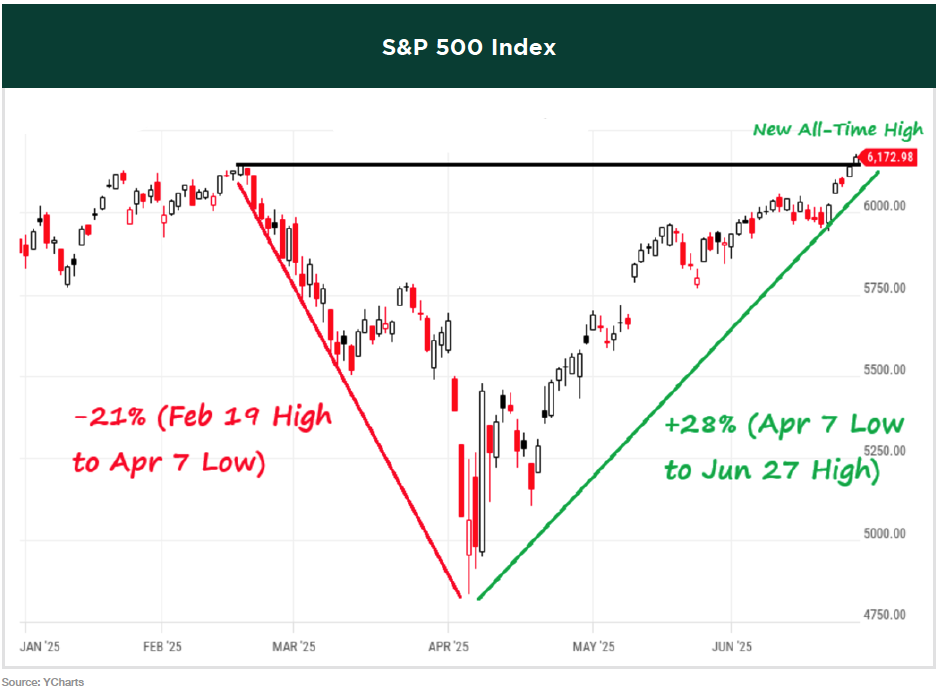

WHAT A DIFFERENCE a couple of months can make. When we sent out our last newsletter in late April, the stock market was trying to regain its footing after a sharp selloff earlier that month. Concerns about tariffs, trade tensions, and a potential recession dominated the conversation, with many analysts warning of a possible retest of recent lows. Few, if there were any, predicted the market would go on to hit a new all-time high just two months later.

Fast forward to today and that is exactly what has unfolded. As of this writing, the S&P 500 is sitting at an all-time high fueled by one of the most powerful short-term rallies on record.

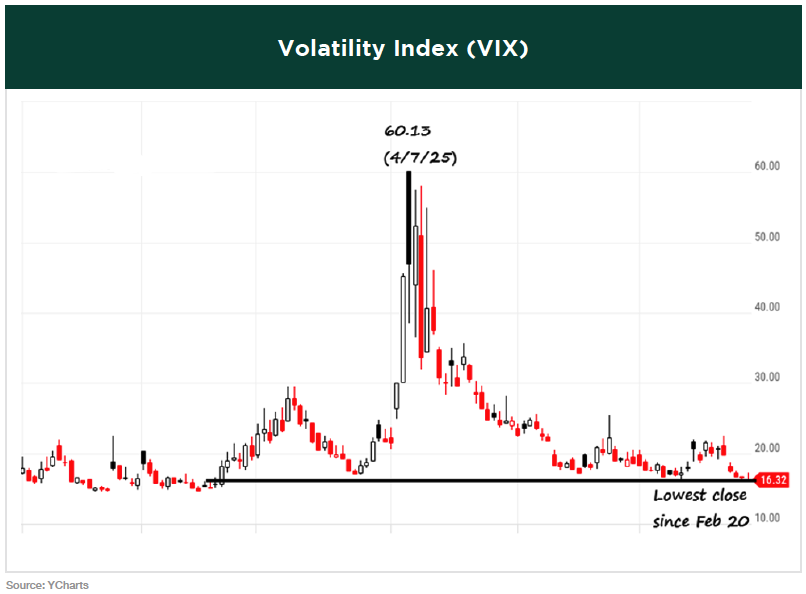

Meanwhile, volatility, as measured by the Volatility Index (VIX), has experienced its sharpest collapse ever, falling 64%.

