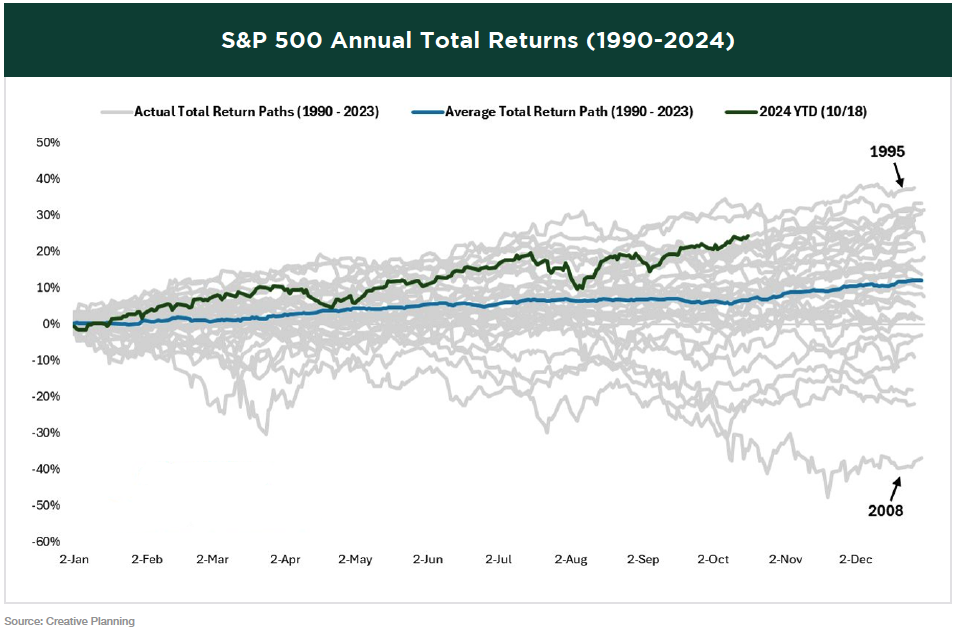

AS THE YEAR DRAWS TO A CLOSE, the stock market is on track to deliver one of its strongest performances on record. The S&P 500’s total return of 23% (as of this writing) is nearly four times the average for this time of year, marking the best start to a year since 1997.

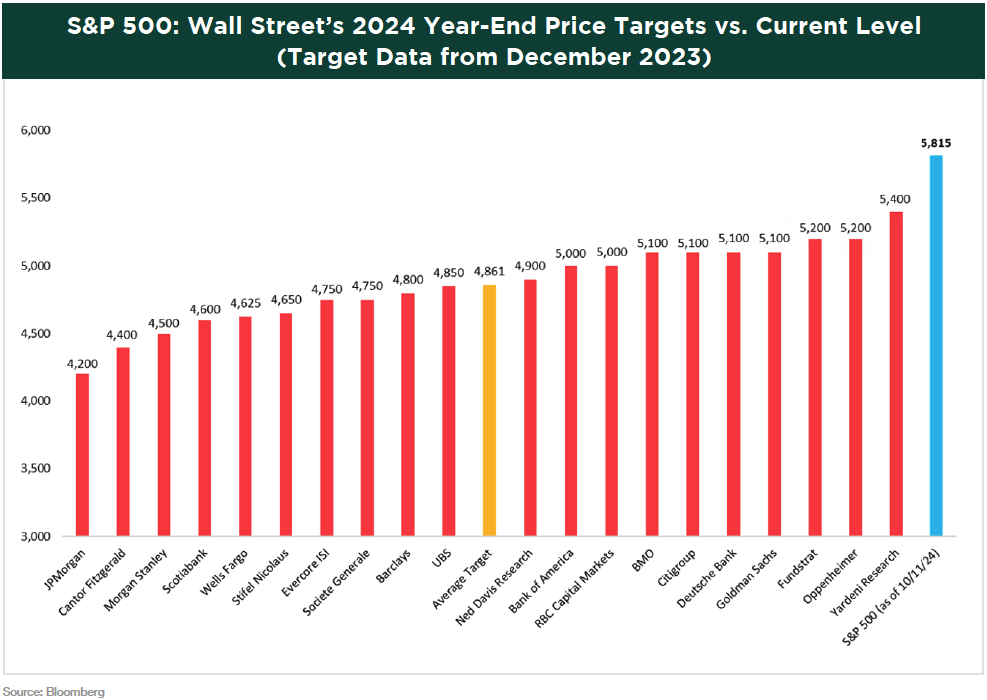

Given the equity market’s impressive performance this year—exceeding every Wall Street analyst’s forecast heading into 2024—investors are now wondering how long the stock rally can continue.

We believe there’s a strong likelihood that stocks will continue to rise, especially given the backdrop of steady economic growth and anticipated rate cuts. Furthermore, the markets could gain from increased clarity surrounding the U.S. election results and their potential impact on key areas such as taxes and trade.

The U.S. economy has successfully passed its first soft-landing test, showing resilience throughout a challenging disinflation process. Inflation has significantly cooled, enabling the Federal Reserve to shift toward rate cuts and refocus on supporting a slowing labor market. The final challenge will be whether the Fed can reduce rates to normal levels while maintaining economic stability. Employment growth has slowed, making it increasingly difficult for new workforce entrants, such as college graduates and immigrants, to find jobs. As a result, the unemployment rate is rising, though notably without the widespread layoffs typically seen during a recession.

Corporate sector fundamentals appear strong, which should help maintain a period of low layoffs. Economy-wide corporate profits improved in the second quarter, and consensus earnings growth estimates for the third quarter indicate continued resilience, with expectations of broader growth beyond just mega-cap companies. This isn’t the typical corporate environment that would trigger a layoff cycle. However, it’s crucial to closely monitor initial jobless claims and similar indicators for any signs of a shift toward recession.

