We recently celebrated the one-year anniversary of the March 2020 market bottom. Little did we know how much the world, our daily habits, and our portfolios, would be changed. Some stocks lost over half their value in a matter of days. But, since the bottom through April 15th (the time of this writing) the Dow is up 82%, the S&P 500 85%, and the NASDAQ a massive 106%. Goes to show how important staying invested is, no matter how grim things look.

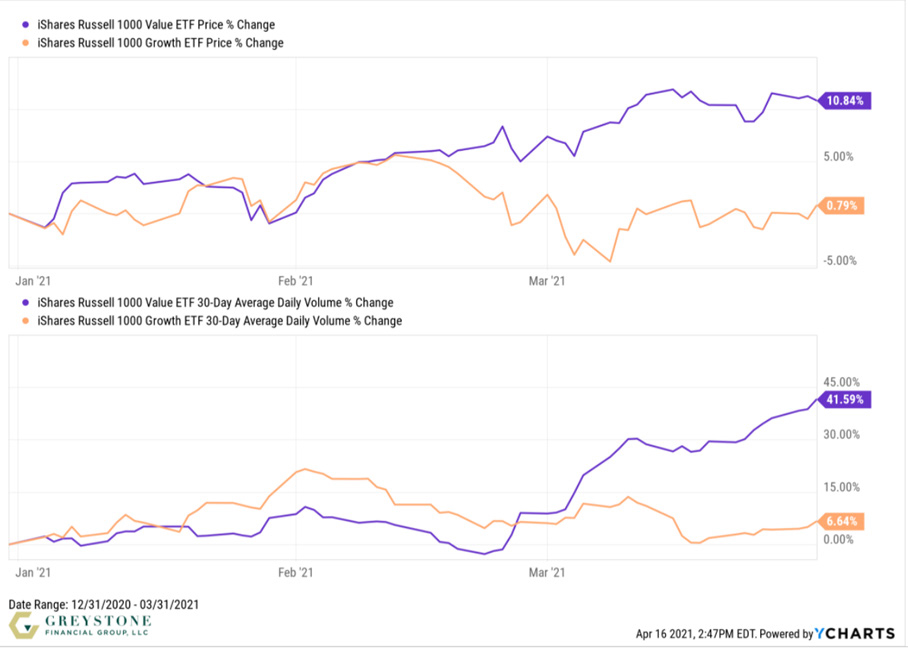

The big story of 2020 (and the last decade) was growth’s outperformance over value. However, in March the tables turned — value was up 10.8% after Q1 2021, while growth was about flat. Value has been experiencing surging levels of trading activity, too.

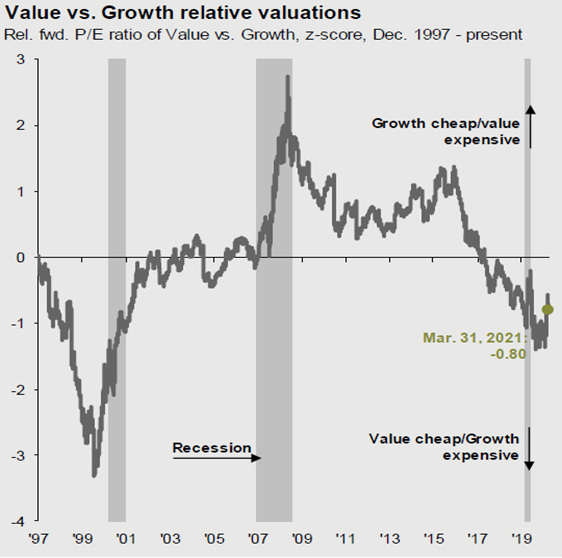

Are we finally witnessing the arrival of the long-awaited growth to value rotation? Many investors believe this is the case, and we at Greystone are no different. But what is value investing after all? In short, this can be defined as investing in stocks that appear undervalued in the marketplace and are cheap by some statistical measure, such as price-to-book or price-to-earnings ratios. Over the last few months, the investment team at Greystone has been shifting the portfolios away from stocks that have become exceedingly overvalued, to cheaper stocks that should provide a better return on investment for our clients in the current climate of the market.

