THIS OCTOBER MARKS TWELVE MONTHS since the stock market bottomed out in what was a very painful year for many investors. 2022 was filled with uncertainty and volatility which caused investors to be leery of any market rally we experienced along the way. This is because each time it looked like the market might have hit bottom and started to turn around, it ended up being just another bear market rally which subsequently resulted in the market hitting new lows.

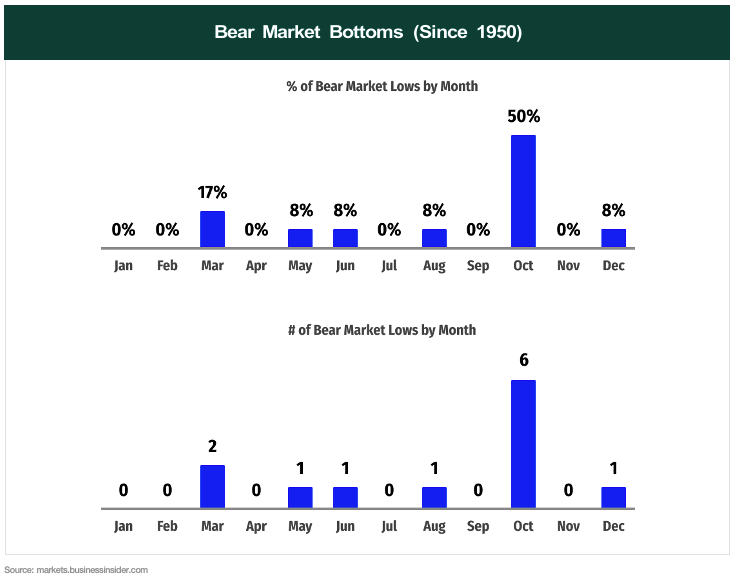

Therefore, when the market started rallying last October, why would investors think that this time was any different? After all, we knew the Fed wasn’t done hiking rates and inflation levels, while starting to trend down, were still at historically high levels. One possibility might simply come down to the positive seasonality that we typically experience in the fourth quarter, which tends to produce the best returns of the year. Interestingly, out of the twelve bear markets we have experienced since 1950, six of those have hit bottom in October.

Fast forward to now, and even as the market has had a decent run off its lows (although most index gains can be attributed to a select group of mega-cap stocks as discussed in The Viewpoint last quarter), the last few months have seen the rally fizzle out, with the S&P 500 falling 3.65% in the third quarter. But as we head into the final months of the year, the odds are pretty good that the market will attempt to rally again just as it did around this time last year.

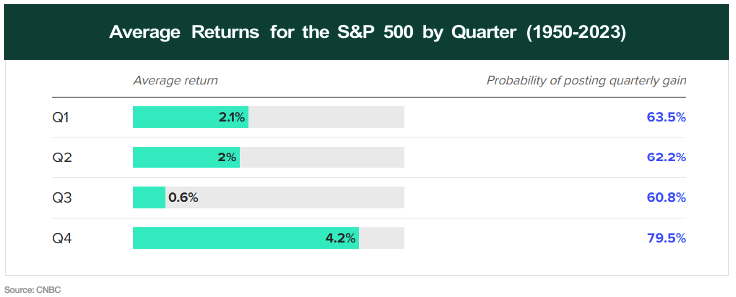

Since 1950, the S&P 500 posted positive returns in the fourth quarter 79.5% of the time with the average return being 4.2%. Those figures are higher than the other three quarters by a wide margin.

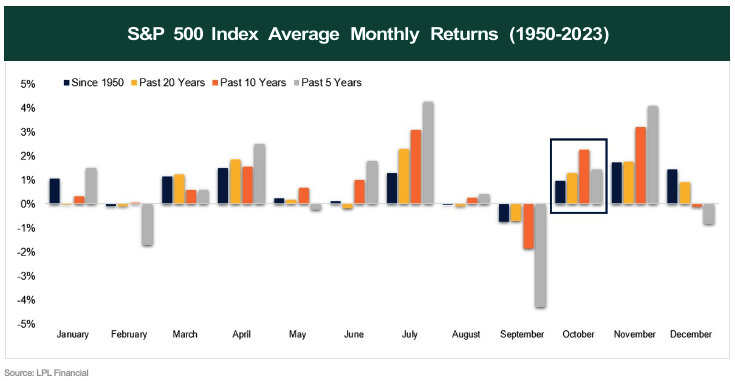

Although this October hasn’t been great so far, historically it has been a solid month for stocks with the sixth-best monthly returns over the past five years, and third and fourth-best over the past ten and twenty years, respectively.