The Federal Reserve’s primary concern has now shifted from inflation to the labor market. We believe that job data will be a critical driver in 2025, influencing stock market performance. Consumer spending, which makes up more than two-thirds of the economy, needs to stay strong. As long as the labor market doesn’t weaken significantly, consumer spending should hold up. However, if data points to deterioration in these areas, the Fed has room to cut rates aggressively, which should help stabilize the economy.

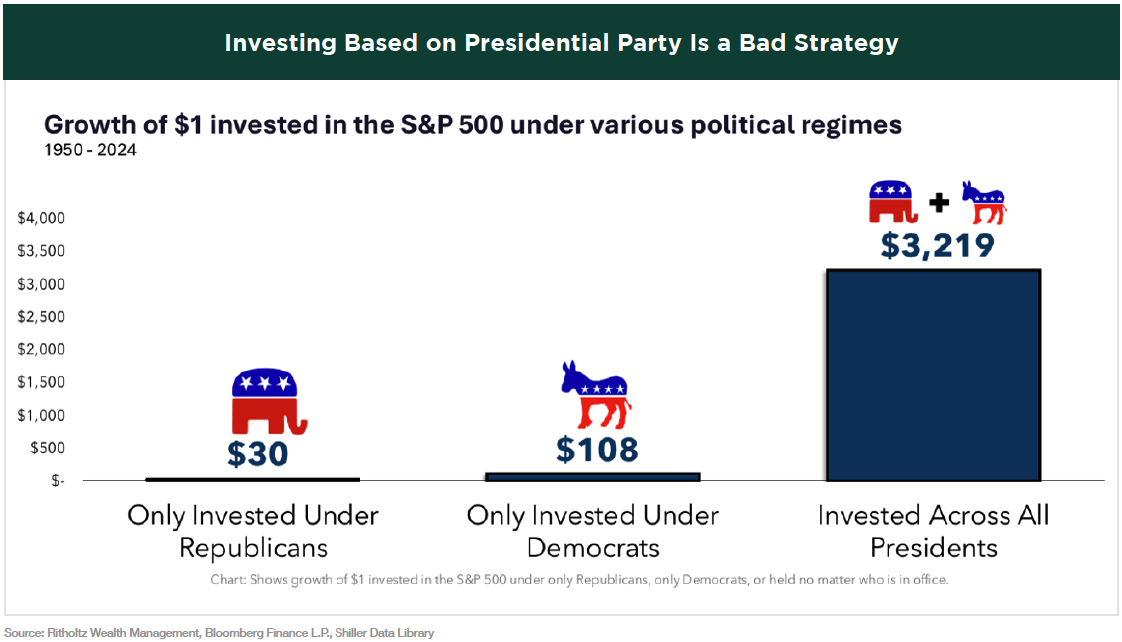

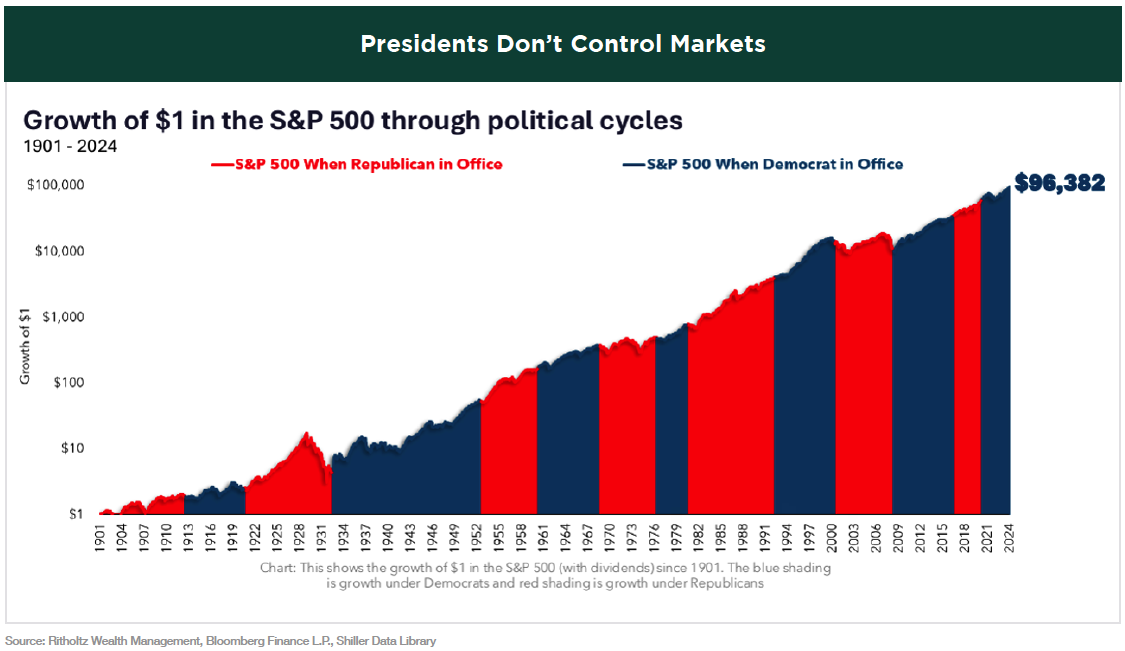

While future economic data will play the most crucial role in shaping the stock and bond markets, the upcoming presidential election is currently in the spotlight. We’ve previously emphasized that investors should not base their asset allocation decisions solely on the election outcome and certainly shouldn’t let the winning party dictate whether they remain invested in the market.