The chart below provides good visual representation of how growth stocks have been getting more and more expensive over the last 6 years or so compared to value stocks, based on their respective indexes.

However, that doesn’t necessarily mean we are shying away from growth stocks. After all, one of our most popular investment strategy’s objective is to hold stocks we believe will provide the best opportunity for capital appreciation. But we also think that we can find value within growth stocks. That is why stock selection is so critical right now in the current market environment.

This amazing market run recently has left many investors thinking that it is just too overheated right now and good investment opportunities are few and far between, so they would rather cash out and wait until something happens that causes the market to crash before putting that money back to work. We at Greystone would argue this should not be the mindset to have, and trying to time the market rarely works out in the investor’s favor. Quality investment opportunities are in fact still out there, and if proper research is done, which is what our clients trust us to do, cash will benefit more from being in the game rather than sitting on the sideline. The Greystone team is constantly monitoring market indicators and if we see a reason to increase our cash position, we will do so without hesitation. However, at this time, there is not a significant reason to be missing out on the benefit that this soaring market is providing.

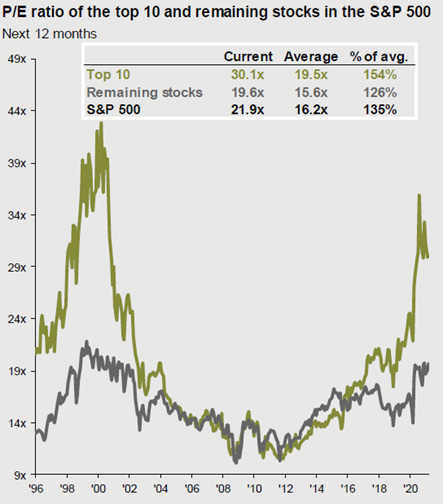

A typical investor might look at the S&P 500 index and select a valuation metric such as the price-to-earnings ratio to see how expensive the market is. If they did so, they could be misled by the results. This is because the top 10 stocks in the S&P 500 currently contribute to over 27% of the weight of the index. The average P/E ratio of those 10 stocks is 30.1. The average P/E ratio of the remaining 494 stocks is 19.6. Therefore, you can see how a snapshot of this index isn’t exactly the best representation of the valuation of the U.S. market as a whole. The point is, while yes, the market in general is expensive right now, there are still plenty of places to put your money that can provide decent value.

Source: Factsheet, Standard & Poor’s, J.P. Morgan Asset Management

The top 10 S&P 500 companies are based on the 10 largest index constituents at the beginning of each month. The weight of each of these companies is revised monthly. As of March 31, 2021, the top 10 companies in the index were AAPL (5.7%), MSFT (5.3%), AMZN (3.9%), FC (2.1%), GOOGL (1.8%), GOOG (1.8%), TSLA (1.5%), BRK.B (1.5%), JPM (1.4%), JNJ (1.3%), and V (1.1%). The remaining stocks represent the rest of the 494 companies in the S&P 500. Guide to the Markets – US Data are as of March 31, 2021.