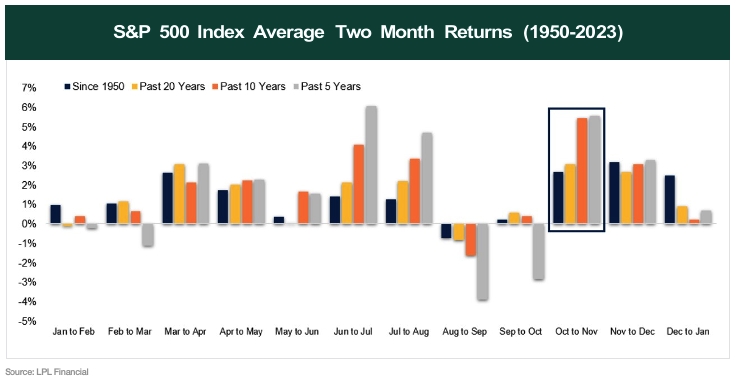

Looking out further, the October-November two-month period is on average the strongest of all the monthly pairings over the past five and ten years and is second strongest over twenty years and all periods dating back to 1950.

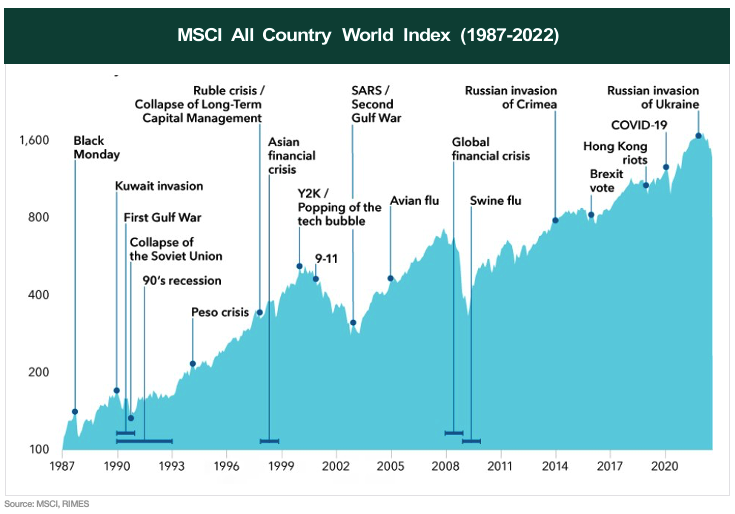

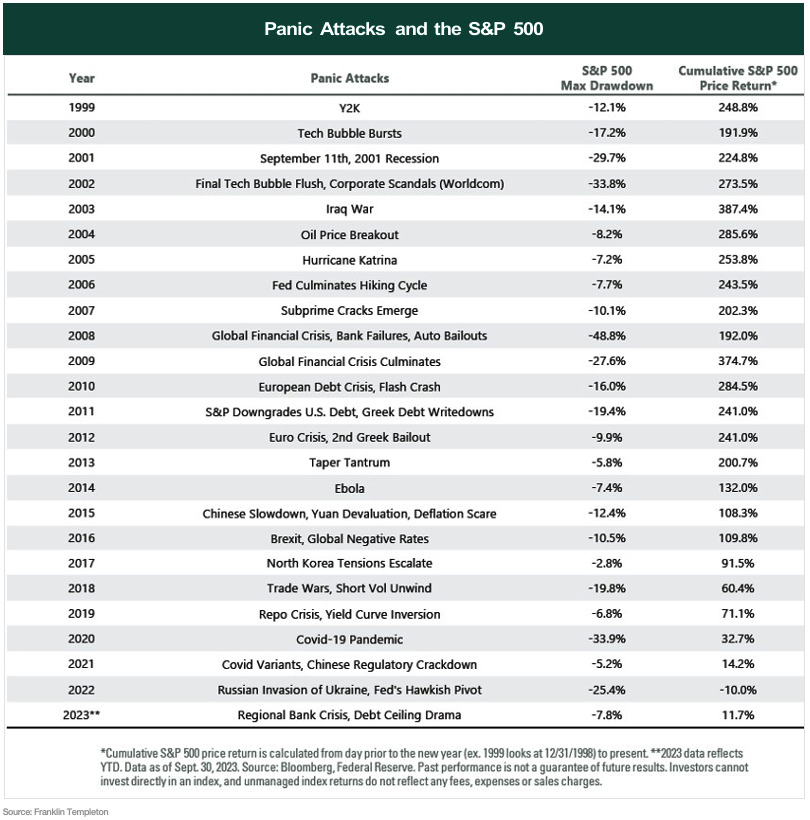

We’re not suggesting investors should trade purely off the market’s seasonal tendencies, but it does help give some perspective with all the risks and concerns that are on the minds of market participants right now. Elevated inflation, rising rates, political dysfunction, slowing economic growth, and conflicts overseas being just a few examples. The “wall of worry” is always present, and the 24-hour news cycle ensures it reaches you in one form or another. There are always going to be risks and shocks to the market, but in the end, the market has always recovered and continued its path higher over time. Market disturbances are a fact of life for investors.

History shows us that negativity tends to be a temporary impediment rather than a permanent blockade for markets. Why is this? Because capitalism and markets work. Volatility will always be a feature of investing and should be expected and planned for, not feared. Climbing the “wall of worry” is one of the keys to investor success.

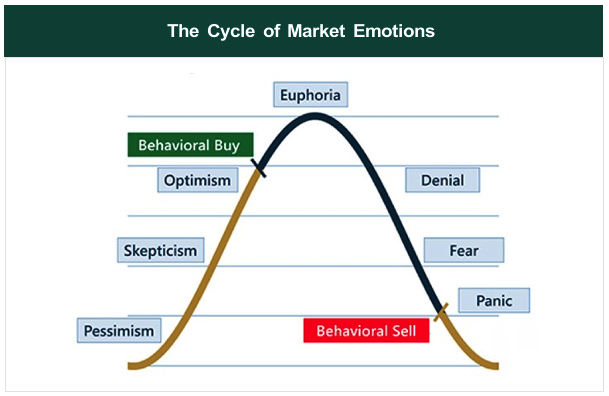

