BACK IN JANUARY, we cautioned that 2025 was likely to be a more turbulent year for the stock market compared to 2023 and 2024. As the bull market entered its third year, we foresaw tempered returns and rising volatility, driven largely

by uncertainties surrounding global trade, immigration, and tariff policies. While the right combination of policies had the potential to boost economic growth, it also carried risks—particularly around inflation and potential shifts in interest rates. At the same time, there was optimism surrounding possible tax cuts and deregulation under the new administration, but it quickly became clear that immigration and tariffs would take precedence on the policy agenda.

On April 2, President Trump announced sweeping tariffs, dubbed “Liberation Day,” targeting nearly every sector of the global economy. The scale and scope of these measures caught investors off guard, sparking a market sell-off of historic proportions. Over the following two days, the S&P 500 Index plunged more than 10%, erasing approximately $6.6 trillion in market value, the largest two-day loss of shareholder wealth ever recorded.

President Trump, who often touts his negotiation skills, is using aggressive tariffs as a strategic tool to bring other nations to the negotiating table. With the U.S. running sizable trade deficits with many of its global partners, the administration is aiming to honor a key campaign promise of improving trade agreements. By leveraging tariffs, President Trump is seeking what he views as more equitable trade terms for the United States.

This initiative sparked growing concern among investors, with markets reacting negatively to the uncertainty surrounding the administration’s tariff policies. The lack of clarity and consistency has only heightened investor anxiety. Unfortunately, the matter has also taken on a political dimension—though arguably, it should not. All the tariffs implemented during President Trump’s first term were retained by former President Biden, who not only upheld them but also expanded some of them, particularly those targeting China.

While tariffs have the potential to encourage companies to bring manufacturing and jobs back to the U.S., this kind of structural shift is a long-term endeavor that can take years to materialize. In the short term, many economists warn tariffs may lead to higher consumer prices and significant disruptions in global supply chains. Additionally, retaliatory tariffs from other countries could reduce demand for U.S. exports, prompting domestic companies to scale back production and cut jobs. The combined potential impact of these factors raises the risk of a recession—concerns that have been clearly echoed in the recent sharp declines across the domestic stock market and the U.S. dollar.

There is a big difference between a recessionary economy and a slower-growing economy. A recession means the economy is shrinking, particularly in terms of the production of goods and services. A slower-growing economy indicates expansion in terms of the production of goods and services, but at a lower rate. In short, a recession means we’re falling behind, whereas a slowdown means we’re still moving ahead, but not as fast. The ultimate impact of these tariff policies remains to be seen. While there are clear indications that the economy is losing momentum, an economic recession is by no means inevitable—despite widespread speculation. That said, the longer it takes to secure new trade agreements, the greater the risk that economic conditions could deteriorate further.

The capital markets tend to react negatively to uncertainty—and the past couple of months were a clear example. In less than seven weeks, the S&P 500 dropped 21%, driven largely by the lack of clarity surrounding evolving tariff policies and prompting widespread investor concerns. While history suggests the stock market will recover, living through periods like this can feel overwhelming. When we are in the middle of it, it often feels like the bottom is falling out—largely because investors have no clear sense of where that bottom might be. And it’s that uncertainty that fuels fear.