No president—Democrat or Republican—has the power to single-handedly control the $57 trillion stock market. Historically, the S&P 500 has delivered average annual returns of 12% during Democratic presidencies and 8% during Republican terms. Over time, the key drivers of the stock market have been the economy and corporate earnings, not the occupant of the Oval Office. Investors should remember that staying invested is essential to benefit from the long-term rewards of compounding.

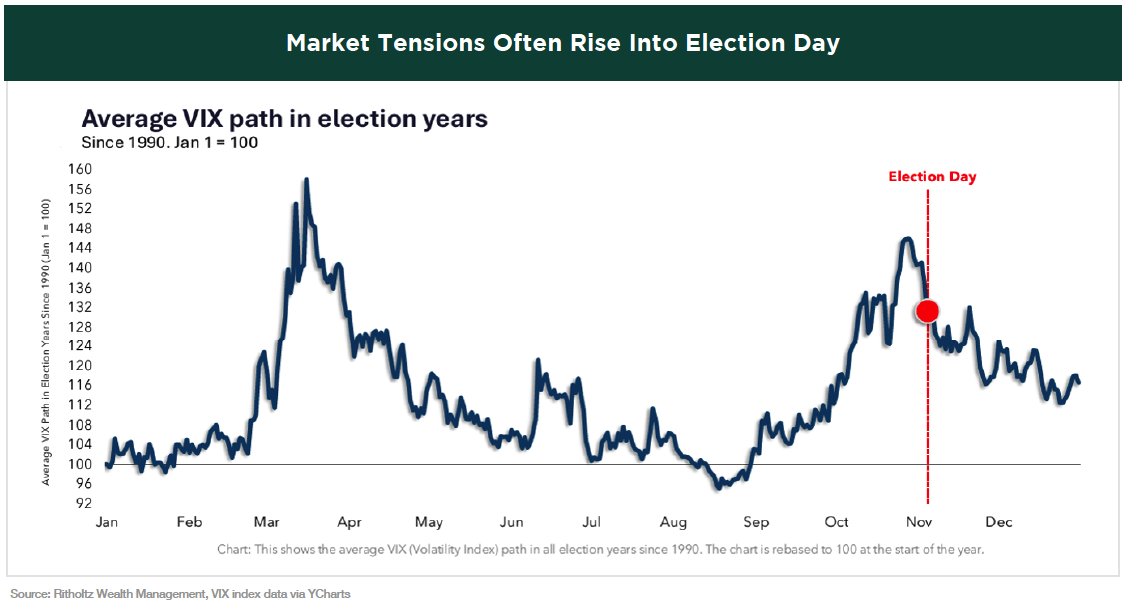

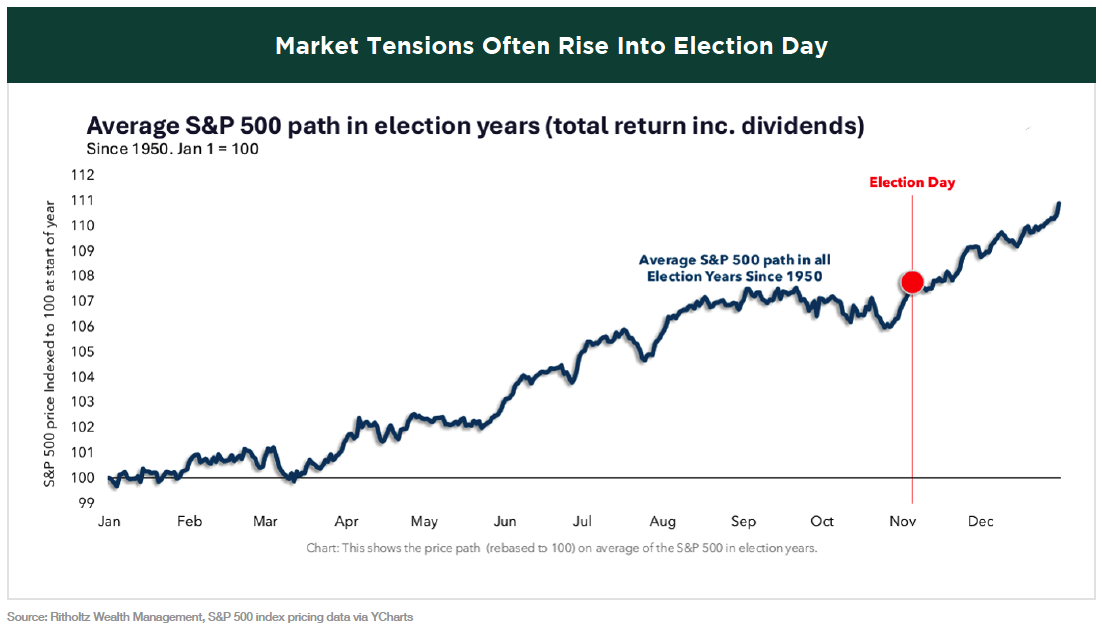

While political themes may not have a lasting impact on the markets, uncertainty often creeps in during the days leading up to an election. Fall is already a historically turbulent period for the stock market, with October being the most volatile month for the S&P 500. As the election approaches, investors often become more nervous, adding to the market’s seasonal volatility.

Election uncertainty typically doesn’t persist for long. The S&P 500 often rebounds from any pre-election weakness and tends to rally into year-end. As we approach Election Day, it’s important to brace for market fluctuations. However, keep in mind that election-driven volatility usually fades quickly.