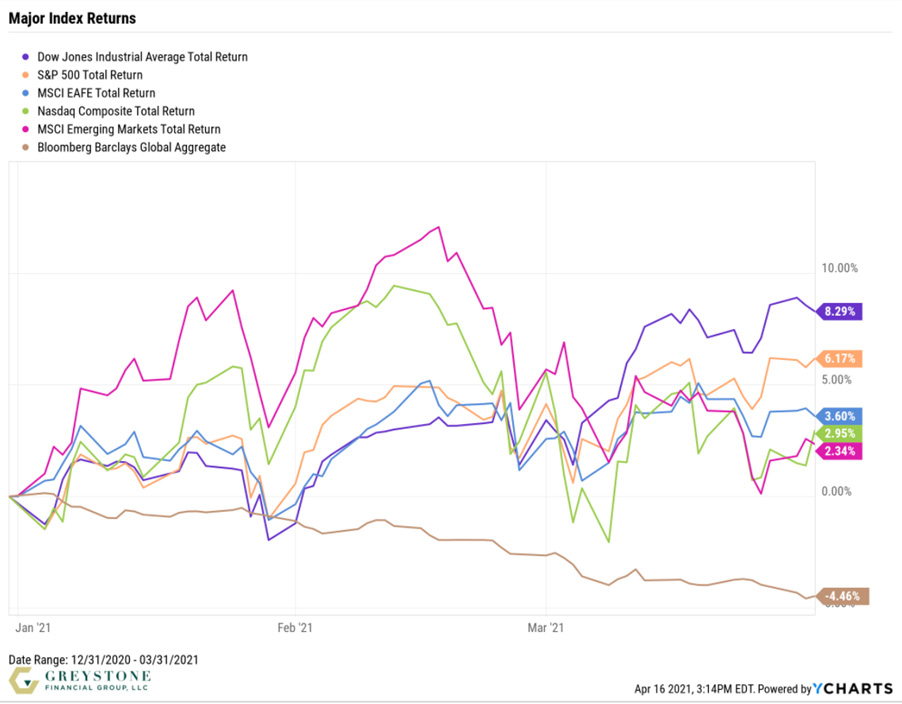

Looking at the Q1 returns for the major indexes, the Dow led the way at 8.29% while the Global Aggregate Bond Index was down 4.46% and has had three straight losing months to start the year.

The negative return from the Global Aggregate Bond Index can seem alarming. Let’s dig a little deeper into what is happening here. For years, yields have been ultralow for Treasurys, meaning investors earned very little in interest for owning them. That in turn made stocks and other investments more attractive, driving up their prices. But when Treasury yields rise, so does the downward pressure on prices for other investments.

So why are Treasury yields rising? Part of it is rising expectations for inflation, perhaps the worst enemy of a bond investor. Inflation means future payments from bonds won’t buy as much. So when inflation expectations rise, bonds are less desirable, and their prices fall. That pushes up their yield. And although there has been a lot of talk over the potential for future inflation, and therefore the worry that the Fed will raise rates sooner than later, thus giving rise to yields, the Fed has repeatedly said they have no intention of raising rates anytime soon.

While Fed Chair Jerome Powell is indeed expecting inflation to tick up later this year, he contends it will be temporary. And he is on the record as being more concerned with the lack of inflation over the last handful of years than rising inflation. And he has been right, because inflation has not been able to get to the Fed’s targeted 2% level in the longest time. Modest inflation is not bad for the economy, it is actually good for the economy, and should be viewed as a positive. Yields tend to rise early on in economic recoveries and bull markets because the outlook is improving. When the economy is healthy, investors feel less need to own Treasurys, considered to be the safest possible investment.

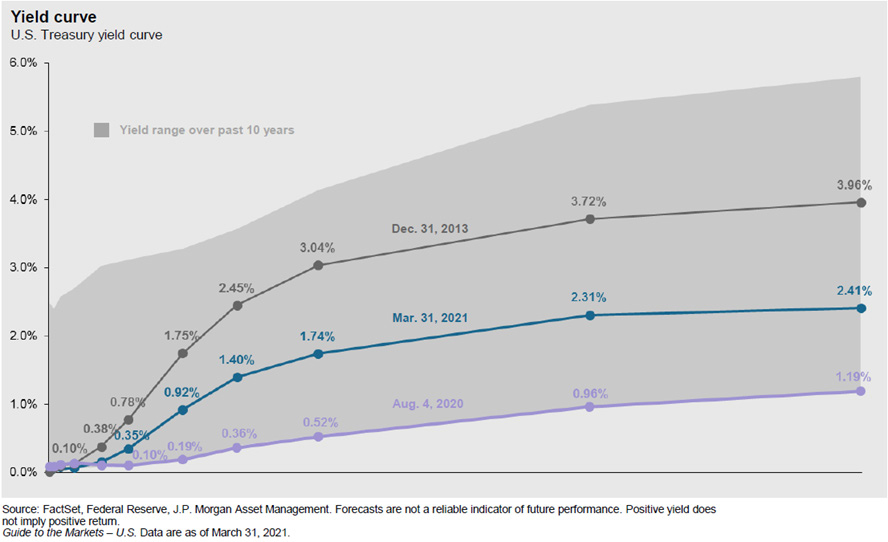

At the time of this writing, even at 1.6%, the 10-year Treasury yield is still well less than the 2.6% level it was at two years ago or the 5% level of two decades ago. The blue line on the chart below represents the yield curve at the end of Q1, which is still very much in the bottom half the yield range over the past 10 years. As the curve continues to normalize it is a good sign for a healthy economy.