We have written numerous times in the past about the importance of staying invested and just how detrimental it can be to your portfolio performance over time if you attempt to time getting in and out of the market. The market will have pullbacks and corrections, and there will be times when you want to sit on the sidelines until things calm down. But as we have stated before, it’s almost impossible to time the market effectively and most investors who try will end up selling when stocks are close to the bottom and buying back in when stocks are near the top.

Things happen each year which provide shaky investors excuses to go to cash, and some events do in fact cause a significant drawdown in the stock market (as shown in the following chart). However, we have learned over time that this financial pain is temporary, and the market recovers and becomes stronger than it was before. This is because the strongest companies learn from the past and adapt to become more efficient and profitable, and shareholders have been rewarded for that over the long run. Since 1957, which is when the S&P 500 adopted the current methodology of using 500 stocks in the index, the average annualized return of the stock market, using the index as a proxy, has been just over 10% through 2022. There aren’t too many investment vehicles you are going to find that provide a long-term average annual return better than that.

Let’s think back to 2020. One of the worst things that can happen to the U.S. stock market is that companies of the U.S. can’t do business…can’t sell their products…can’t make money. That literally occurred in 2020. We put everybody in their homes and shut down the economy. And yet the stock market closed the year positive. Don’t underestimate the resiliency of the stock market.

