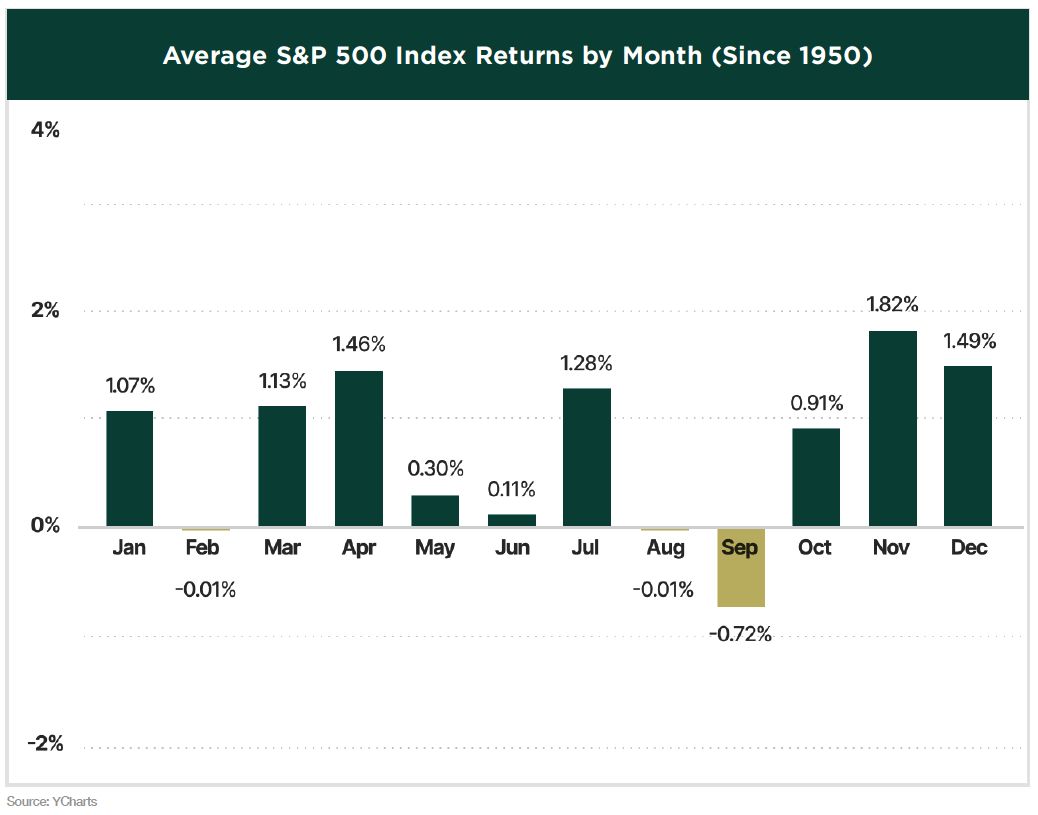

WE HAVE JUST FINISHED what has historically been the rockiest stretch of the year for stocks. Going back to 1950, August and September have, on average, delivered negative returns for the S&P 500, with September standing out as the worst month of all. However, this year bucked the trend, with both months ending solidly in positive territory.