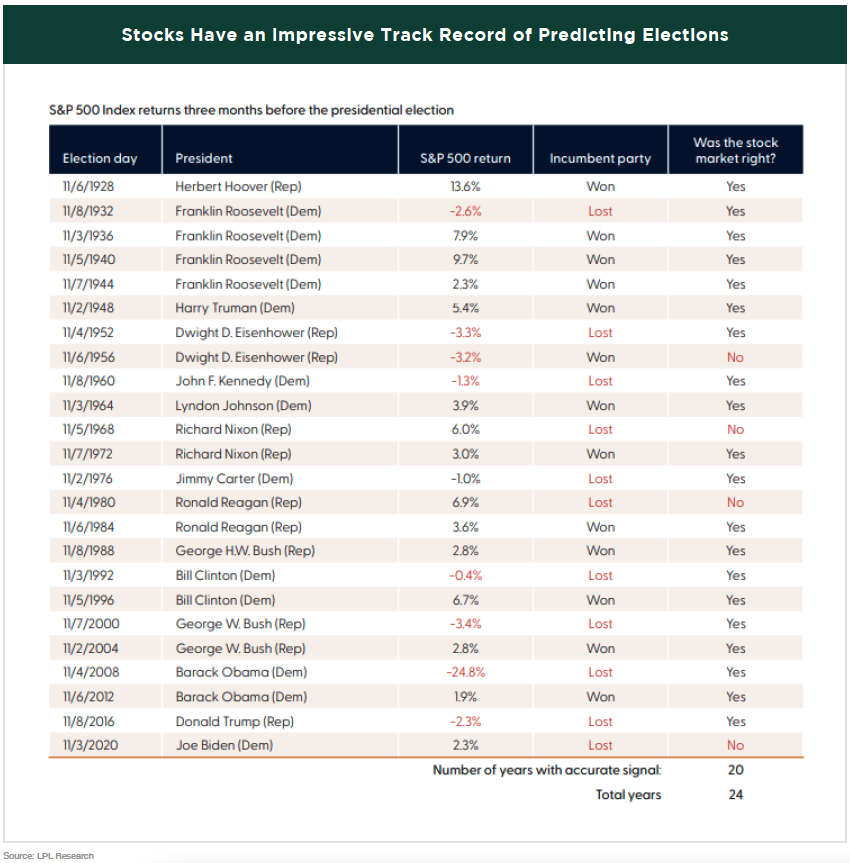

The 2024 election is shaping up to be extremely close, with polls indicating a virtual tie and key swing states likely to determine the outcome on election night. Interestingly, the stock market has historically served as a surprisingly accurate and unbiased election forecaster. Since 1928, when the S&P 500 has been positive in the three months leading up to an election, the incumbent party has retained control of the White House 80% of the time (12 out of 15 elections). Conversely, a declining market during this period has typically indicated a loss for the incumbent in 8 of the last 9 elections. Overall, market trends have accurately predicted 20 out of the last 24 elections. Since August 5, which marks three months before this year’s election, the S&P 500 has risen by about 8% (as of this writing), suggesting that the Democrats will remain in power. However, given the unpredictability of this election season, we should be cautious about relying solely on these historical patterns.

To conclude this quarter’s newsletter—and to continue in the coming quarters—we believe it’s beneficial to revisit some key investing principles that Greystone considers essential for every investor. It’s easy to lose discipline when the market is performing well, as it is now, but it’s important to keep core investing ideas in mind for when market challenges arise, as they inevitably will. Here are the first four rules to remember:

