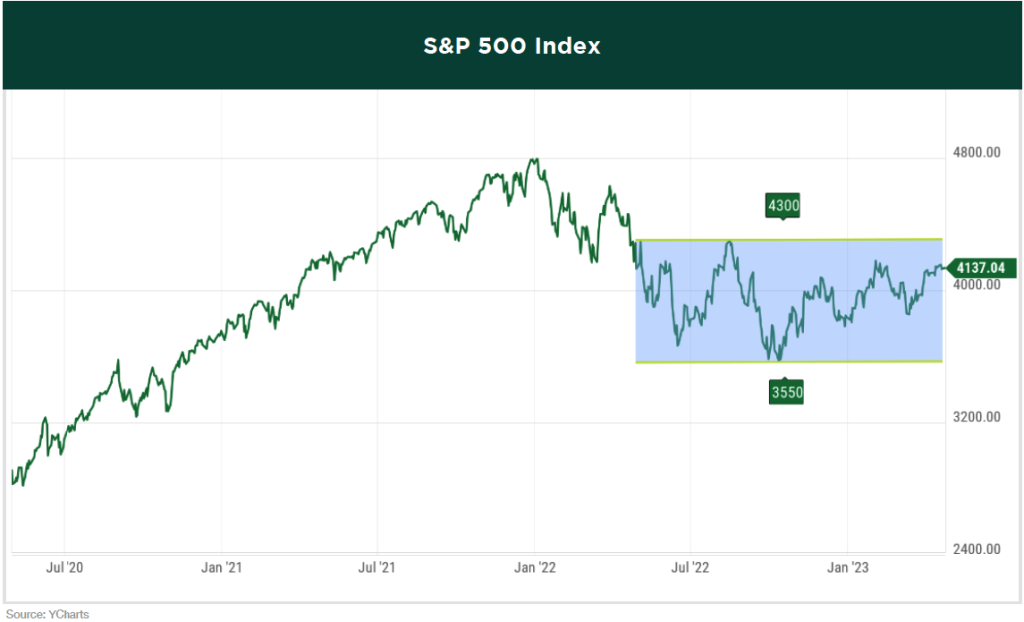

WE ARE A THIRD OF THE WAY THROUGH 2023 and so far, both the stock and bond markets have provided decent results. However, this recent path higher wasn’t a smooth one and despite the bounce to start the year, stocks remain in a bear market and have been trapped in a fairly consolidated trading range for around the last twelve months. This has caused frustration for many investors as the short-term up and down moves haven’t provided an opportunity to take a directional bias with any duration.

Bullish investors are clinging to the narrative that the Fed is finally nearing the end of the rate hike cycle and may even be able to start cutting rates before the end of the year. Additionally, inflation continues to decline, the labor market and consumer spending have remained strong, and although the economy is slowing, GDP projections are still coming in positive for this year and next.

On the other hand, the bears have been scratching their heads at the continued resiliency of the market, with investors seemingly unfazed by the enduring inflation, the ninth interest-rate hike in a year, imminent earnings compression across the broad stock market, and a regional bank crisis that is leading to tighter credit conditions and raising financial stability concerns. Not to mention rising geopolitical tensions and the increased risk of a recession.

Greystone understands and can appreciate arguments from both sides, and we can’t say with conviction which way the market is headed. But at least in the short term, we tend to be more in the bearish camp, and we continue to take a cautious approach to our asset allocation while the market is filled with a high level of uncertainty. Our portfolios remain broadly diversified, although we have been and continue to be positioned a bit more defensively than our benchmarks until a clearer picture emerges in market direction.

Even though we remain cautious, we have been very impressed with the resiliency the market has shown, and for the first time in a while there have been signs of broad technical strength. Stock price multiples have come down to levels more appropriate for the current environment, and there is still some hope for the Fed to achieve a soft landing due to inflation decreasing and continued strength in the labor market. Most importantly, we are nearing the end of the Fed raising rates. All of these factors increase the likelihood that we registered the market bottom back in October.