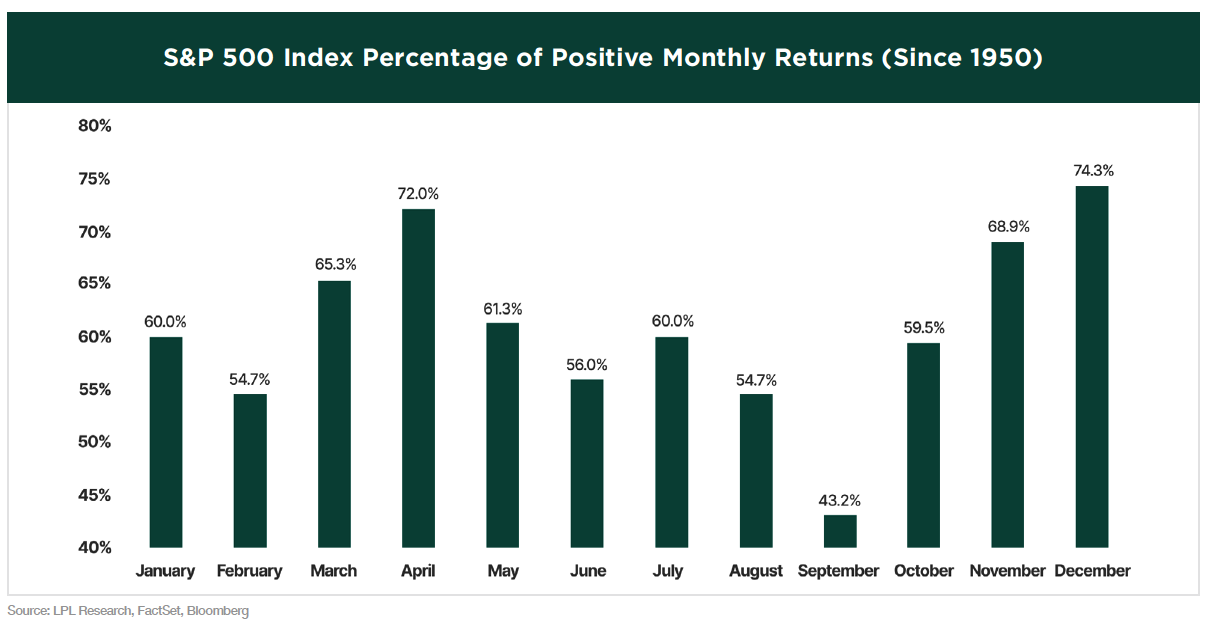

While each year brings its own dynamics and past performance never ensures future outcomes, history suggests that the fourth quarter tends to be a favorable season for equities. Since 1950, the market has posted gains 59.5% of the time in October, 68.9% in November, and 74.3% in December, supporting the potential for this year’s rally to extend further.

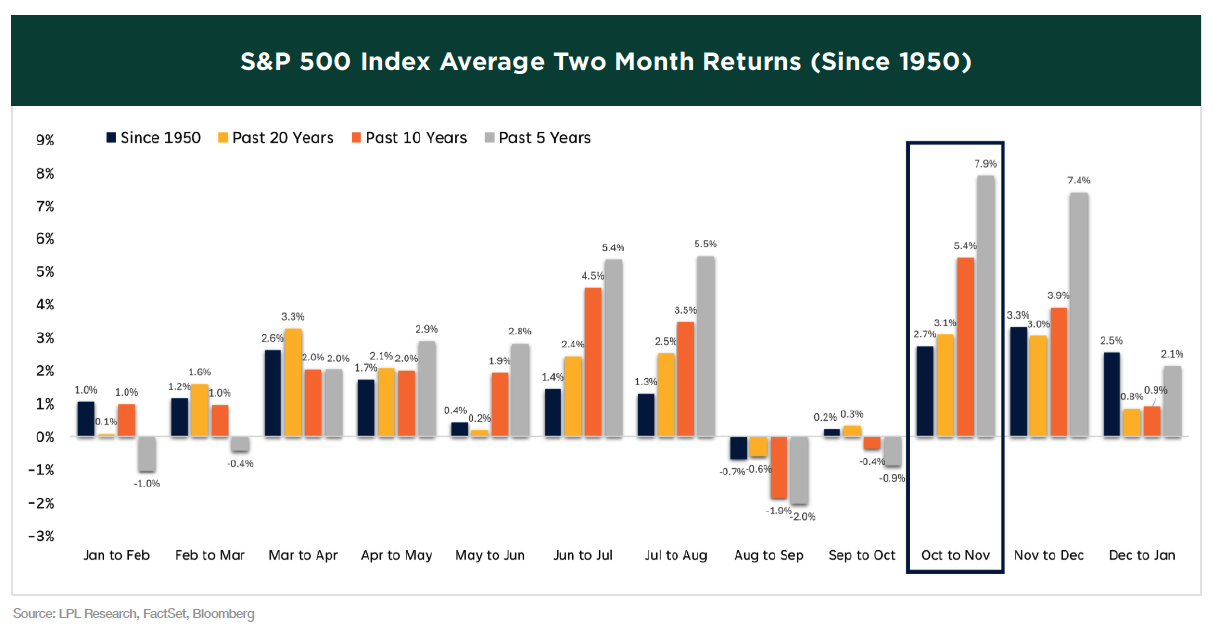

Over both the past five- and ten-year periods, October and November have stood out as the stock market’s strongest two-month stretch of the year.

