Every morning as I enjoy my coffee before getting ready for work, I put on CNBC and listen to what the “experts” have to say about what is moving the markets today. Lately it seems the one topic that is discussed more than any other is inflation. What will the next PPI report show? What about CPI? How will (or should) the Fed react? Does the Biden administration have a plan? If so, will it work?

After several decades of declining and low inflation, a confluence of events has played their part in making fast rising prices a daily topic of discussion. Such events include a global pandemic and the supply chain issues it caused, the government policy response to help voters through the challenges created by lock downs, and of course, the first major conflict on the European continent since WWII.

In the short run, markets don’t like inflation, first and foremost, because inflation usually spurs the Federal Reserve to raise interest rates. Higher interest rates make borrowing money more expensive thereby slowing economic growth in future quarters. While the inflation itself might be a sign the economy is doing well and workers are receiving increased wages, markets begin to worry about how high interest rates will need to go to get the inflationary pressures under control. Will the Fed cause a recession by overshooting on interest rates? Maybe, but what should you do about it?

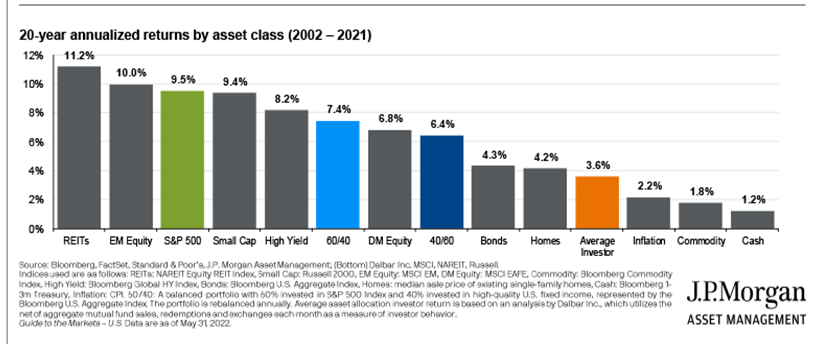

Over the long-term keeping a portion of your portfolio allocated to stocks may be your best hedge against inflation. As indicated by the chart below, the 20-year annualized return of the long-term stock market, as indicated by the S&P 500, averaged 9.5% while long-term inflation averaged 2.2%. This supports the theory that allocating investment dollars to stocks provides good protection against inflation. However, the challenges are more in the short-term. When inflation starts to rise, and at an increasing rate, the stock market will react negatively. This year has been no exception. We have seen significant market volatility so far in 2022 and it’s happening at the exact same time you are experiencing higher prices, especially for rent, food, and gas.

There are two keys for managing through this market volatility caused by rising inflation. First, be tactical. As longtime investors with Greystone Financial Group know, we rarely stay static with our portfolio allocations. Most of our strategies have held higher than normal levels of cash all year. In addition, we adjust the types of stocks held in the portfolios. By holding more defensive names, it helps reduce our exposure to sectors that struggle during rising interest rate environments. By being tactical with the portfolios, many of our strategies have performed better than their benchmarks. Also, by holding extra cash we are in a good position to buy high quality companies at prices well below where they were trading just six months ago.

The second key to managing this market volatility is to focus on your long-term goals. We know the markets will go through periods of difficultly. It’s part of investing in the financial markets. We also know that the long-term returns of the stock market have historically given us our best results compared to cash, bonds, and inflation. The mistake many investors make is to react emotionally to what has already happened and exit stocks at the exact time they should be considering adding to their stock portfolio. This is shown in the following chart where the Average Investor only earned 3.6% annualized return over the past 20 years.

It is impossible to say with certainty how long we will be experiencing this inflation; if the Fed will cause an actual recession or how low the markets will go in reaction to these headwinds. But by tactically taking advantage of what the market gives us and focusing our emotions on the long-term opportunities created by lower current stock prices, we give ourselves better odds of achieving our financial goals.

As always, if you have specific questions about your financial circumstances or how your portfolio is behaving, please reach out to your wealth advisor.

Eric Babcock

Director

Disclosures:

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their wealth advisor prior to making any investment decision.