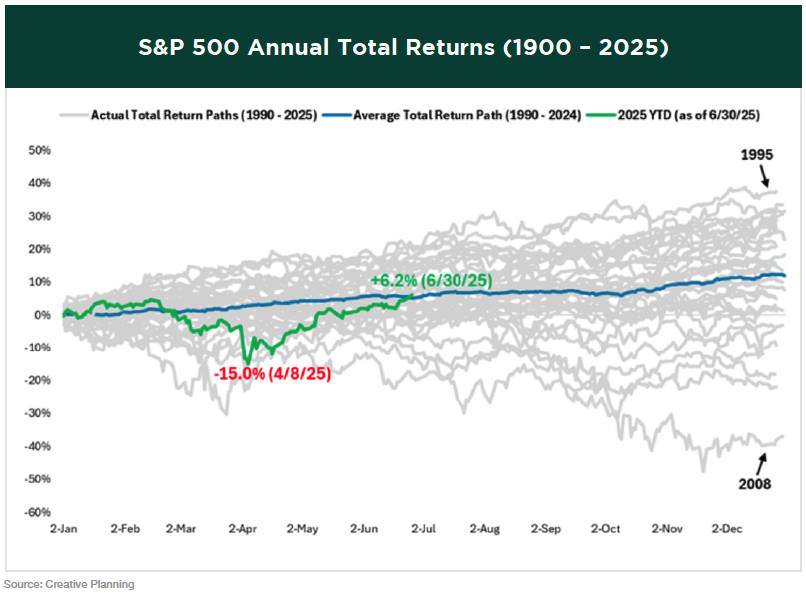

On April 8th, the S&P 500 was down 15% year-to-date marking the fourth worst start to a year in history. Yet following one of the most impressive rebounds on record, it’s now up over 6% for the year, even slightly ahead of the historical average for this time of year.

As we noted last quarter, enduring sharp market declines is never easy, and the uncertainty that comes with them often amplifies investor fear. There will always be a reason to sell, and if there isn’t, it probably means the market is near a peak. But having reasons to sell doesn’t justify being scared out of the market. As we emphasized in our previous newsletter, investors should tune out the “noise” and stay focused on their long-term goals.

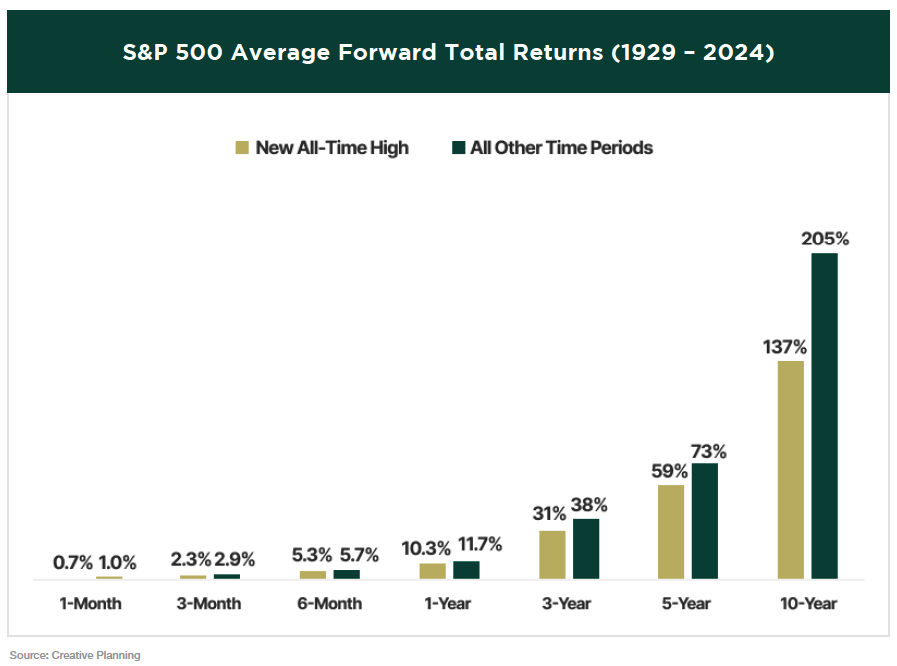

Some investors who missed the recent rally may feel it’s too late to enter the market and prefer to wait for a dip. However, this approach isn’t ideal for long-term investing. Historically, after reaching an all-time high, the market tends to continue climbing with the S&P 500 averaging a 10% gain over the following twelve months.