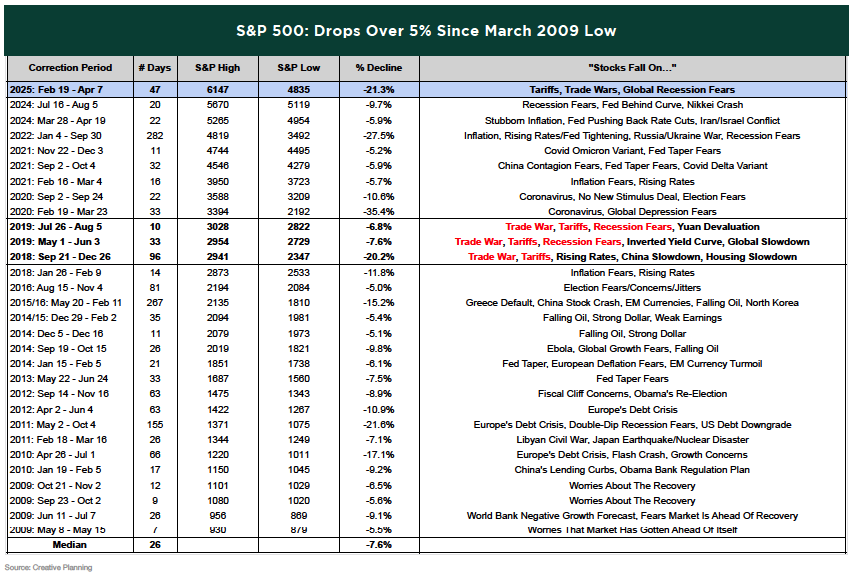

Investors are always going to find a reason to sell. Since the stock market hit its low in March 2009, there have been 30 instances where it declined by 5% or more. Yet most investors have likely forgotten the majority of them—and for good reason: the stock market has consistently recovered. Over time, the noise fades, but the long-term trend of stock market resilience has withstood short-term events.

When we look back at 2018 and 2019, we were facing similar concerns dominating news headlines today—namely tariffs and trade tensions. In 2018, the S&P 500 experienced a percentage drawdown similar in scale to what we recently endured. In 2019, we experienced two separate pullbacks of approximately 7%. And yet, over the following six years, the stock market nearly doubled. While no one can say for certain whether the stock market will fall further in the near term, history suggests a strong possibility that this period will ultimately be viewed as just another temporary disruption— less significant than it felt in the moment, as has been the case with each of the past 30 stock market corrections when viewed in hindsight.

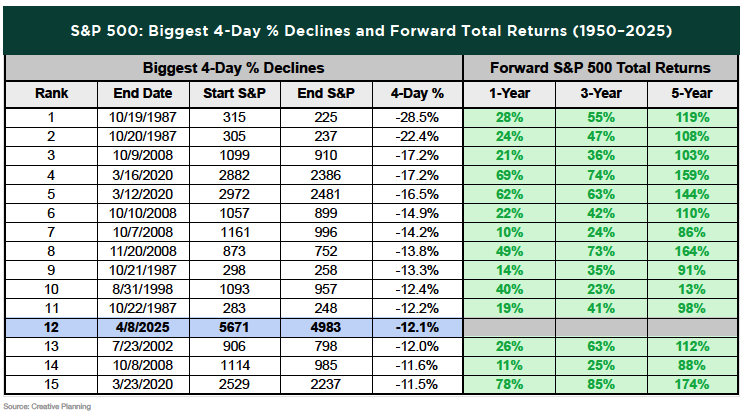

As noted earlier, the stock market experienced a historic two-day drop in early April—but the downturn deepened further over the next two trading sessions, with the S&P 500 falling a total of 12.1% over those four days. Despite the severity of such rapid selloffs, there are reasons for optimism. The following table highlights the largest four-day declines since 1950, and in every instance, the market was higher one, three, and five years after the event.