While seasonal trends favor the market as we enter the fourth quarter of what looks to be another strong year for equities, a range of other factors will influence how the year ultimately ends.

In our last newsletter, we highlighted that inflation and labor market trends are going to be crucial things to monitor, as these key indicators are critical in shaping the Federal Reserve’s rate decisions as it seeks to fulfill its dual mandate of stable prices and maximum employment. In recent months, notable developments have emerged, particularly within the labor market.

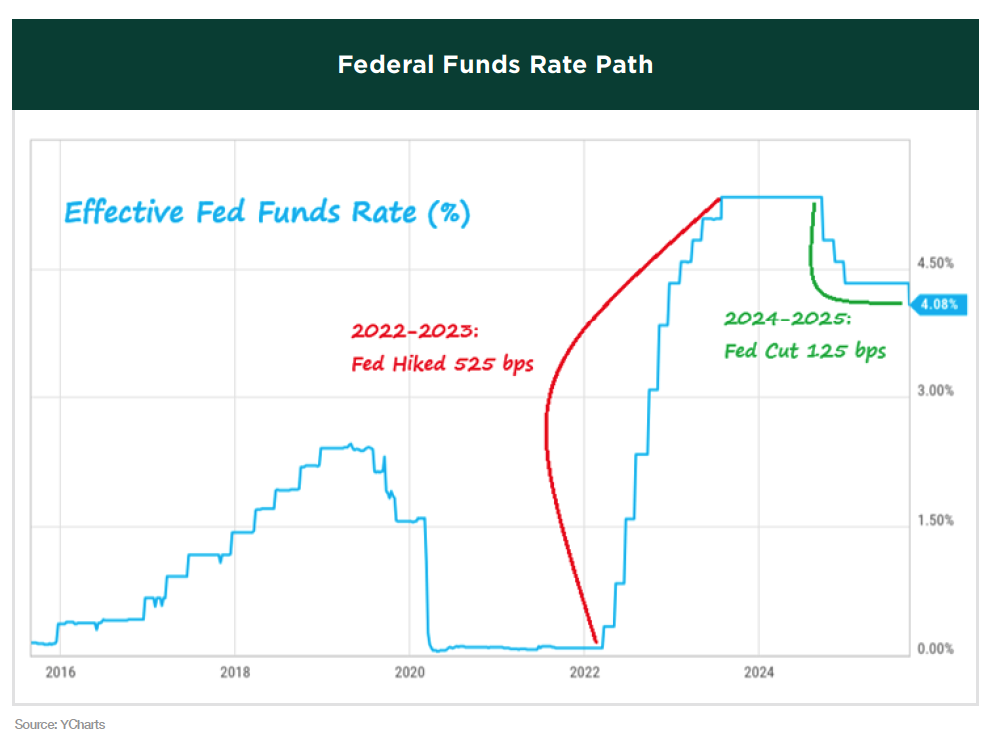

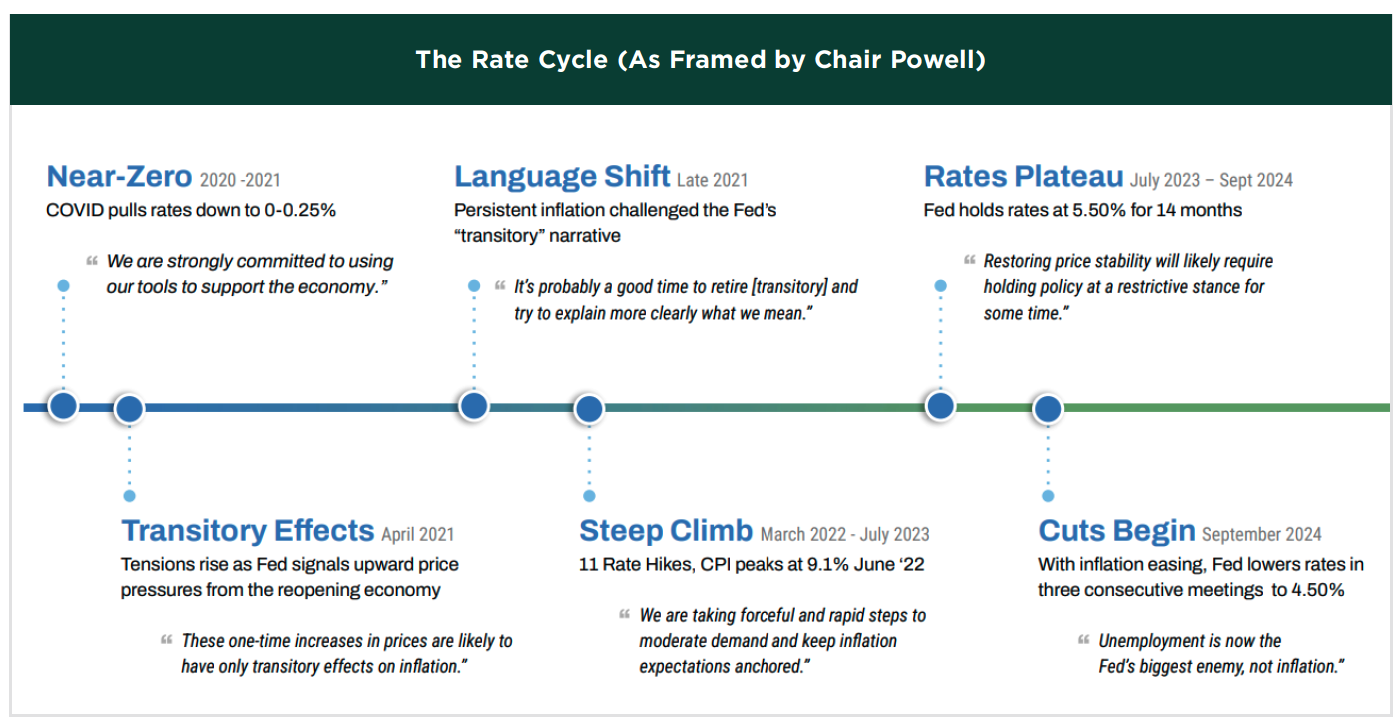

Although inflation remains elevated and persistent, the Federal Reserve’s primary focus has shifted to the weakening labor market. As Fed Chair Jerome Powell noted, the current risks to employment now outweigh those from inflation. While inflation continues to be a concern, the prevailing view is that tariff-driven inflationary pressures are likely temporary, allowing the Fed to prioritize averting a downturn in the labor market. This shift in focus led to a 25-basis point cut in the Fed’s benchmark policy rate at their September meeting, the first reduction since December 2024.

The Fed has also signaled that additional rate cuts are likely, a move that has been welcomed by the stock market as investors see further easing as a positive driver for growth. Rate reductions are generally favorable when the economy remains stable, as they can encourage expansion without sparking a recession. However, cutting rates too aggressively, particularly in a strong economy, risks overheating and higher inflation. This delicate balance underscores the Fed’s challenging task of fostering growth while maintaining price stability.