The threat of recession has eased alongside a significant reduction in tariff-related fears. Although progress on newly negotiated trade deals has been slow, optimism remains. Treasury Secretary Scott Bessent recently stated that the U.S. is actively working on agreements with most of its 18 key trading partners and expects many to be finalized by Labor Day. While there will likely be obstacles in some negotiations, the important takeaway is that the “reciprocal” tariffs announced by President Trump on April 2nd represented a worst-case scenario. The market is responding positively to the fact that most of these potential tariffs are unlikely to be implemented.

Beyond optimism around trade deals, the remarkable rebound has also been supported by a strong labor market, modest inflation, resilient economic data, earnings that have exceeded expectations, and easing Middle East tensions.

While the road ahead is still uncertain and challenges persist, as we’ve noted before, there will always be concerns that merit close attention. In this quarter’s newsletter, we’ll focus on the key issues Greystone is monitoring as we head into the second half of the year.

1. THE EFFECT OF TARIFFS ON INFLATION AND COMPANY EARNINGS

As we wrote back in January, the full impact of tariffs on inflation remains uncertain. Many in the financial media expected monthly inflation numbers to rise by now as tariffs took effect, but those predictions have largely been off the mark. We’re not suggesting that tariffs don’t contribute to inflation, and it will take time for their effects to ripple through the economy, but it’s still too early to determine the magnitude of their impact. Additionally, if oil prices continue to decline, this could significantly help offset any inflationary pressures from the tariffs.

More importantly, it’s crucial to track how tariffs impact company earnings, which ultimately drive stock prices. So far, earnings have stayed strong and surpassed expectations, with S&P 500 profits reaching new highs during the latest earnings season. It will be telling to see how much businesses pass tariff costs onto customers through higher prices since rising prices could dampen consumer demand and potentially slow economic growth. We anticipate earnings will remain strong in the second half of the year, but with equity valuations once again elevated, there is some concern about future returns.

2. POTENTIAL WEAKENING OF THE LABOR MARKET AND CONSUMER CONFIDENCE

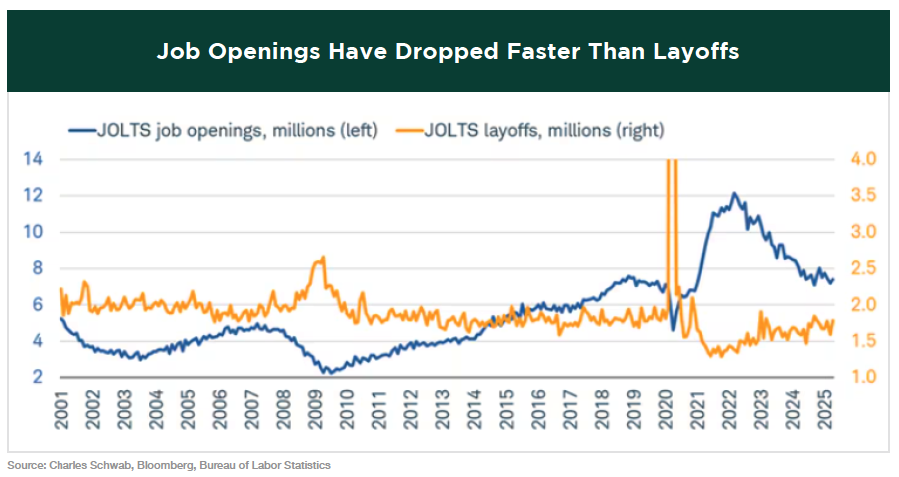

The labor market plays a crucial role in shaping the economic outlook. Currently, it remains strong with low unemployment and wage growth outpacing inflation. The present environment can be characterized as one in which companies are scaling back on hiring but have yet to initiate significant layoffs. As shown below in the monthly Job Openings and Labor Turnover Survey (JOLTS), job openings have been declining steadily and at a faster rate than layoffs have been increasing.

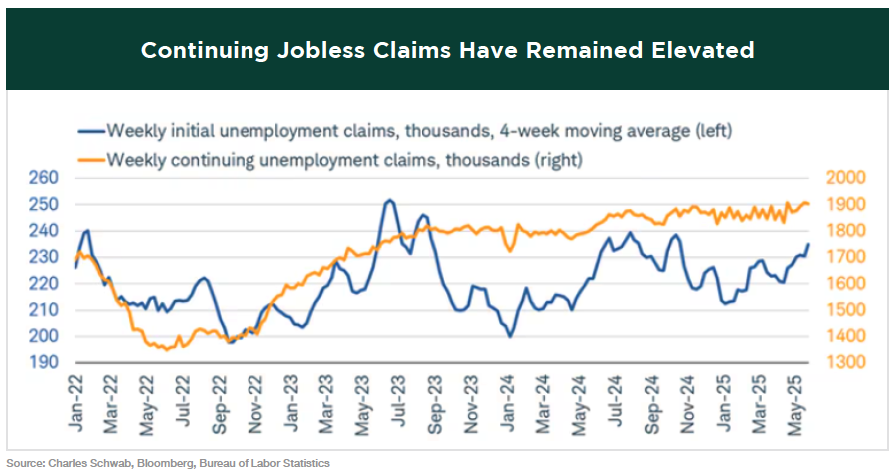

Although initial jobless claims have been rising gradually, continuing claims have reached a new cycle high indicating that laid-off workers are facing growing challenges in securing new employment.