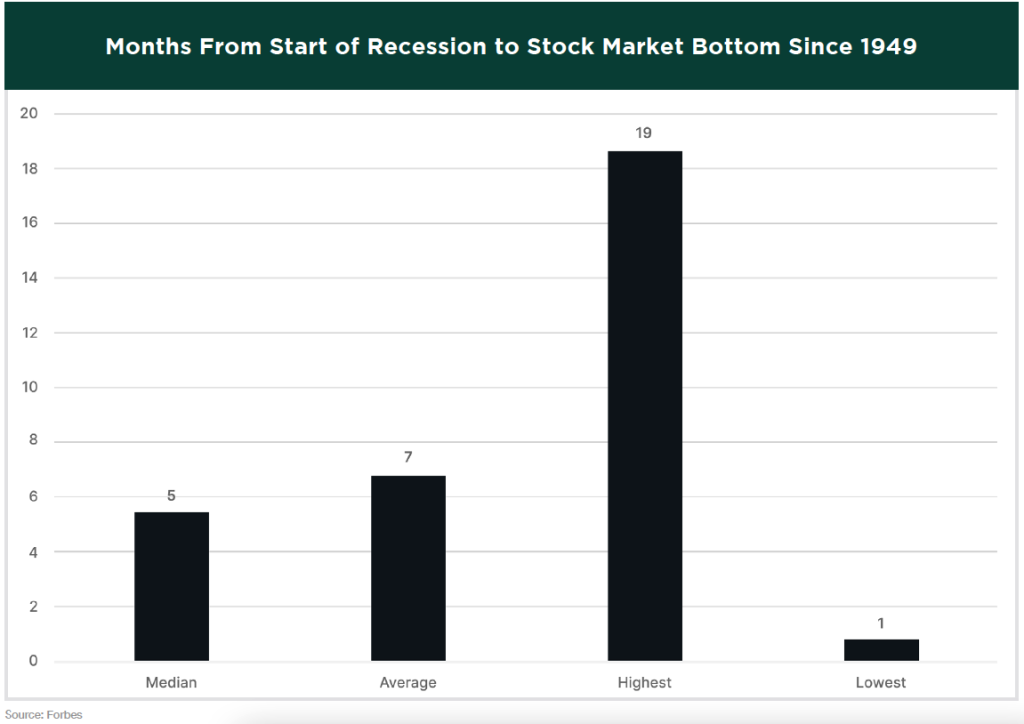

If we can avoid a recession, then there is a very good probability that we have in fact seen the lows and we are in the beginning stages of a new bull market. Or maybe in hindsight we’ll find that we are in the middle of a recession right now. After all, an “official recession” isn’t typically classified as a recession until well after one has begun, sometimes for up to a year. But the most likely scenario, in our opinion, as the risks seem to be increasing with each passing month, is that while we aren’t currently in a recession, we are heading towards one. The number of indicators flashing an upcoming recession makes it hard to imagine a scenario without one. And this is important because no bear market has ever bottomed before a recession has begun. Could this time be different? It very well could be. But the fact is that it typically takes about six months for the market to bottom out from the start of a recession.

But even if we can avoid a recession, we believe there are compelling reasons that support the idea that the market isn’t making significant and sustainable moves higher in the short term.