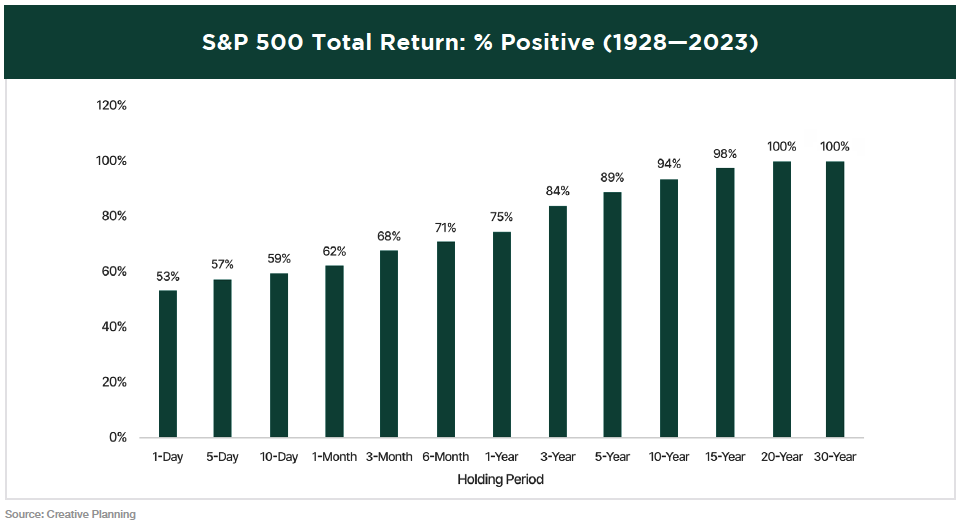

1. PLAY THE LONG GAME

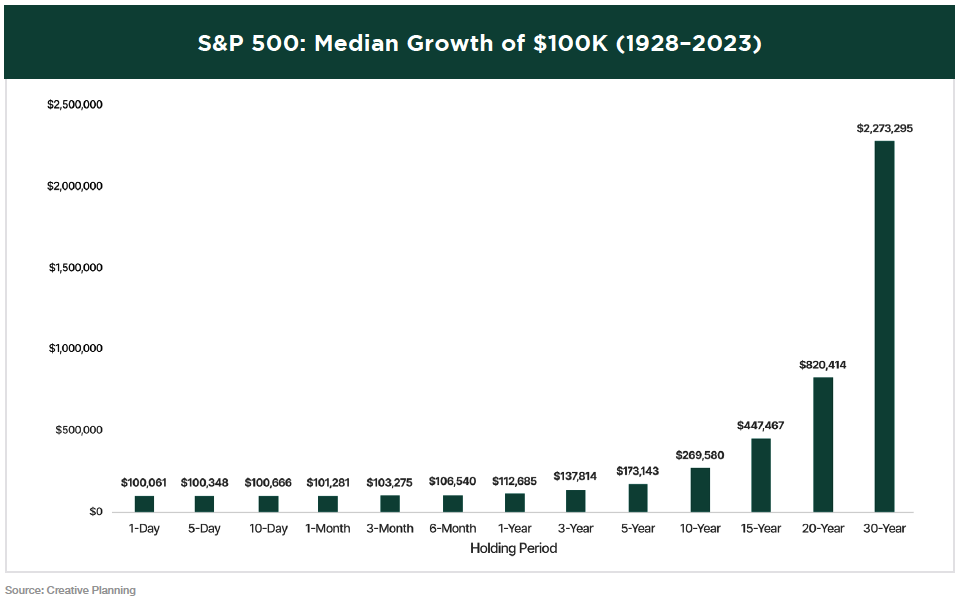

On any given day in the stock market, the likelihood of a positive return is just 53%, slightly better than a coin flip. However, if you extend your time horizon to a year, your chances of success increase to 75%. For a 20-year holding period, U.S. equity investors have never experienced a negative return.

2. NEVER INTERRUPT COMPOUNDING UNNECESSARILY

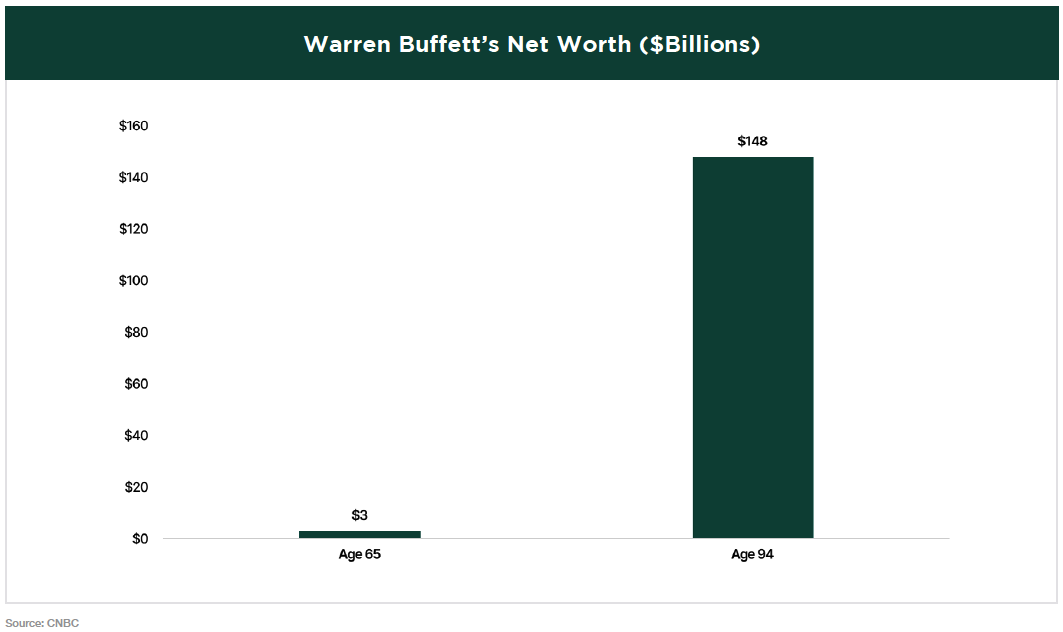

When Warren Buffett turned 94 this year, his net worth reached an impressive $148 billion. While that figure is astounding on its own, even more remarkable is that 98% of his wealth was amassed after he turned 65.