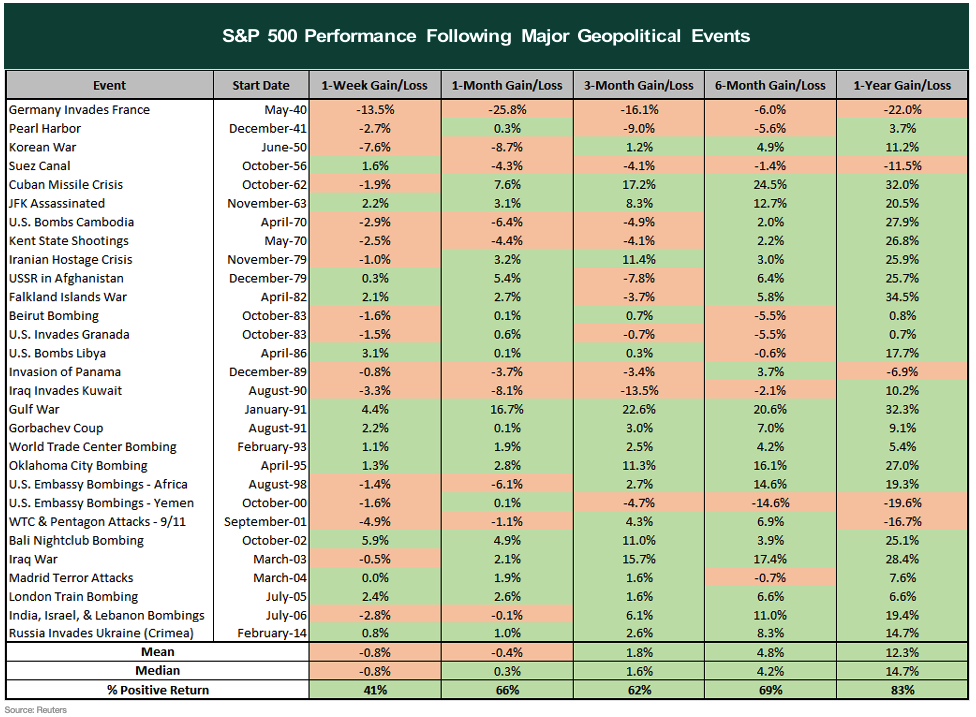

And now we can add the Israel-Hamas war to the above list. This unfortunate event has controlled the headlines of late and for good reason. The geopolitical ramifications are important and will likely not be fully understood for years. While it is difficult to do so during times like these, our job as investment managers is to assess what impact the conflict might have on the global economy and financial markets. Let’s briefly talk about the possible implications of this war.

As of this writing, we do not see significant economic or market impacts stemming from the conflict in its current form, although that could change quickly depending on how the conflict develops and if it spreads beyond the Gaza region.

But at this time, unlike Russia’s invasion of Ukraine, with its significant direct and indirect impacts on global supplies of energy, fertilizer, and agricultural goods, the war between Israel and Hamas will likely cause few, if any, significant disruptions to the global supply of critical goods, assuming again that it does not spread into a wider regional conflict.

Neither side are key oil players, and the conflict as it stands does not meaningfully impact oil production or supply. However, at times like these, energy supply and price shocks are never far from investors’ minds. Memories remain of the experiences during the 1970s. During the 1973 Arab Israeli war and again in 1979 following the Iranian revolution, embargoes and other dislocations disrupted oil supplies from the Middle East. In the event the current conflict escalates beyond its present scope, oil prices could spike and, potentially, supplies could be disrupted.

One possible way to imagine a widening of the conflict is via Iran, which has been a long-time supporter of Hamas. If Iranian-backed militants in Lebanon (e.g., Hezbollah) or elsewhere attack Israel, counter strikes from Israel could escalate the conflict into a regional war. Unfortunately, within the last couple days, we are starting to see a possible situation develop in Northern Israel along the Lebanon border as Israeli forces and Lebanon’s Hezbollah have begun exchanging fire. It started with militants in Lebanon launching a barrage of rockets and two missiles toward Israeli military sites and towns, in which Israel retaliated by striking Hezbollah targets in Lebanon.

The situation is incredibly fluid, and we are closely watching the potential for escalation beyond the sides currently involved. There are still questions about Iran’s involvement, but unless the conflict spreads, it appears that the supply- and-demand dynamics for oil won’t change materially. Conversely, if Iran does become involved, it is not unreasonable to assume they would attempt to militarily disrupt or sabotage Persian Gulf oil production and shipments via the Straits of Hormuz. In such a scenario, oil prices would surely jump, as would market risk premiums. But as of this writing, the likelihood of that happening is not very high.