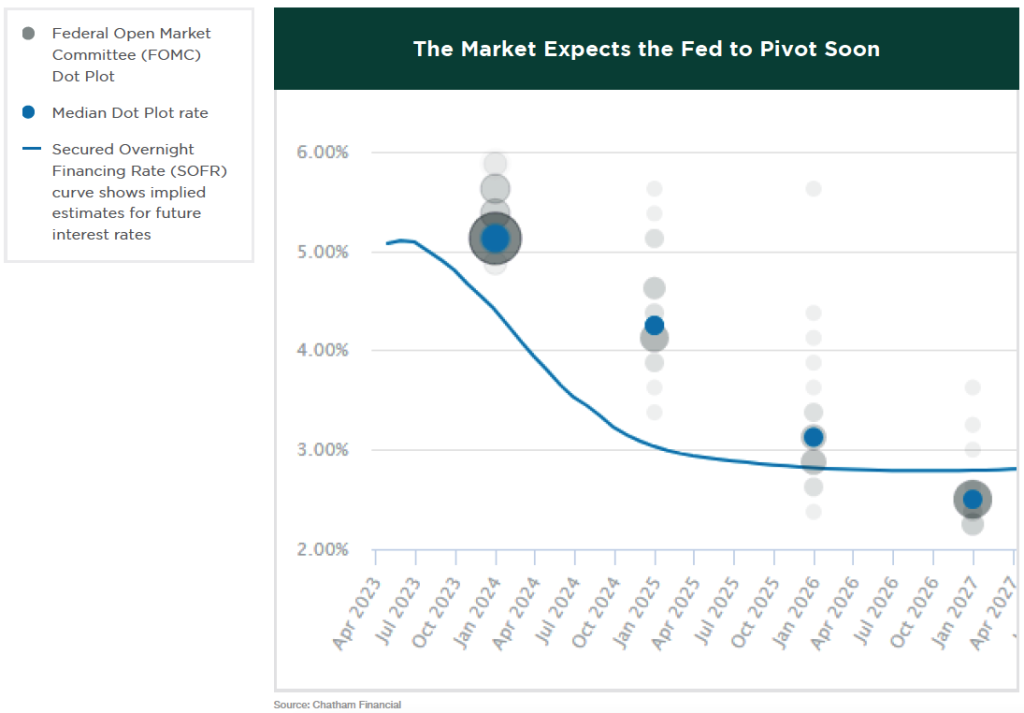

First, we think the market is being too optimistic regarding the future path of the Fed funds rate. As shown in the following chart, there is a disconnect between when the Fed (blue dots) thinks they will start cutting rates and when the market (blue line) thinks the Fed will start cutting rates. The market is pricing in that the Fed will cut rates sooner and at a quicker pace than what the Fed is anticipating. While that might sound like a positive development for the market, chances are the Fed will not pivot that hard unless the market is facing an earnings problem considerably worse than currently projected, or things start to break in the economy. As we’ve seen numerous times over the past year, fighting the Fed hasn’t worked out too well for investors, and it’s our opinion the market is going to eventually reassess the impact of higher rates for a longer period.

Hopefully, in next quarter’s The Viewpoint, we can write about how the Fed has recently announced a pause. That would mean they feel they have reached a level that is adequate to beat inflation. Currently, based on Fed Funds futures, there is about a 25% probability the Fed will pause at their next meeting in May. If they instead decide to increase rates by another 0.25%, which we believe they will, then there is about a 65% probability the Fed will pause in June.