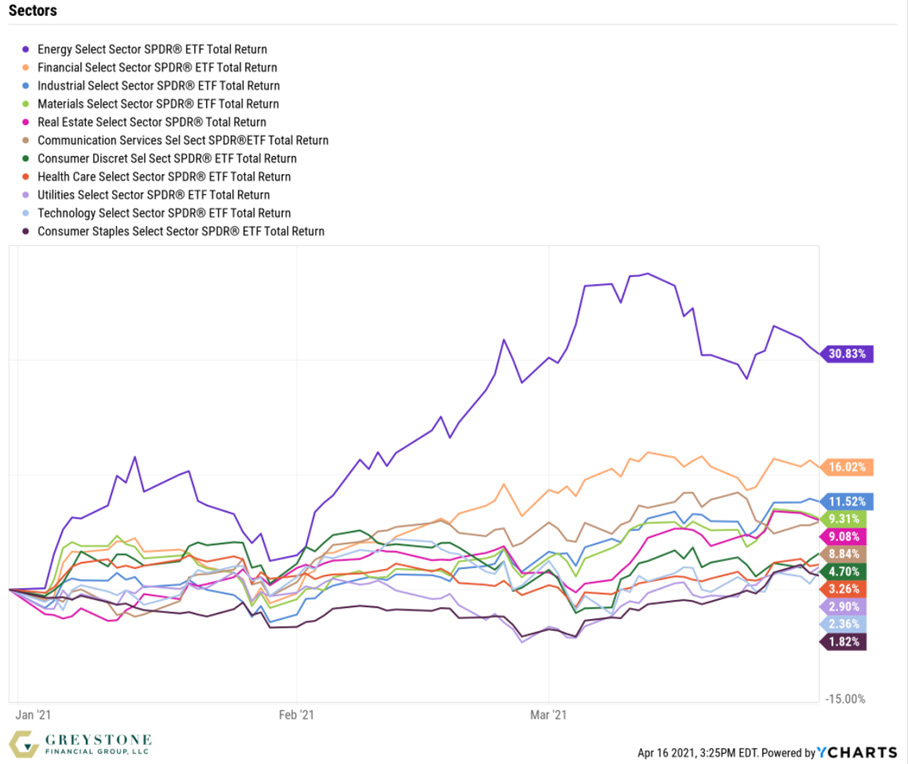

As for sector performance, all 11 sectors posted positive gains in Q1. Taking the cake was Energy with a 30.8% uptick, which almost doubled the performance of the next closest sector, Financials. Technology cooled off from the torrid pace we witnessed in 2020, and Consumer Stables brought up the rear at 1.8%.

In conclusion, it has been an incredible recovery over the past year by this extremely resilient market. It seems we are seeing all time highs on the major indexes on a weekly basis. The economic recovery continues to impress. More people are getting back to work, GDP is expected to grow at the fastest pace in decades, and as the vaccination rollout keeps progressing, more and more big cities are loosening restrictions. And as more businesses open back up, we should see pent-up demand being unleashed, and that will only continue to boost the economy.

And while there are certainly things to keep an eye on that could have adverse effects on the market, which we at Greystone are always watching for, at this time, we believe the positives outweigh the negatives and are taking advantage of this market momentum. We do expect there to be some additional volatility this year and that is where being tactical and stock selection is essential. We have said this before but it’s worth mentioning again — stocks usually pull back about -5% roughly 3-4 times per year and usually pull back -10% on average of about once a year. It is our job at Greystone to capture as much of the upside for our clients, but more importantly, to protect them from experiencing the full downside when the market turns.

Please speak with your Wealth Advisor if you have any questions or want to review your portfolio to be sure that you are in the most appropriate strategy to help you accomplish your long-term goals.

Sincerely,

The Investment Team at Greystone Financial Group