Since consumer spending accounts for two-thirds of U.S. GDP, consumer confidence plays a vital role in the economic outlook making the strength of the labor market a crucial pillar supporting both confidence and spending.

1. FIXED INCOME VOLATILITY AND YIELD CURVE MOVEMENT

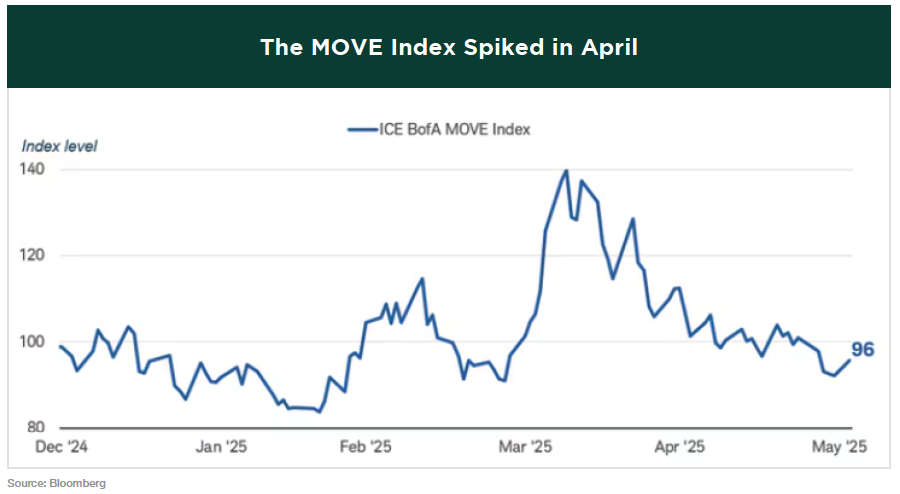

The first half of the year was volatile not only for equities but also for fixed income. The MOVE index, which tracks volatility in the Treasury bond market, surged in April as investors reacted to swift and ongoing shifts in trade and economic policies.

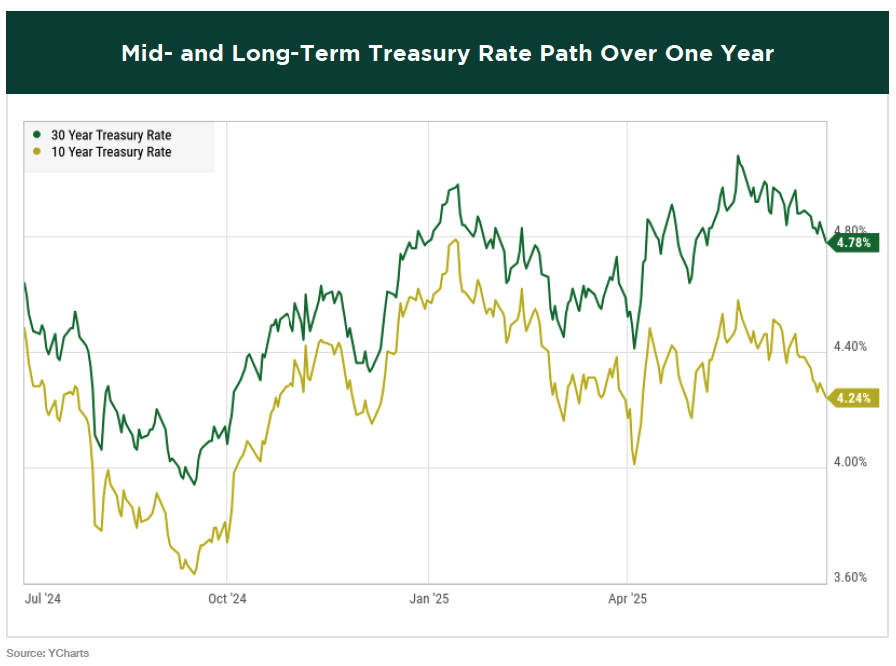

Recently, 30-year Treasury yields climbed above 5%, their highest level since 2007, driven by worries that the proposed tax-and-spending bill will boost U.S. government debt. The market is indicating that increasing budget deficits, accumulated over the past two decades of low interest rates and inflation, will necessitate higher yields to attract investors.

