age 50 have a new contribution limit of $22,500.

The catch-up contribution limit has been raised.

Also, in the coming years, SECURE Act 2.0 will include multiple provisions to increase contribution limits. For example, there are currently certain limits on what can be contributed to a retirement plan by someone age 50 or older. Starting in 2025, SECURE Act 2.0 raises these limits to the greater of $10,000 or 50% more than the regular catch-up amount for those who are 60, 61, 62, or 63. These amounts will be indexed for inflation after 2025.

Additionally, SECURE Act 2.0 rules will change how eligible workers with income over $145,000 make catch-up contributions starting in 2024. The income threshold will also be adjusted for inflation.

IRA catch-up contributions will be indexed to inflation starting in 2024, raising the $1,000 cap for the first time in over a decade. In addition, a new, higher contribution cap will apply to people between 60 and 63 beginning in 2025, which will also link 401(k) catch-up limits to inflation.

A savings credit to a savings match.

Starting in 2027, SECURE Act 2.0 will replace the nonrefundable Saver’s Credit with a government matching contribution deposited directly into your IRA or retirement plans.

As part of the Saver’s Credit match, people can contribute up to $2,000 to their IRA or retirement plan. It will, however, be subject to income limits and phase-outs.

Inflation-adjusted Social Security payments.

Social Security beneficiaries are receiving their most significant increase in monthly benefits in more than 40 years because of inflation. Cost-of-living adjustment (COLA) increases the average monthly retirement benefit by $146, from $1,681 to $1,827, due to an 8.7% increase in the cost of living.

Changes to Medicare.

There will now be reductions in Medicare Part B premiums and deductibles. For 2023, Medicare Part B will cost $164.90 per month, a decrease of 3%, or $5.20 per month, from $170.10 per month in 2022.

A $226 annual deductible will be in effect in 2023 for Medicare Part B beneficiaries, a reduction from the $233 deductible in 2022.

The Inflation Reduction Act guarantees that copays for insulin for 3.3 million Medicare Part D beneficiaries with diabetes will be capped at $35 for a month’s supply beginning in 2024.

What else is noteworthy in 2023? There will be no copays or deductibles associated with vaccines covered under Part D.

Please note that several years will pass before most of the provisions of the Inflation Reduction Act, including lower prescription drug prices and out-of-pocket expenses for Medicare beneficiaries, take effect.

A 401(k) can be used for emergency savings.

SECURE Act 2.0 seeks to make it easier for individuals to access their 401(k) savings in an emergency.

In the wake of the COVID-19 pandemic, employers became concerned because early 401(k) withdrawals were widespread despite heavy penalties. As a result, 401(k) plans now include emergency savings accounts, allowing employers to enroll employees automatically.

Also, rainy-day funds of up to $2,500 will be available for employees to save. Employees who use their emergency fund will no longer be penalized 10% for pre age 59.5 early withdrawals.

The bill also allows penalty-free withdrawals for exceptional circumstances, such as payment of long-term care insurance and withdrawals for terminally ill or domestic abuse victims.

Moreover, federal disaster victims can withdraw up to $22,000 without penalty, plus take three years to repay the money and income taxes owed.

From 2027 onwards, the government will contribute $1,000 each year to eligible retirement accounts. This program encourages low to moderate income workers to save for retirement.

Deductions for standard expenses.

In most cases, taxpayers take the standard deduction instead of itemizing their deductions. Those married couples who fall within that majority can take $25,900 off their taxable income in 2022, up from $25,100 in 2021. A $12,550 standard deduction will be replaced by a $12,950 standard deduction for individuals.

The full retirement age.

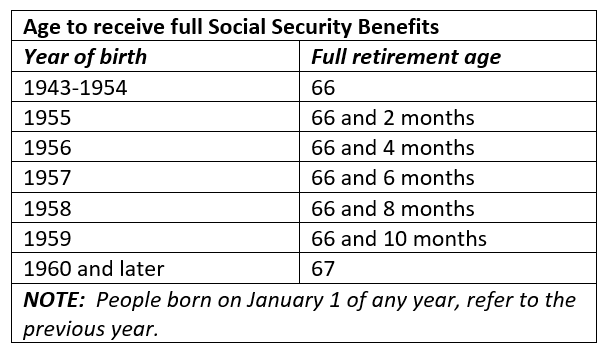

In 1983, Congress passed a law to gradually raise the Social Security full retirement age (FRA) from 65 to 67, the age at which you are eligible to receive 100% of your retirement benefit. By mid-2023, the change will be complete, with FRA reaching 66 years and six months.

FRA is 66 years and four months for people born in 1956. By the end of April this year, you will reach the milestone if you were born between September and December 1956. Those born in 1957 can claim their full retirement benefit midway through the year at 66 and 6 months. If you were born after 1960, you will reach FRA at 67.

The following chart, from www.ssa.gov, lists the full retirement age by year of birth.

Depending on your age, you can start collecting Social Security retirement benefits before FRA, the minimum age is 62, but you will lose up to 30% of your monthly paid benefits. Also, if you wait past FRA, you can enjoy an increase of 8% per year until you turn 70.

More to come…

Like I said at the beginning, there is a lot to cover in this legislation. We will talk about more of the SECURE Act 2.0 provisions in future communications. I will close by noting, while intended to help Americans save for retirement, it also impacts how all of us should view the importance of our estate planning, investment planning, and financial planning. Whether you are focused on accumulating wealth or transferring your wealth to the next generation, we are here to help you navigate an ever-changing landscape.

M. Brian Wachsler

Director

Disclosures:

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their wealth advisor prior to making any investment decision.