Investment Management

Our vision is our ability to look forward, not just to the unfolding paradigm of the global economy, but also at the pace of the transition. In a time of rapidly shifting global dynamics, our versatility and array of investment services allows us to help our clients stay on track to meet their long-term goals.

CUSTOMIZED INVESTMENT CHOICES

There is no internal pressure or incentive to buy “the product of the day,” only to select investment choices that are right for each individual client’s unique position. We generate unbiased, independent, top-down, bottom-up investment research, but as a true fiduciary we do not sell our research; we use it for our client’s benefit exclusively.

We use two primary portfolio management techniques:

As globalization takes hold, it is the companies with the greatest financial resources, strongest balance sheets, and effective management personnel that have the ability to take advantage of nascent high-growth market opportunities. We prefer companies that already have an appreciable portion of revenues ex-US. We call this methodology “Investing domestically but thinking globally.”

Greystone Stock Strategies

Greystone Blended Strategies

Greystone Fixed Income Strategies

Greystone Tactical ETF Strategies

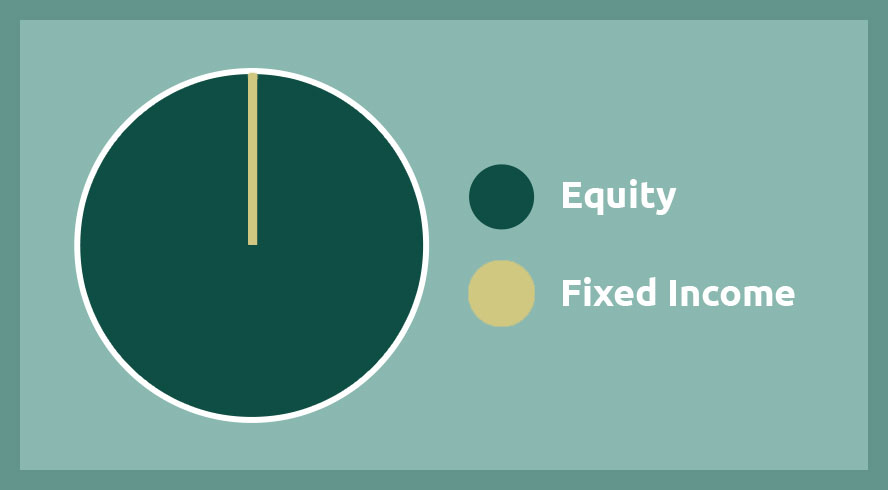

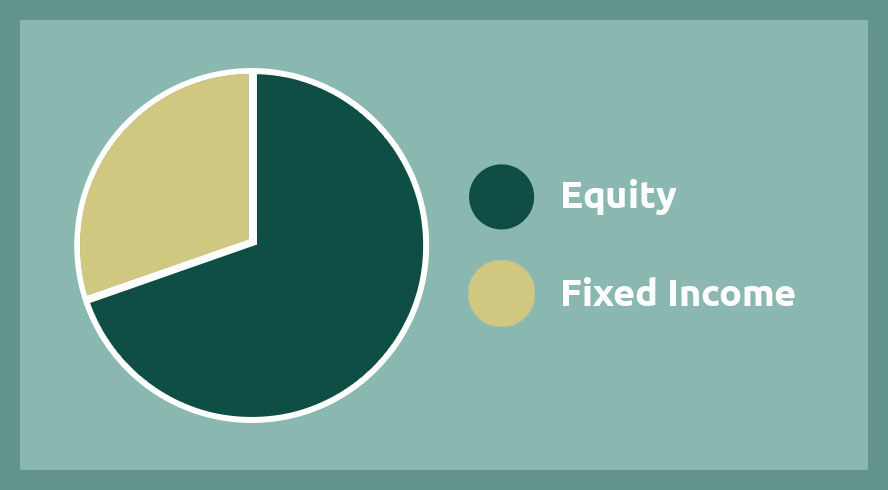

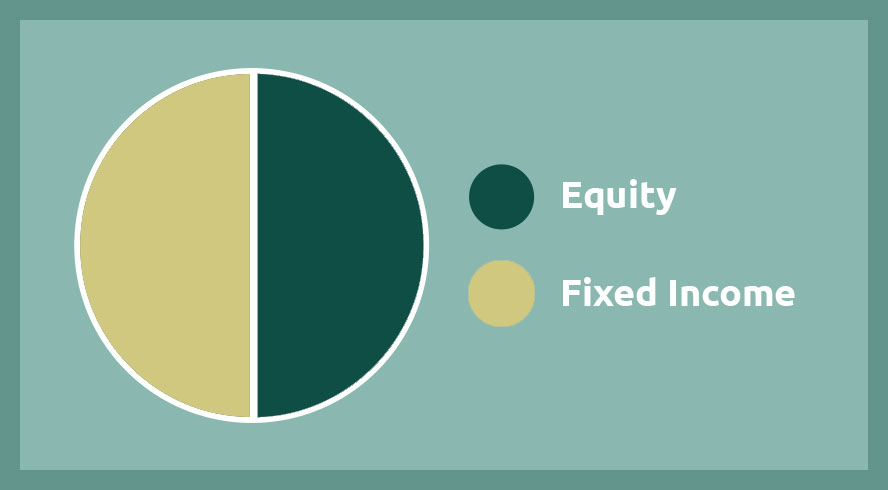

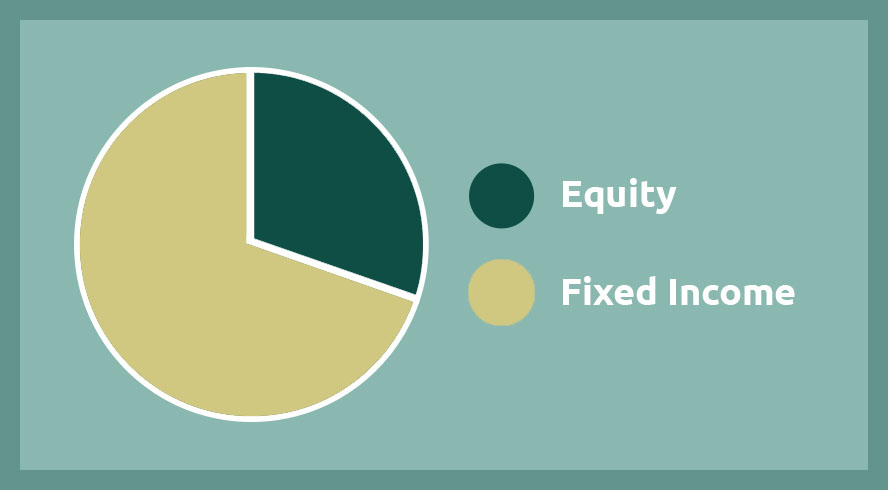

These broadly diversified portfolios invest across multiple asset classes, sectors, and countries. The strategies employ macro-driven, top-down analysis to construct global tactical asset allocation portfolios containing both equity and fixed income exposure depending on the risk tolerance and time horizon of the investor.

OUR PHILOSOPHY

It’s important to know where your finances stand, and Greystone actively works to assure you are fully informed. Your diversified investment portfolio is based on your personal risk tolerance, cash needs, and financial situation. We will help you to understand the strategies behind your plan’s conception based on your unique position, as well as provide scheduled reports, statements, and other updates on a timely basis.