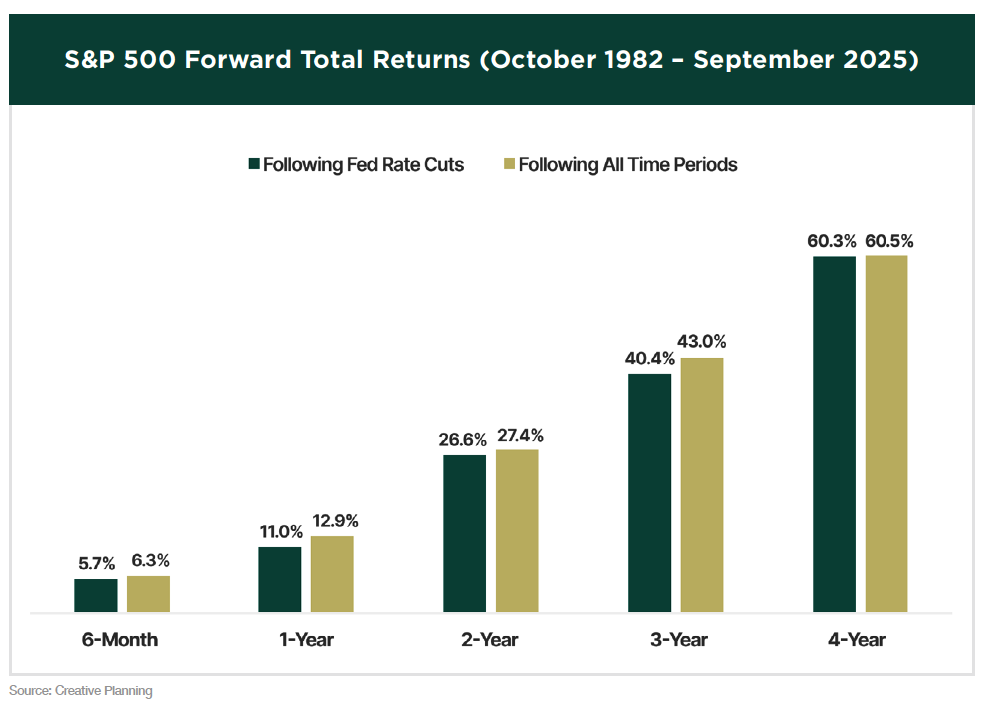

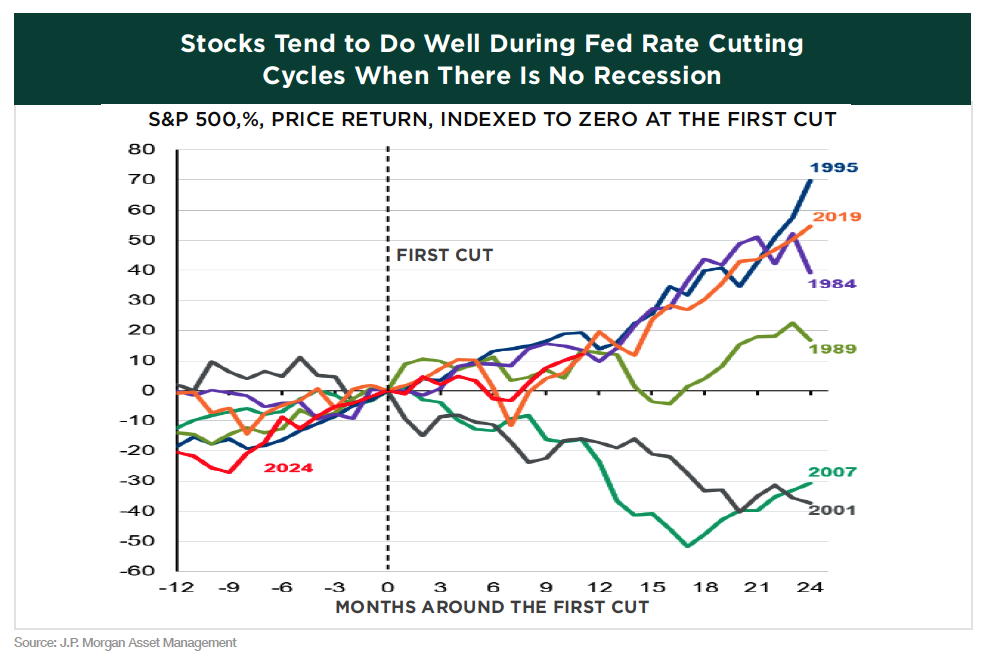

There’s often enthusiasm when the Fed cuts interest rates, with the expectation that stocks will benefit from an easing cycle. However, the data tells a different story. Over the six months to four years following rate cuts, the S&P 500 has delivered slightly below average returns compared with any random day.