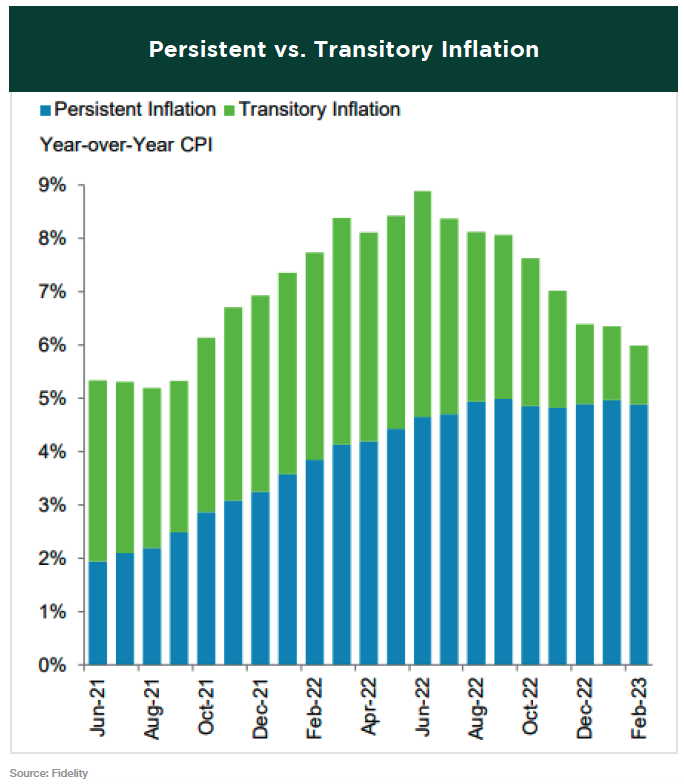

While the market would most likely cheer a pause, we think inflation is going to remain at elevated levels for longer than the market is anticipating. The Fed has made it clear that they want to get inflation back down to the 2% target level, and the quicker they can achieve this, the better. This is because the longer inflation stays embedded in the economy, the harder it is to bring down. We don’t think the Fed is going to be able to achieve that 2% goal for a couple more years.

Certain categories of the Consumer Price Index, or CPI, which is the most popular inflation gauge, are easier to control than others. But more persistent categories, such as housing and food, have historically taken longer to dissipate. On the following chart, you can see that while the categories with transitory inflation have come down, we haven’t quite turned the corner yet with the harder to tame categories.

Along with rate cut expectations and the pace of decreasing inflation, we also think the market is being overly optimistic regarding future corporate earnings growth. While we aren’t anticipating a deep recession, it is extremely likely the economy will continue to slow down, the unemployment rate will increase, consumer spending will decrease, and corporate profits will decline.

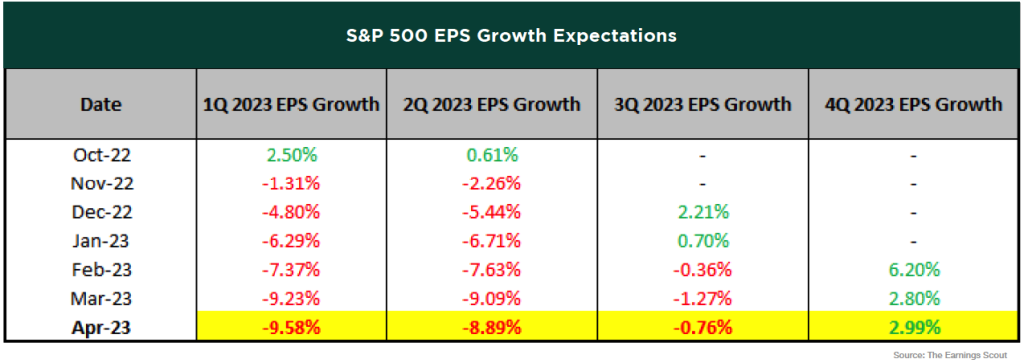

The average recession typically brings about a 20% drop in earnings per share (EPS). As you can see from the following table, while earnings estimates have been decreasing by the month, they aren’t even close to the historical recession average, which is due to the fact that analysts are having a tough time figuring out the extent of an economic downturn. If earnings forecasts keep getting revised lower, share prices are likely to decrease, which will hold back the market from breaking out of this trading range and moving significantly higher, at least for a while.

Now let’s look at a few of the aforementioned indicators that suggest a recession is looming.