Global

The team incorporates geopolitical, economic, currency, and interest rate expectations into its strategy and decision making.

Comprehensive

Our investment process is free of bias regarding the selection of research, investment solutions, and strategies.

Timely

Our team’s nimbleness and combination of strategies allow for effective asset allocation shifts as market-moving events unfold.

Why Work With Us?

What’s different about working with our team at Greystone? We’ve developed our own approach that helps us get to the heart of our clients’ financial concerns, now and in the future. We will start with the Greystone discovery process that helps identify important documents and information for analysis.

TOP-DOWN ASSET ALLOCATION

Global markets, industry dynamics and technological trends are all

weighed to guide portfolios for long-term growth potential.

Bottom-Up Investment Evaluation

Investment candidates are industry leaders with solid balance sheets and distinct

industry advantages. Our fundamental research emphasizes companies with high

returns on invested capital and growing free cash flow operations.

Allocations to most major asset classes will be maintained. Over-weighting the

specific sectors with the highest probability of superior performance and

under-weighting sectors viewed as overvalued or underperforming.

01

Asset class weightings are determined by the overall macro environment

02

Candidates are selected from a universe of large capitalized company

03

Multi-Discipline approach (Macro technical fundamental)

04

To assure full discovery, Substantial outside research is consulted

05

The probability of investment success determine the portfolio

Risk Profile

The investment risk profile identifies the core portfolio’s overall

risk characteristics when measured against other asset classes

and considering an assumed 5-year minimum time horizon.

Current acceptable

market Risk

The portfolio’s objective is to seek to maximize total return, consistent

with the determined risk tolerance percentage constraints of a

well-diversified client portfolio.

Portfolio Risk Management

techniques