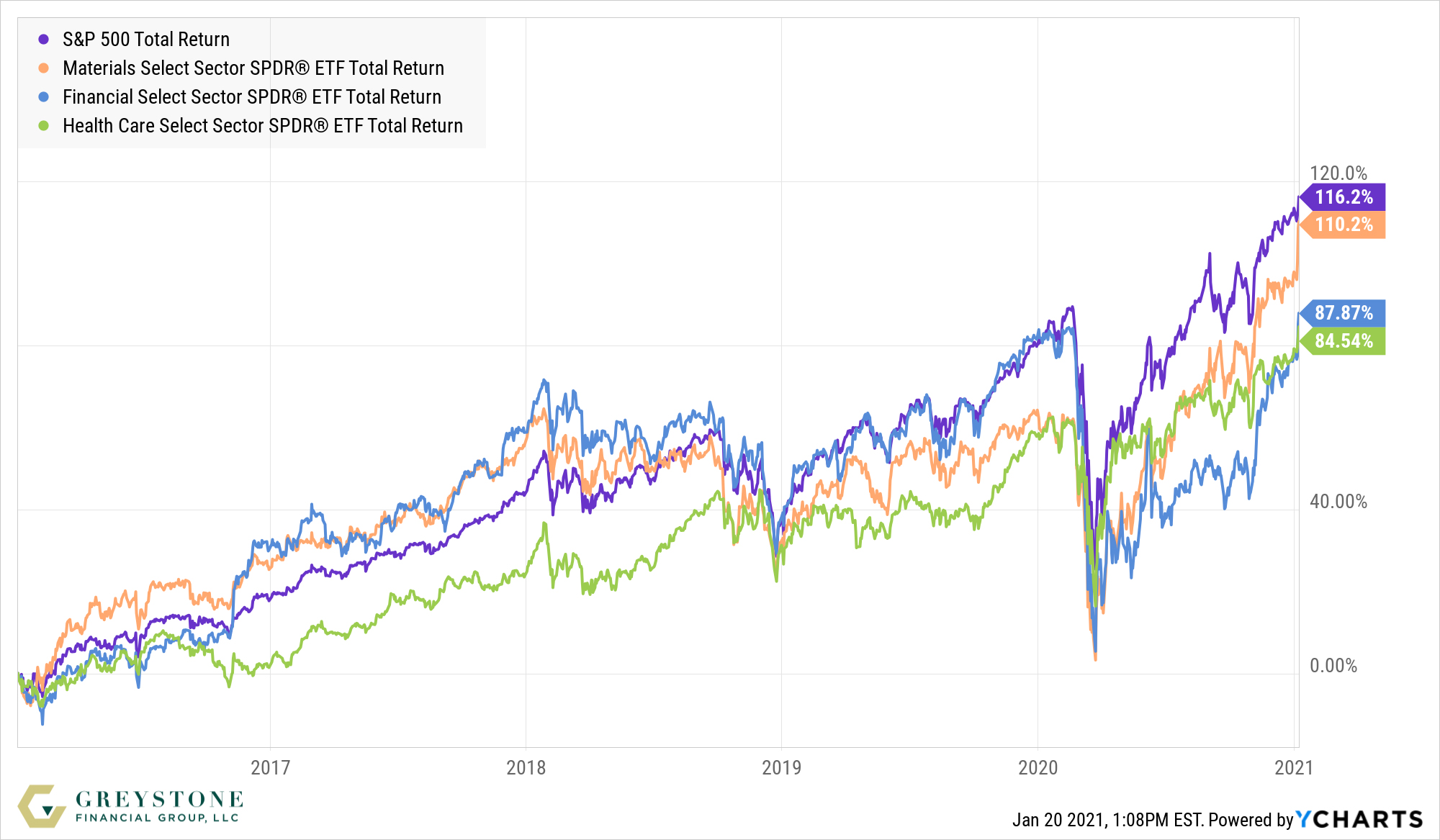

One thing that is sure, 2020 will be a year we never forget. The S&P 500 is up more than anyone would have forecasted, especially after the performance of 2019 and despite a 34% drop in the spring from its February peak. The markets, like the American Spirit, have exhibited incredible resilience over the past year. Recent events show how the pandemic has changed nothing politically while simultaneously transforming and disrupting many things economically. (Let’s just say thank you to the Federal Reserve for bailing out the financial markets.) The prophecies of Armageddon were loud and unsettling back in March. With just an announcement, 22 million people were unemployed by government edict that shut down most non-essential, public-facing businesses, and required non-essential workers to stay at home. It absolutely devastated our economy. Our lives were upended instantly. To say it was disconcerting is an understatement.

For Greystone, our job was to figure out, very quickly, who the winners and losers of the post pandemic reality will be. Our experience and vision give us the ability to look forward, not just to the unfolding paradigm of the global economy, but also, more importantly, the pace of the transition. A trillion dollars or two will be thrown around by the next administration, at the very least. Former Fed Chair Janet Yellen will be the new Treasury Secretary.

Do not fight the Fed.

Right now, the markets and the Fed have banked on no interest rate rises for the next couple of years. It may take that amount of time for the economy to heal and go back to late 2019 levels. We expect this year will depend on how the vaccine rollout progresses. Corporations have done an unprecedented and admirable job of responding to the pandemic and pivoting to new realities. From McDonald’s delivery, Zoom meetings, to a Moderna COVID-19 vaccine, it has been quite incredible how the pace of events and trends have accelerated. Now it is up to the government to get it out to people in an orderly fashion. Their predictions, as in the past, could prove to be too optimistic.