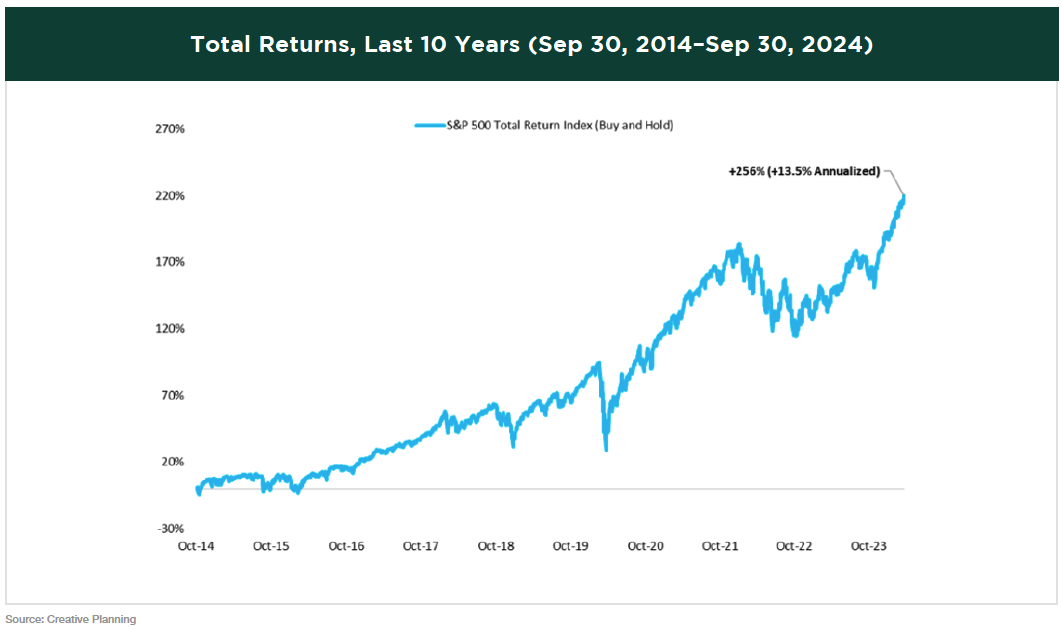

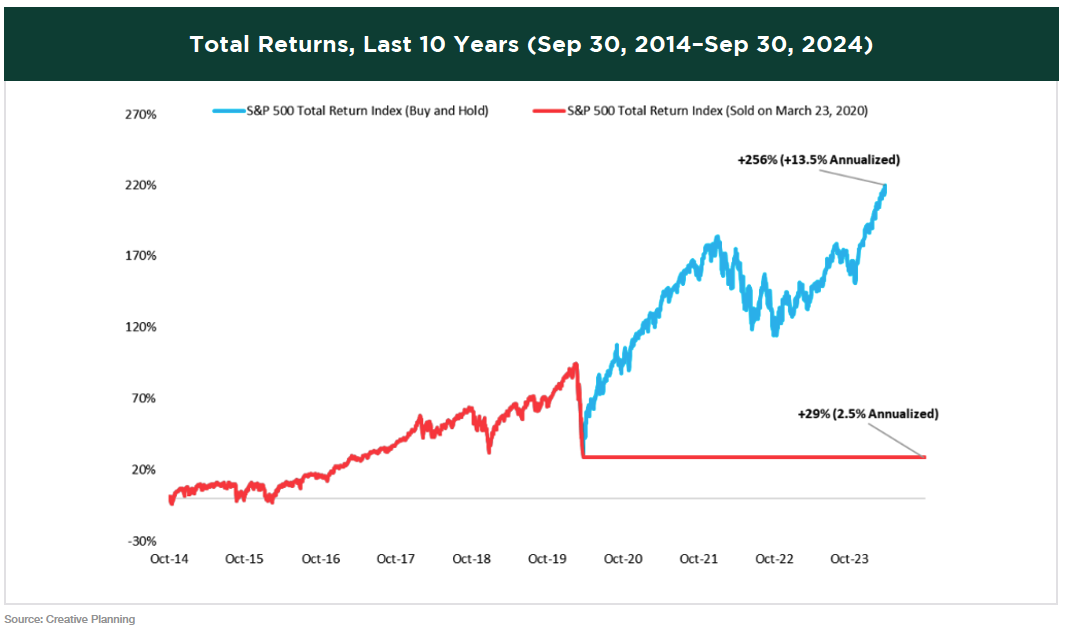

Compounding can yield remarkable results over extended periods. Over the last 10 years, a $100,000 investment in the S&P 500 would have grown to $356,000. This represents a 13.5% annualized return, equating to a cumulative gain of 256%.

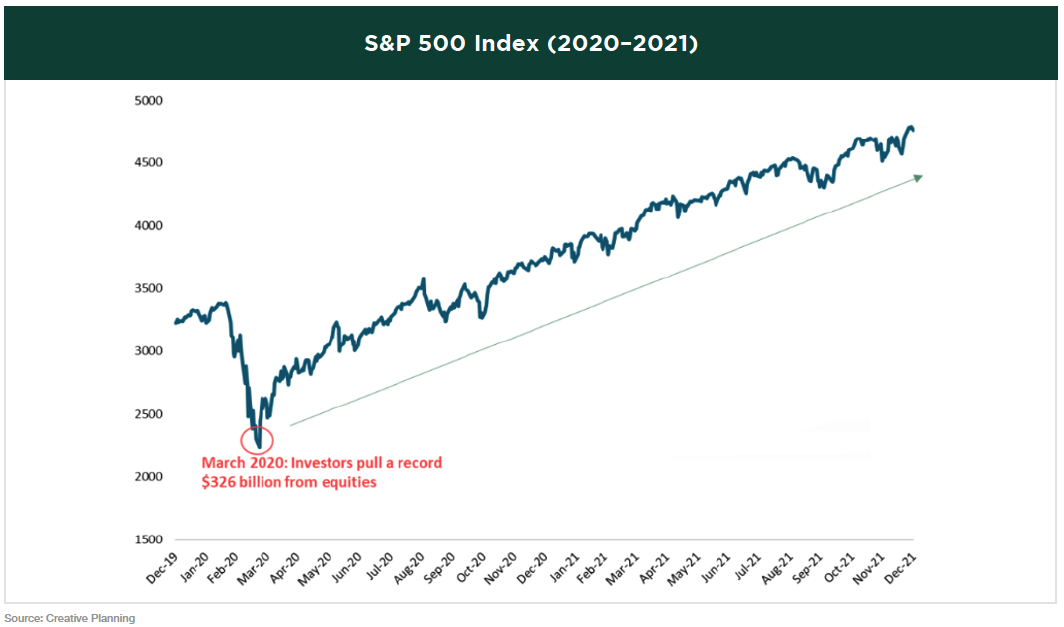

However, this scenario assumes that you invested 10 years ago and held on through both the highs and lows of the market. Many investors did not take this approach, as demonstrated by the record $326 billion withdrawn from equities during the March 2020 COVID crash.

For those who sold during the panic in March 2020 and didn’t reinvest, the cumulative return over the last 10 years was only 29%. In this case, a $100,000 initial investment would have grown to just $129,000.