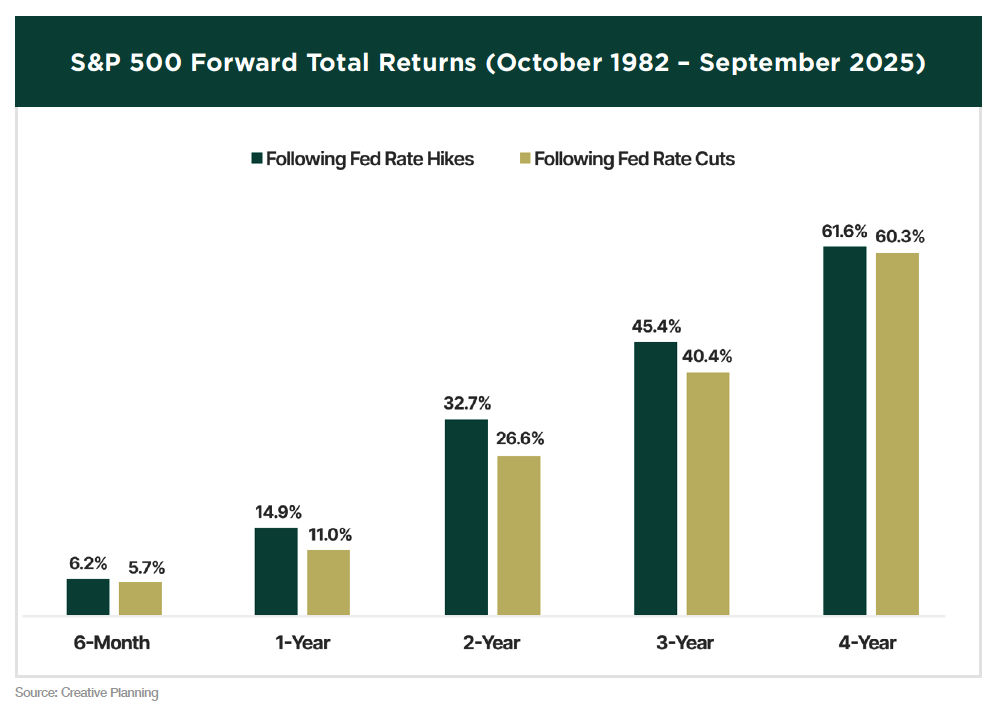

Surprisingly, stocks have actually performed better on average following rate hikes than after rate cuts.

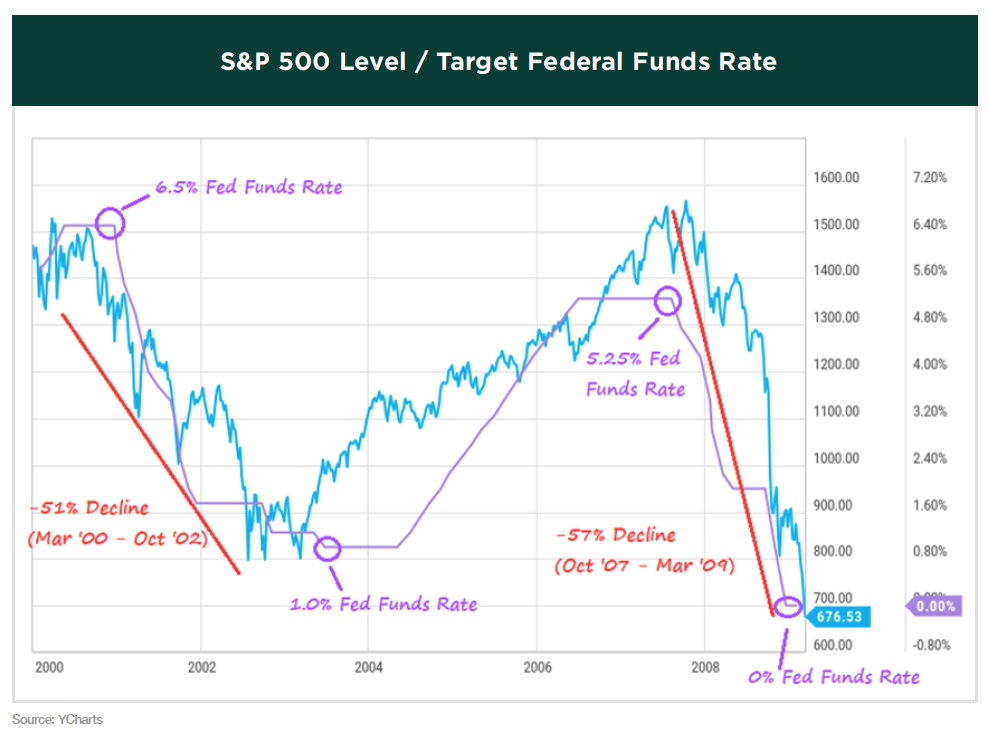

Why would this be the case? Often, the Fed cuts rates in response to economic weakness, as was the case in 2001 and 2007. Those initial cuts back then were followed by two of the worst bear markets in history, pulling down the historical returns.

The key takeaway is that rate cuts aren’t automatically bullish, especially when they occur alongside a recession. It’s important to consider the context: is the Fed cutting rates in an economy that is still growing, which is how investors are interpreting the recent move, or is it responding to a rapidly weakening economy? As long as economic data remains strong enough to avoid a recession scare, we believe the market can continue advancing, not just through the end of this year, but throughout next year as well.