Treasury rates have been declining since late May, and we remain cautiously optimistic that this trend will persist. A renewed spike in mid- and long-term rates would disrupt stock market momentum, as higher borrowing costs for businesses would likely dampen investor sentiment and hurt profitability.

We anticipate the Federal Reserve will cut the federal funds rate, the rate banks charge each other for overnight loans, once or twice during the second half of the year. This is expected to lower short-term rates with the hope that medium- and long-term rates will follow, though that is not guaranteed. There’s a slight possibility of a rate cut at this month’s meeting, but if it doesn’t happen then, we expect it to occur in September, as the Fed has expressed a desire to evaluate the impact of various policies on the economy and inflation before making a move.

1. THE U.S. DOLLAR’S STEEP DECLINE

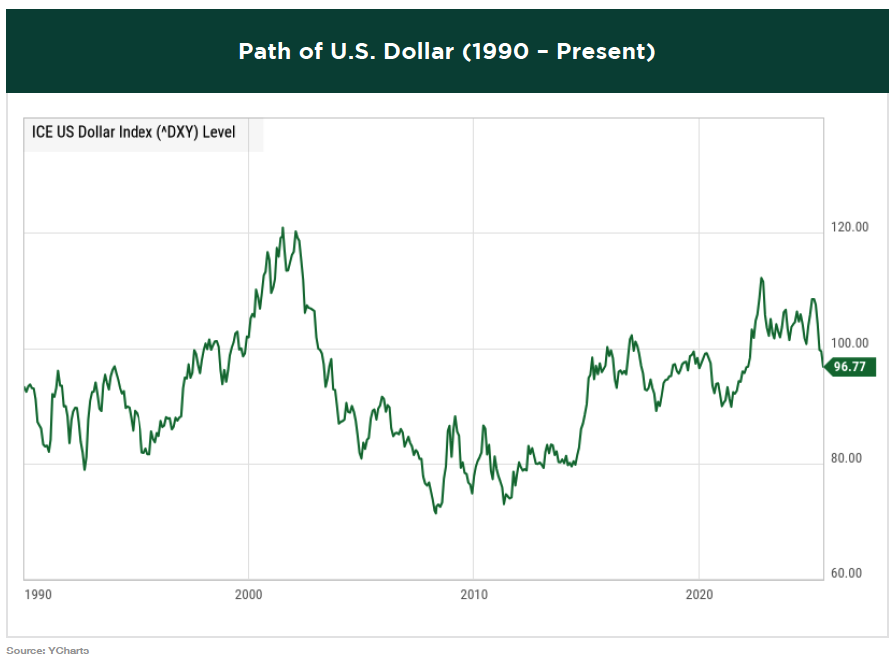

The dollar has declined sharply this year, raising questions about investor confidence in the United States. Currency strength or weakness can result from factors like interest rate differentials, inflation, economic growth, and foreign investment flows. Many variables influence currency movements, but trust and faith in the system remain intangible yet critical factors.

The U.S. dollar index, which tracks the dollar’s strength against six major foreign currencies, dropped 7% in the second quarter and is down roughly 11% for the year marking its worst first half since 1973. While stocks have bounced back from their April lows, the dollar has continued its significant fall. A weaker dollar isn’t inherently negative for stocks, but we would prefer to see it stabilize near current levels.

The weaker dollar this year is a key factor behind international stocks outperforming U.S. equities. A stronger dollar often results in weaker overseas sales, while a weaker dollar typically boosts them. When the dollar is down, international stocks tend to outperform U.S. equities because rising foreign currencies increase the value of earnings and dividends from those investments.

The opposite occurs when the dollar strengthens. Consider the many Americans vacationing in Europe over recent years, the strong dollar and weak euro have made travel abroad more affordable for U.S. tourists. This dynamic is one of several reasons international stocks have underperformed for an extended period. A strong dollar has acted as a headwind for those markets.