3. DIVERSIFY, DIVERSIFY, DIVERSIFY

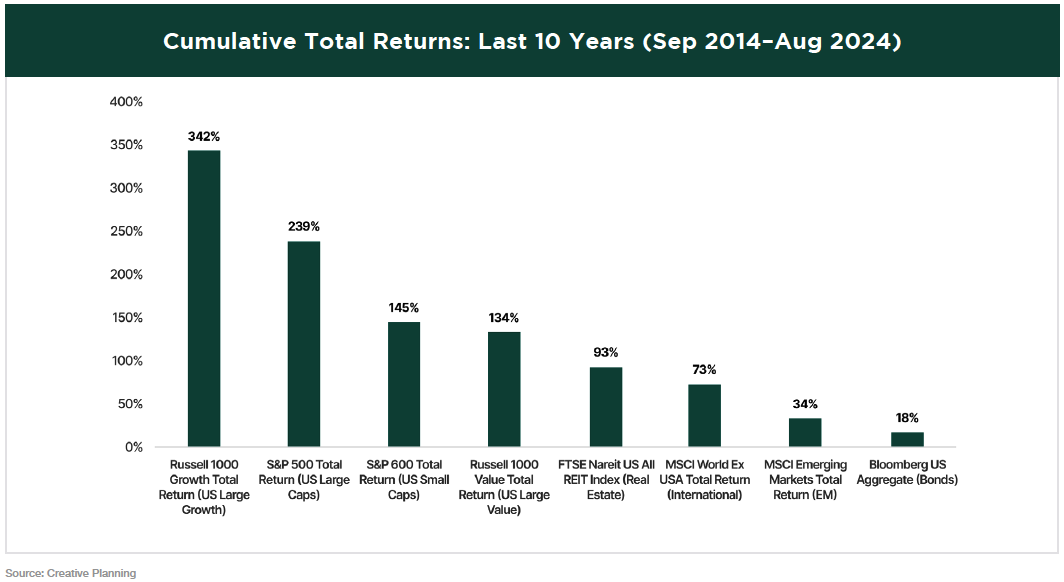

If you could accurately predict the future, you would undoubtedly choose to hold only the best-performing asset class. Over the past decade, that would have resulted in a portfolio focused exclusively on U.S. large-cap growth equities.

However, since no one can predict the future, it’s unlikely that you held a portfolio concentrated solely in that asset class. And that’s perfectly fine because true diversification means that not every part of your portfolio will perform well at the same time. There’s a cycle to everything in the markets; no investment can outperform indefinitely.

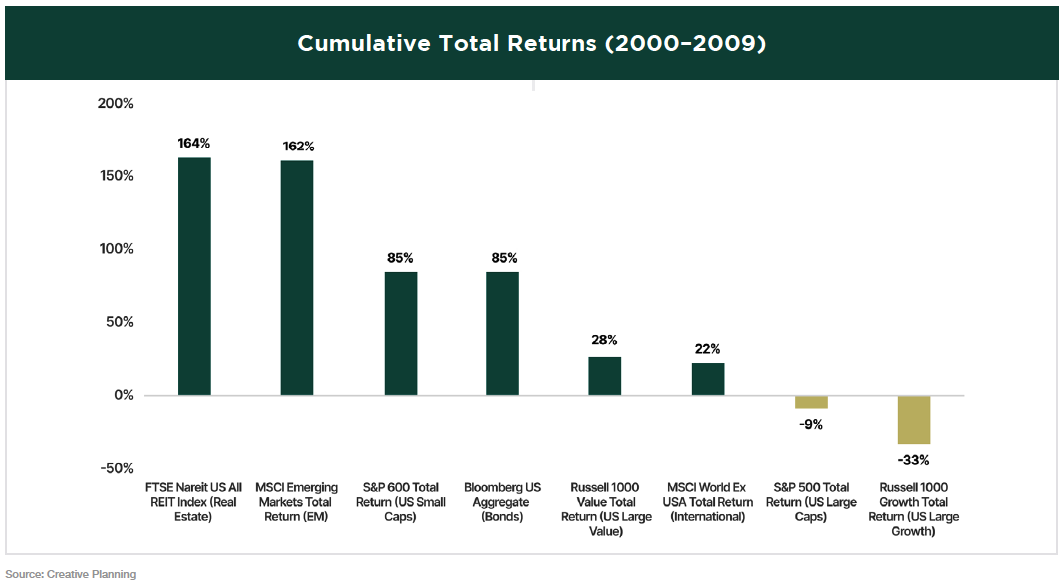

At the end of 2009, many investors were lamenting the “lost decade,” during which the S&P 500 Index declined by 9% and the Russell 1000 Growth Index fell by 33%. It may seem difficult to believe, but at that time, investors were genuinely questioning whether large-cap U.S. growth stocks would ever regain their footing.

Will the next decade for investors mirror the last one? Probably not. The leaders and laggards in the markets are constantly shifting, and the best safeguard against our inability to predict these changes is to embrace diversification.