As we noted last quarter, rate cuts typically lower short-term yields, but they don’t guarantee a decline in long-term rates, which affects mortgage rates and other long-term borrowing costs. That pattern is holding true, with longer-term yields showing more resistance, driven in part by elevated inflation and a reassessment of expectations for future rate cuts.

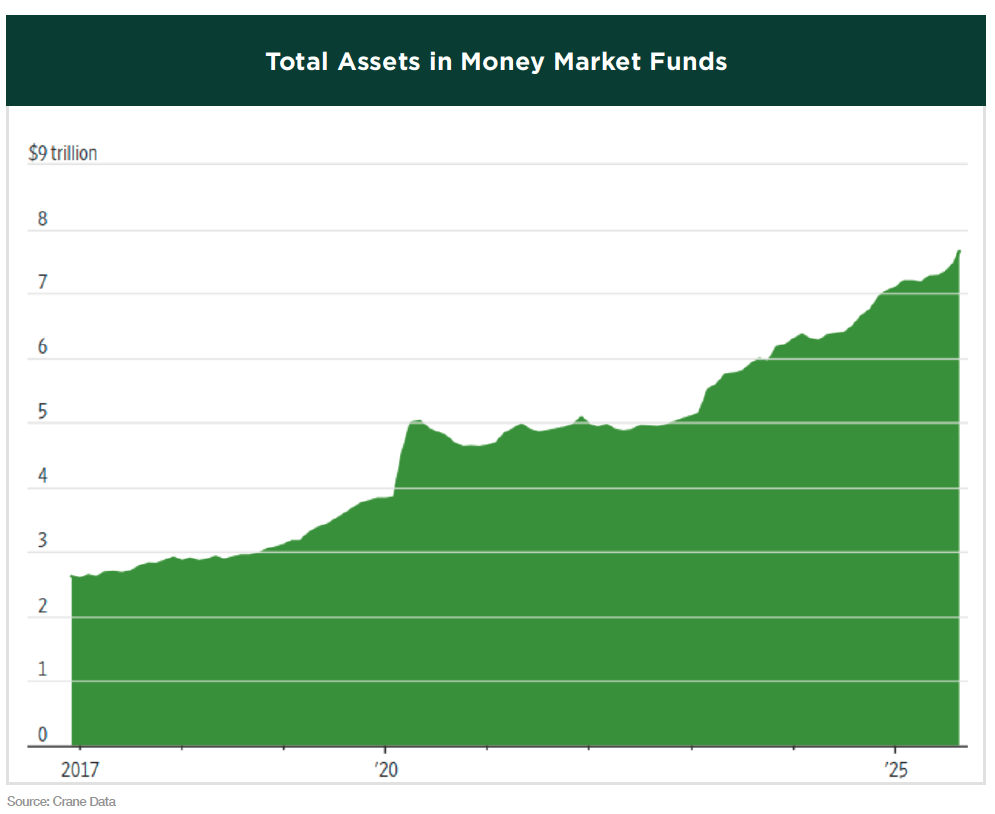

Savings accounts, money markets, and CDs saw a surge in recent years as elevated short-term rates offered some of the highest cash returns in over a decade. Money market assets alone have nearly tripled over the past eight years, reaching a record $7.7 trillion. With policy easing and falling short-term rates, those payouts are now set to decline. As yields drop, deposit income will shrink, making large cash holdings less appealing. This shift is likely to steer investors toward assets that offer higher income or long-term growth potential, a development that could serve as a tailwind for the stock market.