1. GEOPOLITICAL EVENTS

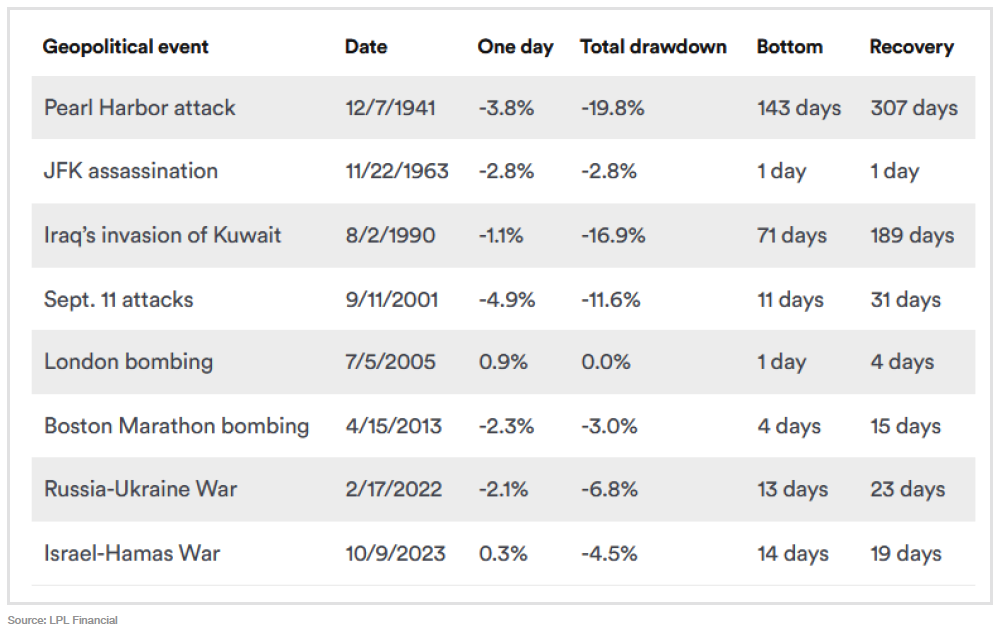

Lastly, we’re keeping a close eye on any escalation in geopolitical tensions, especially in the Middle East following the U.S. airstrikes on Iran’s nuclear facilities on June 21st. While developments like these are important to monitor from a portfolio management standpoint, investors should avoid reacting out of fear and remain committed to their long-term investment strategy.