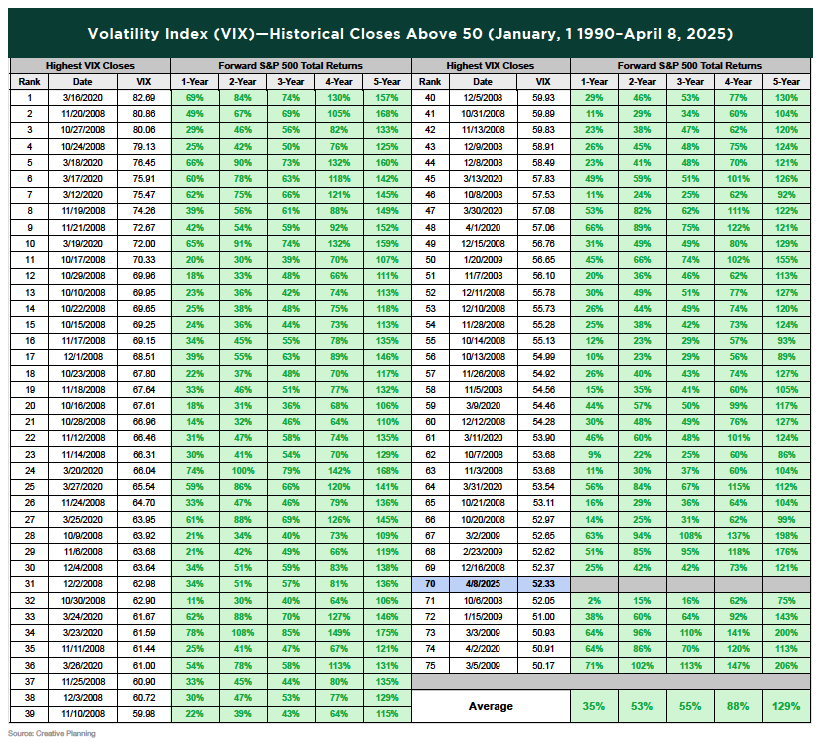

On the fourth day of the recent sharp market decline, the VIX—or Volatility Index, which reflects expected volatility in the U.S. stock market—spiked to 52, marking its highest level since April 2020. Historically, such elevated readings have often signaled strong forward returns. In fact, every time the VIX has surpassed 50 since 1990, the S&P 500 has delivered positive returns over the subsequent one-, two-, three-, four-, and five-year periods—100% of the time! This historical trend offers yet another encouraging sign for mid- to long-term investors.

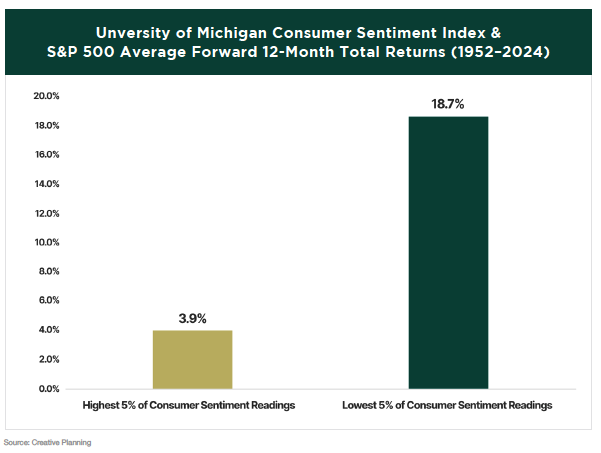

Many of these spikes in market volatility tend to align with periods of negative consumer sentiment—and this time is no exception. In recent months, consumer confidence has dropped sharply, reaching some of the lowest levels seen in the past 70 years. The silver lining? Historically, low consumer sentiment has served as a strong contrarian indicator: the more pessimistic people are about the future, the better the stock market has tended to perform.

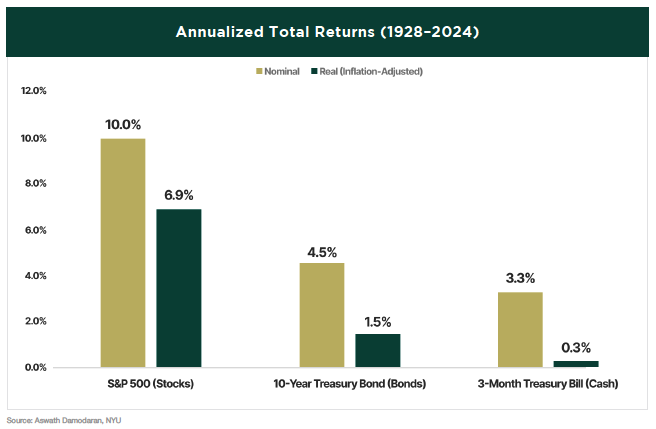

Volatility is an inherent part of investing in the capital markets—it’s the proverbial “price of admission.” If stocks behaved with the same stability as bonds, investors couldn’t expect higher returns. But because stock market volatility is significantly greater, it comes with a risk premium that compensates for that added uncertainty. Looking at the following chart, many investors would naturally prefer the superior long-term returns that stocks provide. However, capturing those gains requires the ability to endure the inevitable drawdowns along the way.