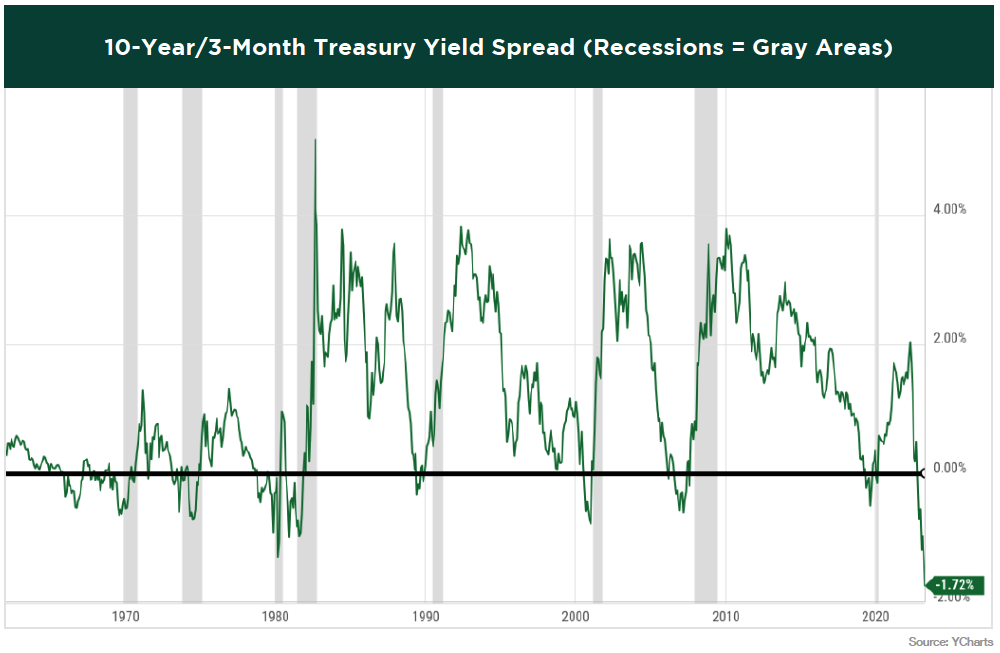

We’ve talked in past newsletters about how an inverted yield curve has historically been a reliable predictor of an upcoming recession. In this case we show the 10-Year/3-Month spread. The last eight recessions were all preceded by this omen. However, there have been two occurrences (1966, 1998) without a recession.

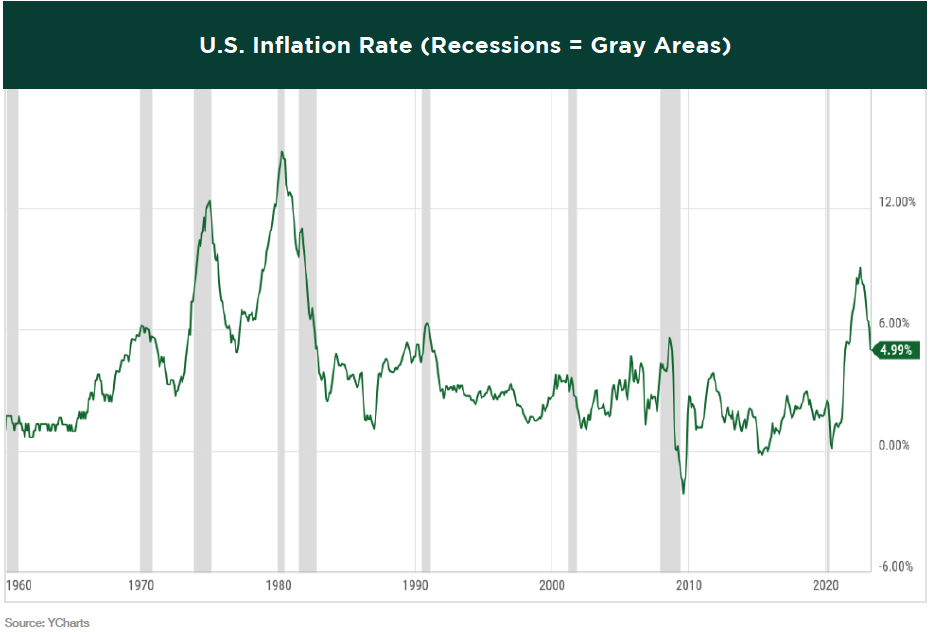

When we look at past inflation levels, we can see that we are well above most of the previous inflationary peaks that have led to a recession.