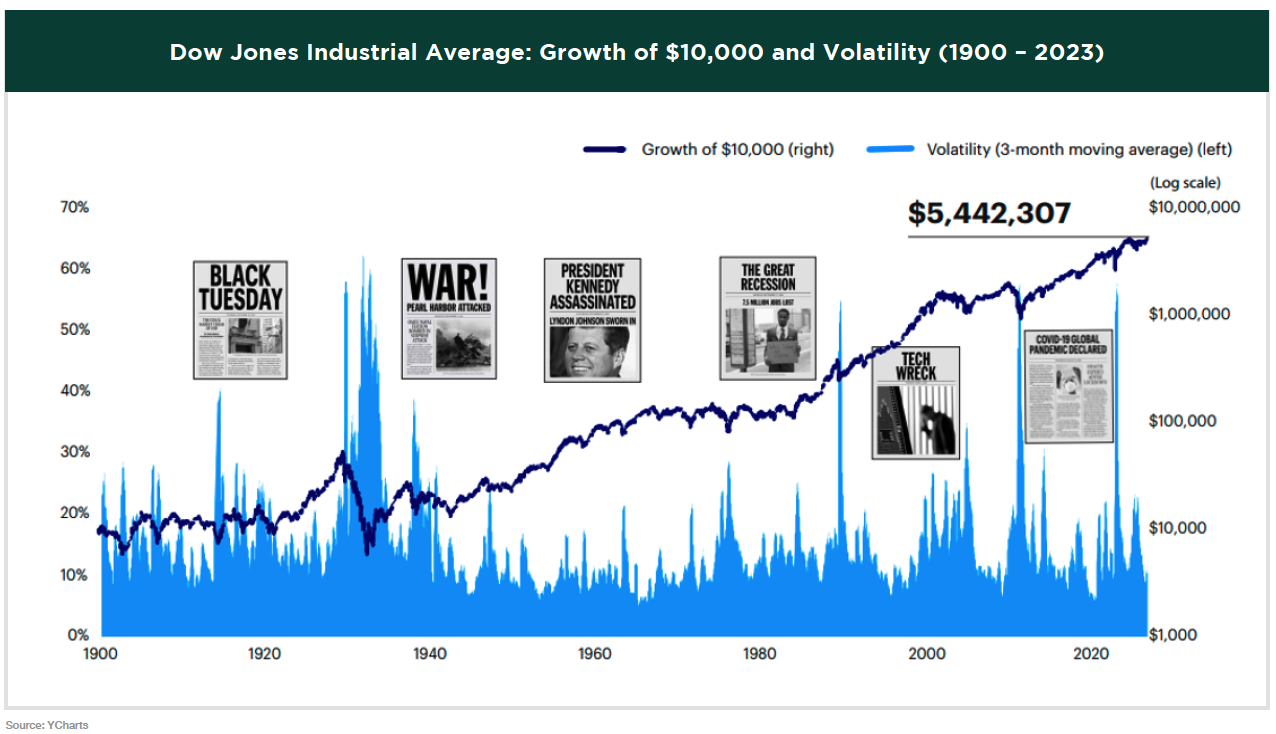

Every event is unique, and some have a greater impact on markets than others. However, history shows that geopolitical shocks typically lead to a short-term downturn lasting days or weeks as markets assess the risks. After that, markets often stabilize and go on to reach new highs. That’s because markets tend to move not on whether conditions are good or bad but on whether they’re improving or deteriorating. And over most of modern history, conditions have generally improved for much of the world’s population. A few notable events from the past century are highlighted below.

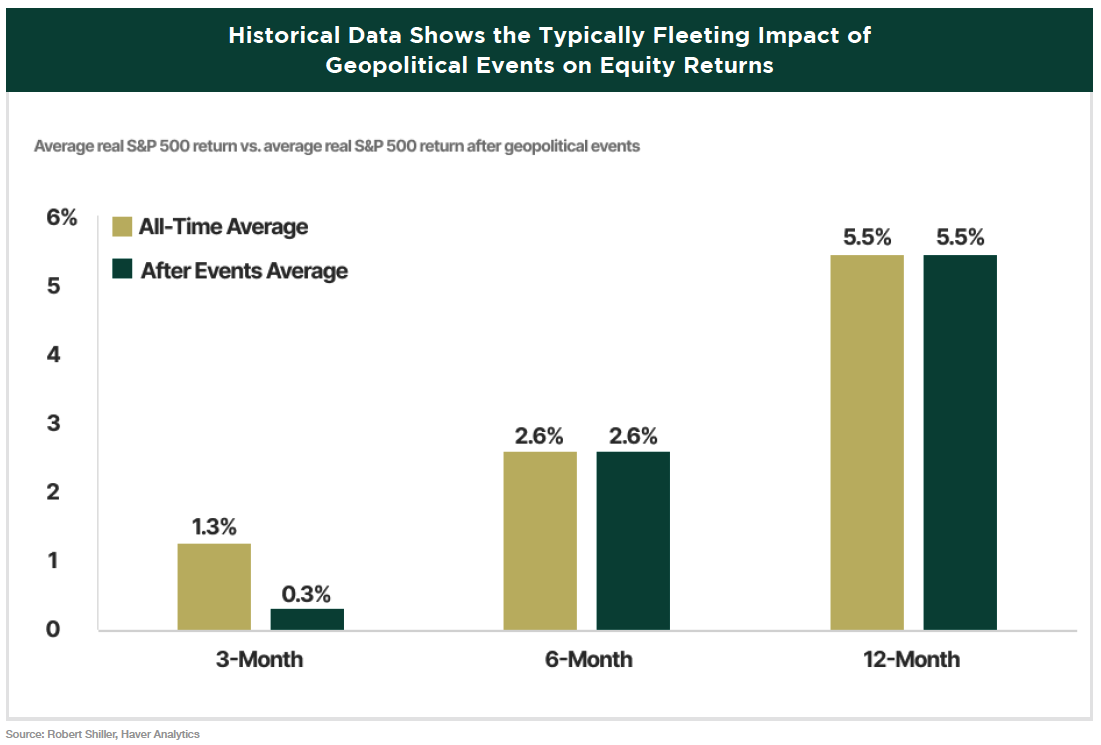

One study analyzed 36 major geopolitical events, starting with Germany’s invasion of France in 1940 and ending with Russia’s invasion of Ukraine in 2022. It compared equity market returns over 3-, 6-, and 12-month periods following each event to returns during similar timeframes without significant geopolitical disruptions. The findings showed that, on average, markets tend to underperform in the 3 months immediately following an event. However, 6- and 12-month subsequent returns are identical. From a long-term investor’s perspective, the effect is often minimal, making the event appear largely irrelevant in hindsight.