A 100% stock portfolio is not the correct asset allocation for everyone. For many investors, a more balanced mix of stocks and bonds may be more suitable. The appropriate asset allocation ultimately depends on the individual’s risk tolerance and investment time horizon. Unfortunately, many investors only discover their true comfort level during sharp market downturns—often leading to reactionary changes at exactly the wrong time. That is why it is important to have

a long-term strategy that aligns with your personal goals and risk profile. Our Greystone advisors are here to help guide you through this process and ensure you are invested in the Greystone investment strategy that best suits your needs.

Throughout the past few quarters, we’ve emphasized several core principles we advocate are fundamental to successful investing. To date, we’ve covered:

- PLAY THE LONG GAME

- NEVER INTERRUPT COMPOUNDING UNNECESSARILY

- DIVERSIFY, DIVERSIFY, DIVERSIFY

- EMBRACE RISK

- LEARN TO BE GOOD AT SUFFERING

- FOCUS ON SAVING BEFORE INVESTING

This quarter, we’re adding another important principle to our list of rules for successful investing.

- TUNE OUT THE NOISE

Investors are constantly inundated with market noise—and at times, that noise can become nearly deafening.

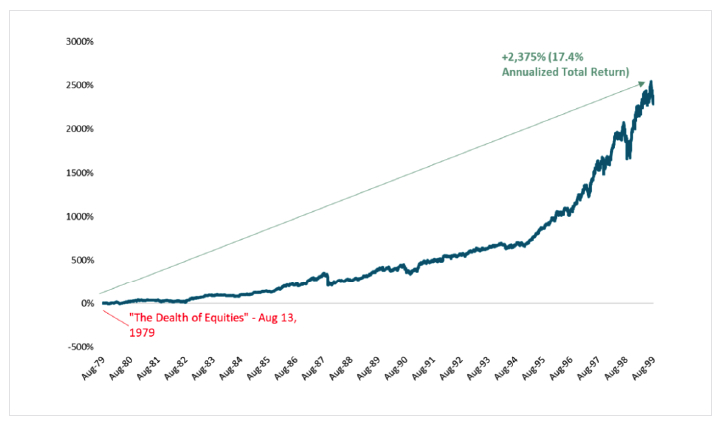

In August 1979, BusinessWeek ran a cover story entitled “The Death of Equities,” with the author arguing that “the old attitude of buying solid stocks as a cornerstone for one’s life savings and retirement has simply disappeared.”

In the two decades that followed, the S&P 500 returned 2,375%, translating to an annualized total return of 17.4%.

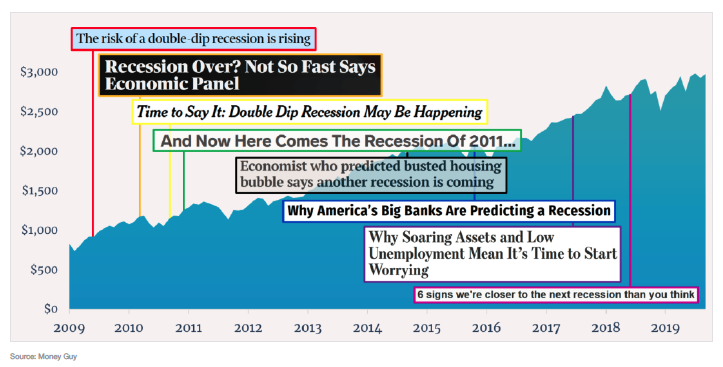

Much of the current “noise” centers around predictions of an impending extreme economic recession. The media has a long-standing habit of forecasting the next recession—though their accuracy is often no better than that of a broken clock. Recessions naturally stir fear across the population, and for good reasons. They can bring significant market downturns, which affect millions of investment and retirement accounts, and they often lead to job losses or reductions in income and benefits. Given the emotional weight of the topic, it’s no surprise that the prospect of a looming recession drives clicks and viewership—something the media rarely passes up, often amplifying fear and uncertainty in the process.

The financial media’s primary job is to entertain, generating as many views and clicks as possible. As investors, our responsibility is to stay focused, remain disciplined to our objectives, and tune out the noise.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.