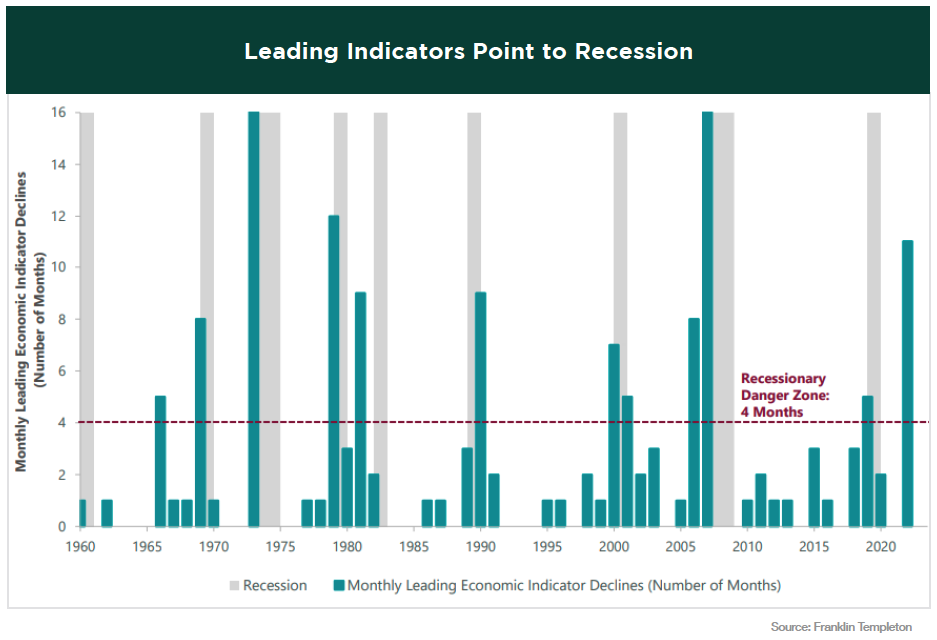

Historical declines in the Leading Economic Indicators lasting more than several months have proven to be a good predictor of recessions. The Leading Economic Indicators have been declining for the last eleven months.

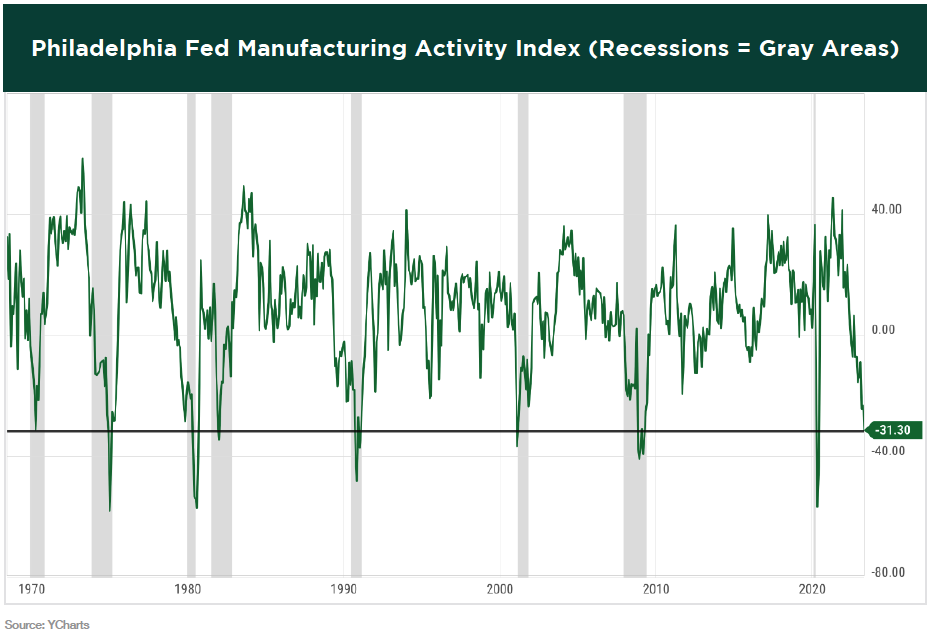

The Philadelphia Fed Manufacturing Index has moved to its lowest level since May 2020. In the past, every time this indicator was at or below current levels, the U.S. economy was either in or approaching a recession.