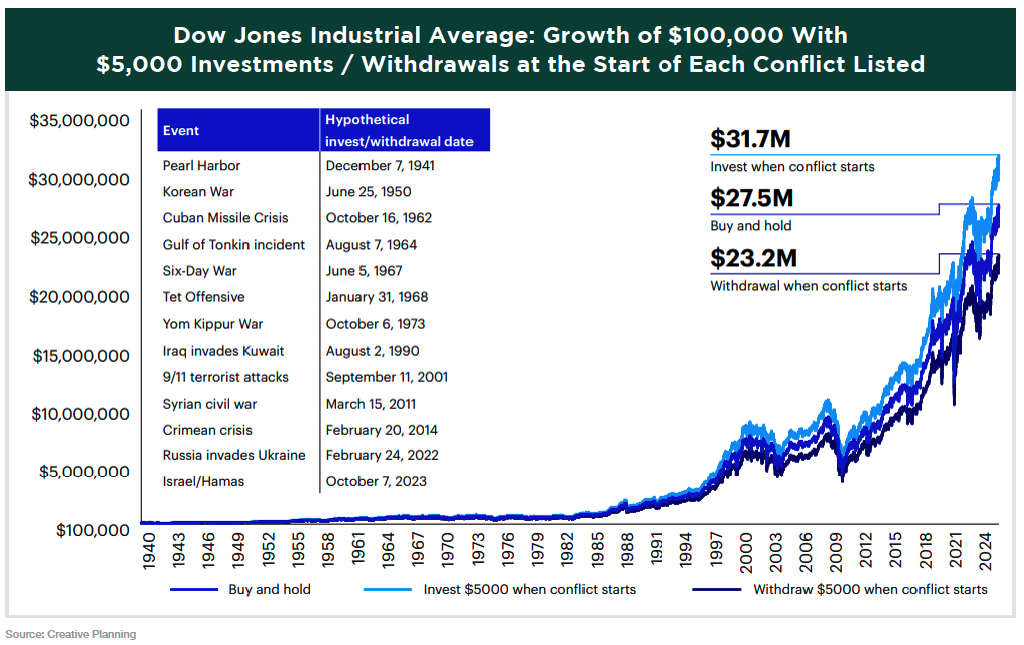

Military conflicts and the uncertainty they create often heighten investor anxiety. However, investors who added to their portfolios during such periods have historically fared much better than those who pulled money out of the market.

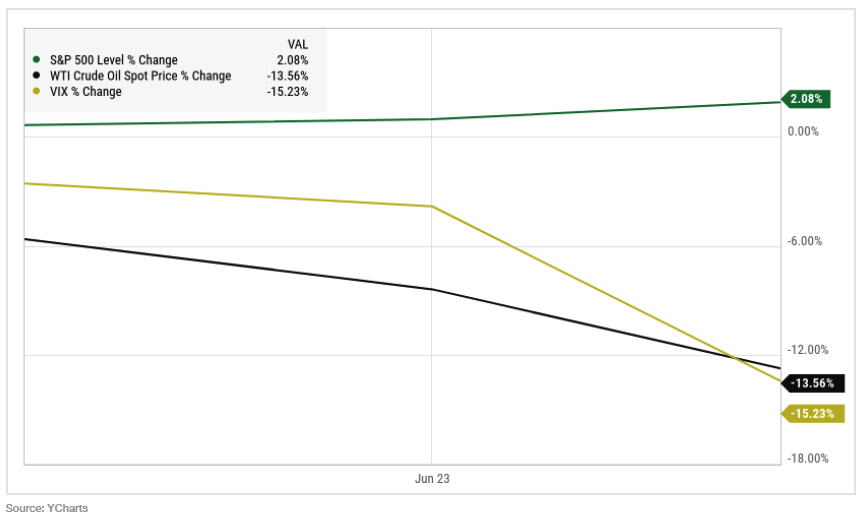

Circling back to the recent U.S.–Iran conflict, nearly everyone from the average investor to the financial media expected markets to react negatively when they reopened the following Monday. The consensus forecast was a sharp selloff in stocks, a surge in oil prices, and a spike in volatility. Instead, over the next two days, the S&P 500 rose 2%, oil prices dropped 13.5%, and the Volatility Index (VIX) fell 15%. The takeaway: Investors must learn to expect the unexpected.

There’s no set script for how markets will respond.

The U.S. has weathered wars, recessions, financial crises, epidemics, and political turmoil, yet the market has continued its long-term upward trajectory.

We hope this provides some clarity on what we at Greystone see as the key factors to watch as we head into the second half of the year. While it’s essential to stay mindful of potential risks, we also want to stress that, though not discussed extensively here, there are many positive forces currently supporting the market. Overall, we remain optimistic as we move into the latter half of 2025.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT

GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.