This year’s markets, we expect, will be choppy as the economy accelerates from pent up demand in the second half of the year. In high GDP growth years market returns are usually muted because the market has already anticipated and gone up in front of it. The stock market looks 9-18 months ahead and will most likely head higher this year albeit at a less torrid pace, barring unforeseen shocks.

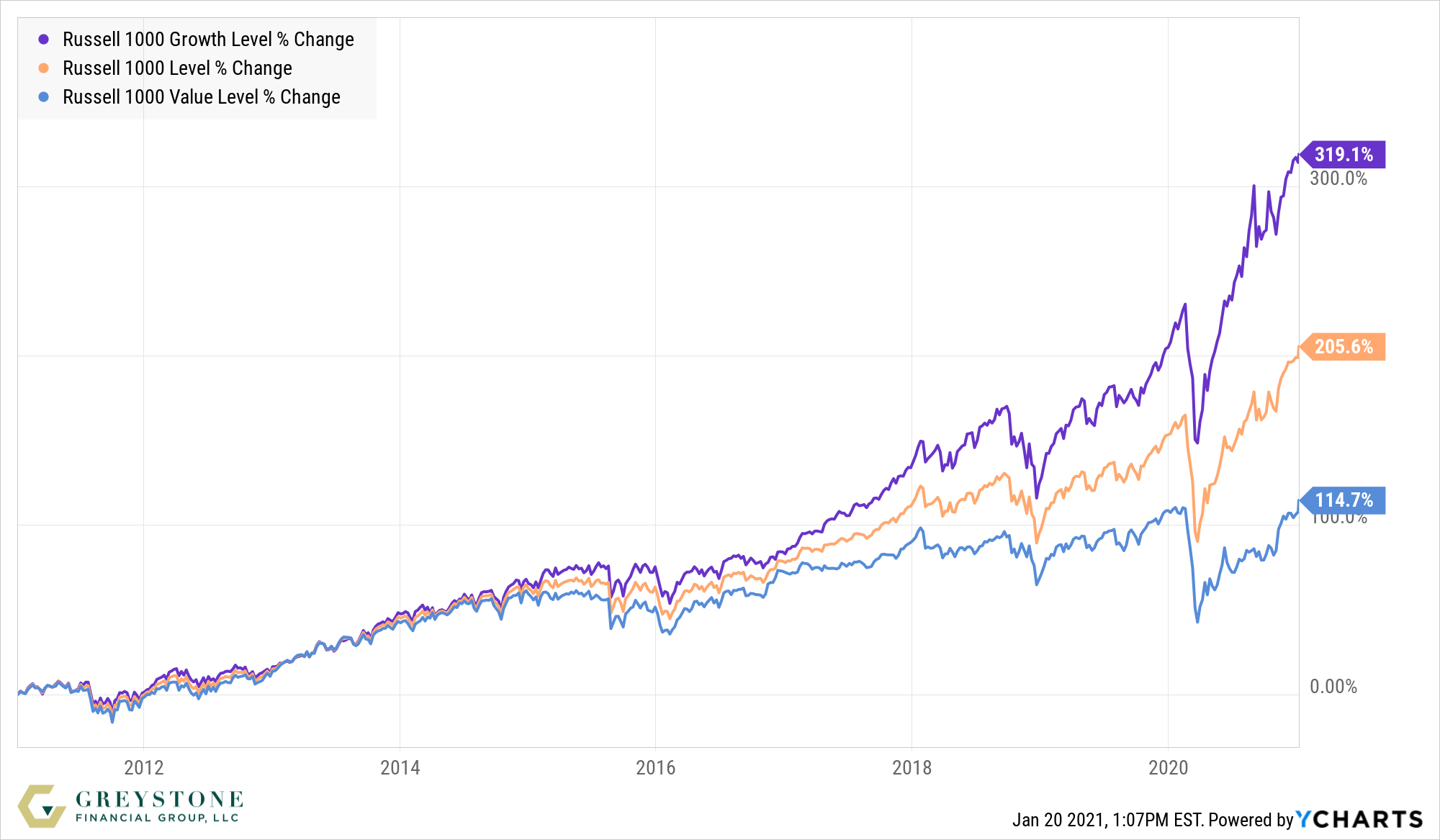

The next chart shows the historic divergence between growth and value stocks. The orange line is the Russell 1000 Large-Cap Index which is a blend of both growth and value. Only in the last 2 months has the disparity begun to revert to the mean that existed prior to 2015 . We expect interest rates could creep higher, as well as inflation, as the economy heals, consequently fixed income returns will depend on a different mix of bonds and maturities than has been successful in the most recent past.

We believe that the pessimists will again be proven wrong. We do not believe that irreparable harm has been done. Projecting the recent past infinitely into the future is, in our experience, always a mistake. The new normal will just be a more sustainable version of the old one. Trends such as work at home and alternative transportation methods and fuels have quickened their pace of adoption. Presidents and politicians can make policy changes around the edges, support individual companies and industries, but larger global economic cycles can take longer to develop. We will, nonetheless, keep a steady eye on the political arena. Washington can only do so much within our system of checks and balances. We will monitor the pace of change. Businesses need economic certainty to grow at their highest potential. We are a Republic, a country of laws, constrained by bureaucracy and the partisan power structure in Washington. The art of compromise has seen its challenges in Washington, and in view of recent events, we expect it might continue that way.