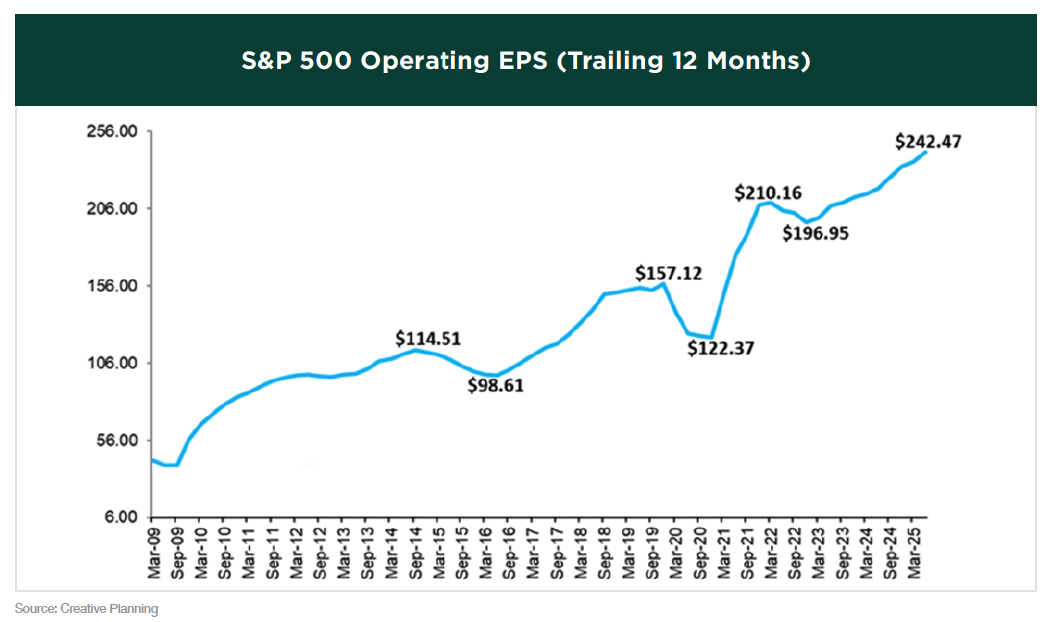

As earnings season ramps up this month, we’ll get another look at how companies are navigating the impact of tariffs. Earnings remain the primary driver of stock prices, and they have continued to grow, with S&P 500 profits reaching new highs last quarter, up 11% year over year. Projections for this quarter are also strong, providing further evidence that the market may still have room to advance.

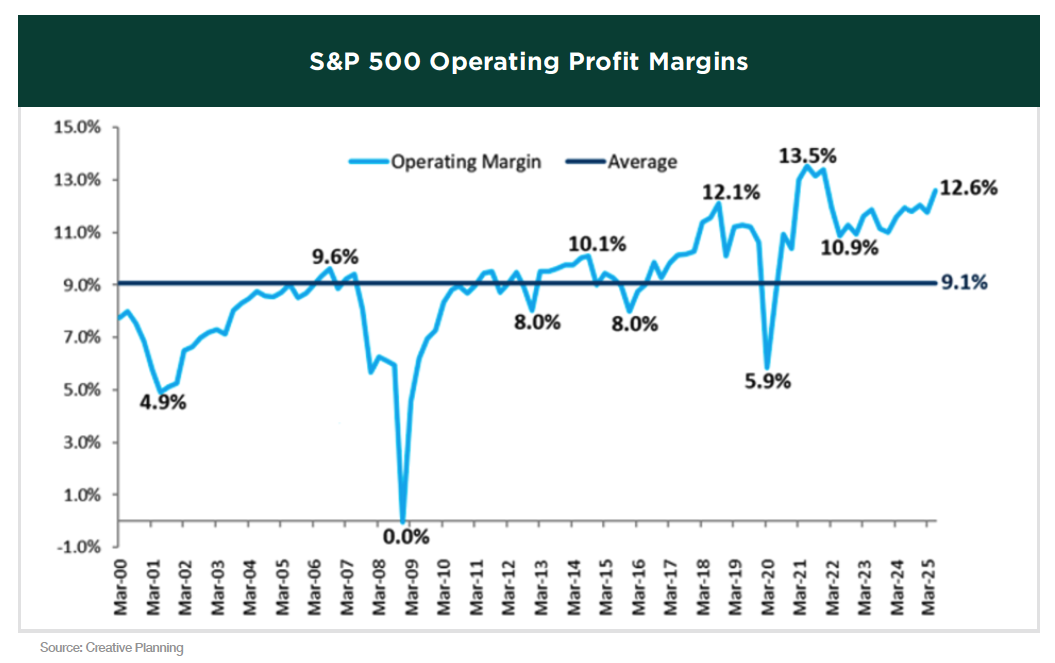

S&P 500 profit margins rose to 12.6% last quarter, reaching their highest level since 2021.

As investors focus on Fed policy heading into year-end, the recent rate cut can be viewed as the Fed pivoting toward easing, but with caution. They are responding to signs of labor market stress while still wrestling with inflation above target. Markets, particularly risk assets, have reacted positively, but much depends on whether future data (lower inflation, softer labor market) will justify further easing. As long as rate cuts occur in a stable, growing economy, the stock market should continue to benefit, with further positive returns likely.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT

GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.