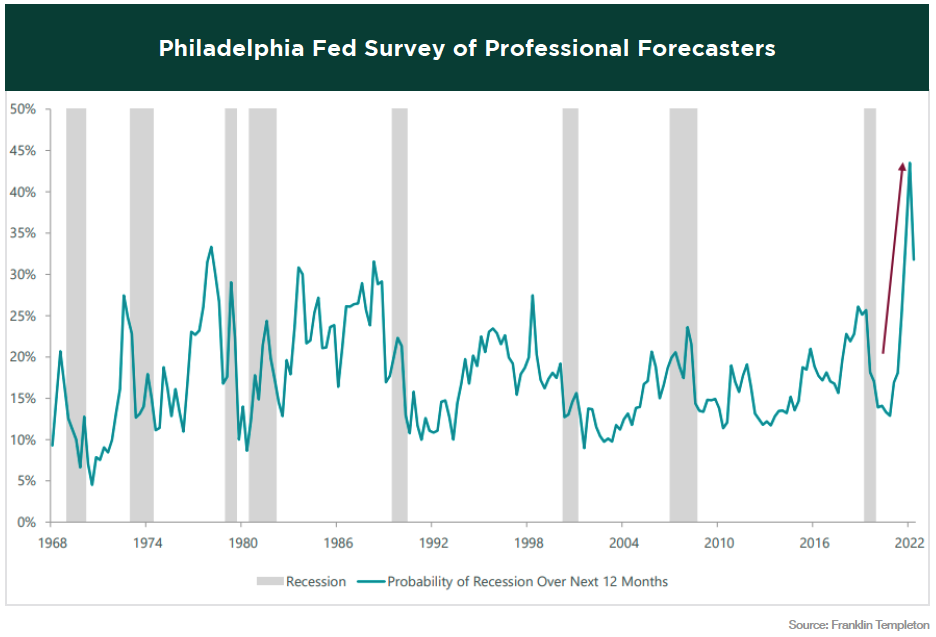

According to the oldest quarterly survey of macroeconomic forecasts, this is shaping up to be the most anticipated recession ever.