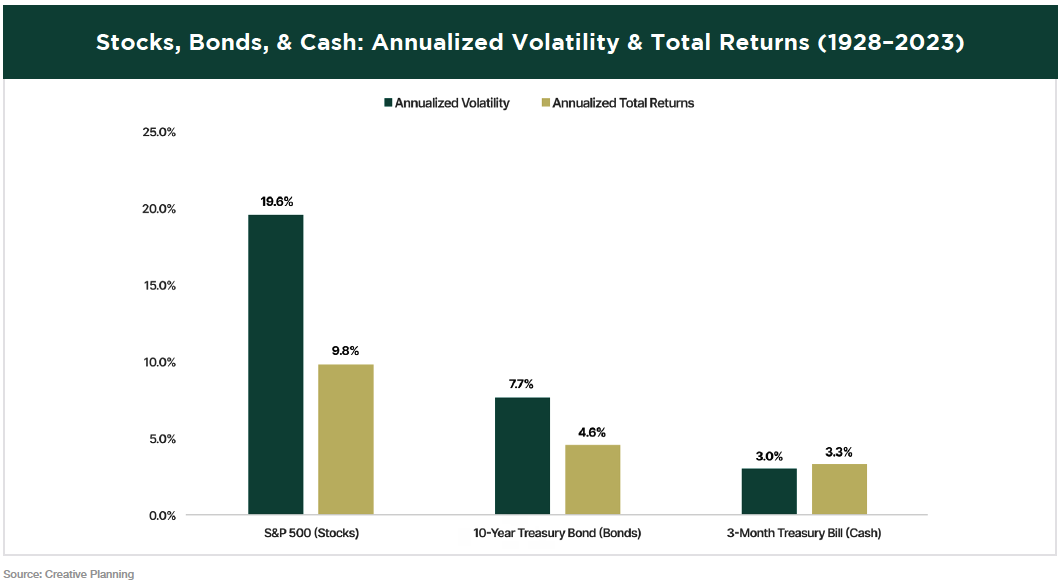

4. EMBRACE RISK

Risk often carries a negative connotation, but it’s important to recognize that without risk, there can be no reward. This principle applies to many areas of life and certainly to investing. For long-term investors, accepting a certain level of higher risk and volatility is essential if you aim to achieve returns that surpass those of cash.

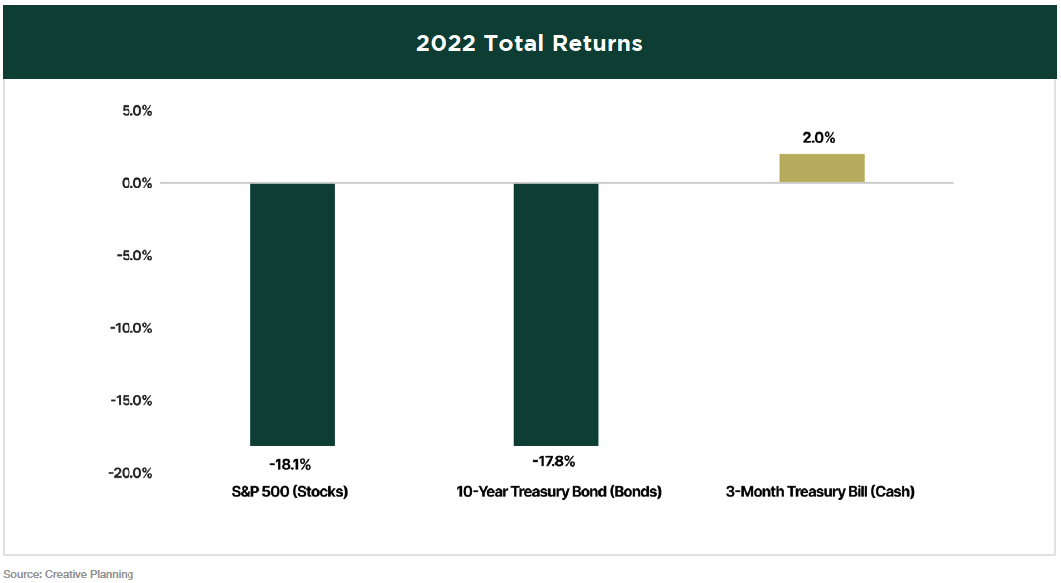

In years like 2022, when both stocks and bonds decline simultaneously, it can be tempting to avoid all forms of risk.

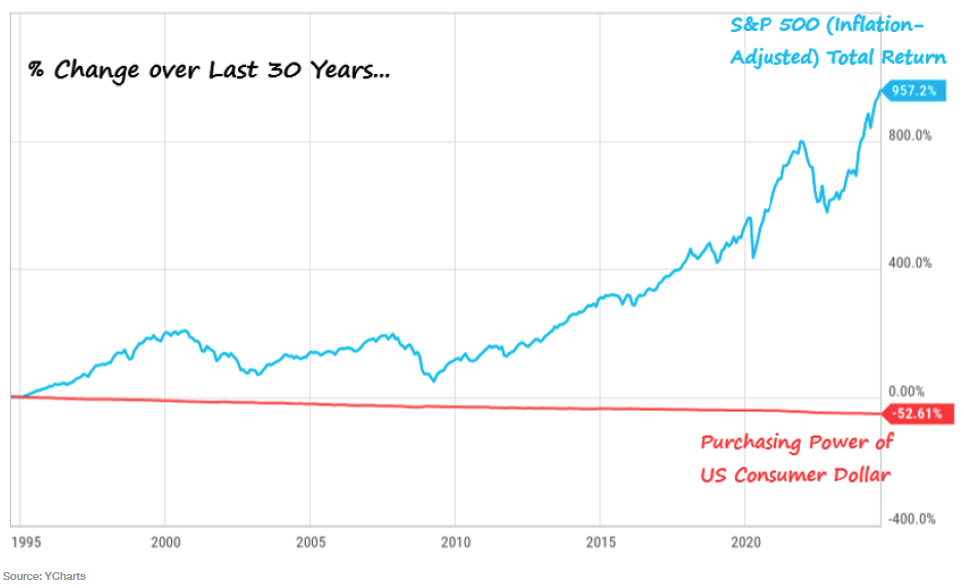

However, in the long run, avoiding risk altogether can be the biggest risk of all, as your purchasing power may be eroded by the persistent impact of inflation.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT

GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.