There may be increased market volatility as investors continue to monitor the situation overseas, but in the long run, geopolitical events generally haven’t had a lasting impact on markets. In the subsequent table, 29 different geopolitical crises starting with WWII are listed along with the S&P 500’s returns following the events. On average, stocks were higher three months after a geopolitical shock, and 66% of the time stocks were higher after only one month. Generally, the odds that stocks will be higher increase as time passes after the event. In addition, stocks sometimes jump sharply after a crisis, so getting out of the market could have significant opportunity costs.

Despite geopolitical uncertainty taking center stage, the U.S. market’s focus remains squarely on interest rates. Over the past two months, stocks have largely taken their cues from the bond market, as the rally in long-term yields to new cycle highs threatens valuations and the economy’s positive momentum. The silver lining behind the surge in Treasury yields, and the resulting tightening of financial conditions over the past few months, is that they may reduce the need for more rate hikes.

In our view, the Fed’s tone appears to be changing, with the focus turning from whether to keep hiking rates to how long to hold policy at restrictive rates. The policymakers agree that interest rates should stay high for some time, which isn’t a new development. But what is new is that some members are starting to express concerns about tightening too much. Nonetheless, this just confirms that we are either at or near the end of this tightening cycle. The market has withstood the rate hikes so far and the labor market remains strong. Also, other than the mini banking crisis in the Spring, nothing in the economy has broken as many people have feared.

We still have a long way to go before the full effect of the rate hikes work their way through the economy, so by no means are we out of the woods yet. History shows the odds are good that we are going to start seeing cracks in the economy, and there is a high probability that we are heading toward a recession. From the number of economic indicators flashing recession warning signs, it’s hard to imagine we can avoid one. With that being said, many economists predicted we would enter a recession in 2023 and they turned out to be wrong. The economy has proven to be remarkably resilient and as of now, the Fed’s goal of a soft landing is still intact.

The possibility of whether an “official” recession happens or not shouldn’t scare investors away from the stock market. The market rarely behaves the way reasonable people think it should. We truly believe in the saying that “the market aims to inflict maximum pain on the largest number of people.” This saying goes hand in hand with the market principle referred to as the “pain trade.” This simply means that when the majority of investors have a bearish outlook, stocks will climb. Conversely, when most people are bullish, the opposite occurs, and stock values decrease. This well-established pattern is what led to Warren Buffet’s famous advice, “when other people get scared, get greedy.”

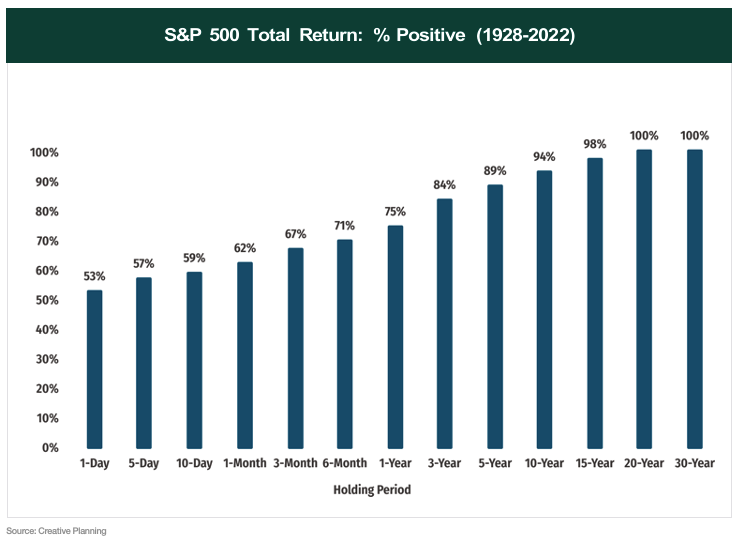

We’ve said this before but it’s worth repeating the old adage: It’s not about timing the market, but about time in the market. Research has proven time and time again that those who stay invested over the long run in a well-diversified portfolio will generally do better than those who jump in and out of the market. And the longer you stay invested, the greater chance you have of a positive outcome.

This improvement has carried into July for the most part too. While large-cap stocks and growth sectors have been and still are leading the way, we are seeing some encouraging signs within the small and mid-cap space as well as improved breadth across almost every sector. Seeing an increase in the number of stocks trading above their moving averages is one way to identify improving market breadth. We can see from the following chart that this is exactly what has been occurring over the last couple of months in most sectors.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.