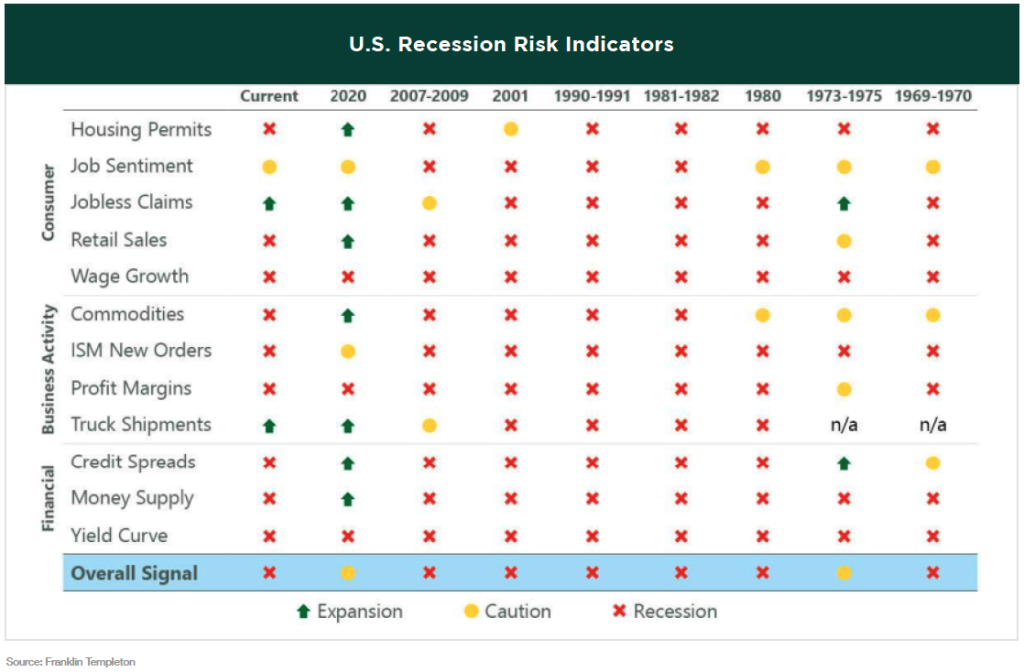

Lastly, we’ll take a look at twelve variables that have historically foreshadowed a looming recession. As you can see, the overall dashboard is currently signaling recession.

IN CONCLUSION

We know this wasn’t the most uplifting newsletter, but we are hopeful that the market has been through the worst of it. Maybe the Fed, through its restrictive monetary policy, can successfully slow down the economy just enough to where inflation continues on a steady downward path, the labor market remains strong, and the U.S. can avoid a recession altogether. This ideal outcome would mean the Fed achieved a soft landing. While we are hopeful for this scenario, history tells us that having it actually occur is a long shot. Most economists agree that the Fed has only achieved one perfect soft landing in the past 60 years. Between 1994-1995, the Fed raised its benchmark interest rate from 3% to 6%, and while economic growth did slow down, GDP never shrank and the job market remained strong, with unemployment actually declining. Therefore, although not likely, a soft landing is possible.

The unprecedented pace of rate hikes over the past year is going to have consequences, and we are starting to see the first signs of cracks in the economy. In March, we witnessed the second and third largest bank failures in U.S. history, with Silicon Valley Bank and Signature Bank being closed by regulators. The banking crisis then shifted overseas as UBS agreed to buy its ailing Swiss rival Credit Suisse in an emergency rescue deal coordinated in part by Swiss regulators. Thankfully, it seems that the crisis has been contained for now and we have been assured by leaders, including Federal Reserve Chair Jerome Powell and the President that the banking system is safe. Even if that was the extent of the banking turmoil, these events have accelerated the pace that banks are tightening lending standards to offset their increased risk and minimize loan defaults as recession odds rise.

Stricter lending standards, specifically among small and midsize banks, are going to slow economic growth overall. Lending to commercial real estate developers and managers largely comes from small and midsize banks, where the pressure on liquidity has been most severe. About 80% of all bank loans for commercial properties come from regional banks. With the commercial real estate sector having already been battered by rising interest rates and half-empty office buildings, many people are speculating that this could be the next thing to break in the economy.

Whether it is the next shoe to drop or not, the point is that we are just starting to see the real impacts of the rate hikes take effect. It usually takes about 12 months for a change in interest rates to have a widespread economic impact, even though the stock market’s response to a change is often immediate. Therefore, when we get to the point when the Fed eventually pauses, by no means does that mean that we’re out of the woods yet. However, as we have written about

in previous quarters, the stock market will recover before the economy does, which is why it is so important to stay invested when things in the economy are looking at their worst.

The information in this newsletter wasn’t meant to be all doom and gloom, but rather to show that the market is still trying to figure out the extent of future economic impacts. We are still in a period of uncertainty and the stock market

is going to fluctuate back and forth as investors attempt to position and reposition themselves as new data comes in. Through times like this, Greystone believes it’s best to maintain a diversified portfolio and position our allocation to preserve capital. If the market irrationally takes off tomorrow, next week, or next month, then there is a decent chance we will lag the indexes. But for now, we are keeping a defensive bias until there is confirmation of sustained market strength.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.