THANKS TO A STRONG ECONOMIC rebound that helped the market weather the persistence of the pandemic along with rising inflation, U.S. stocks finished 2021 near fresh record highs, having posted their third consecutive year of double-digit gains. The S&P 500 posted 70 record closing highs in 2021, and adding in results from 2019 and 2020, it’s been the best three-year run since 1999.

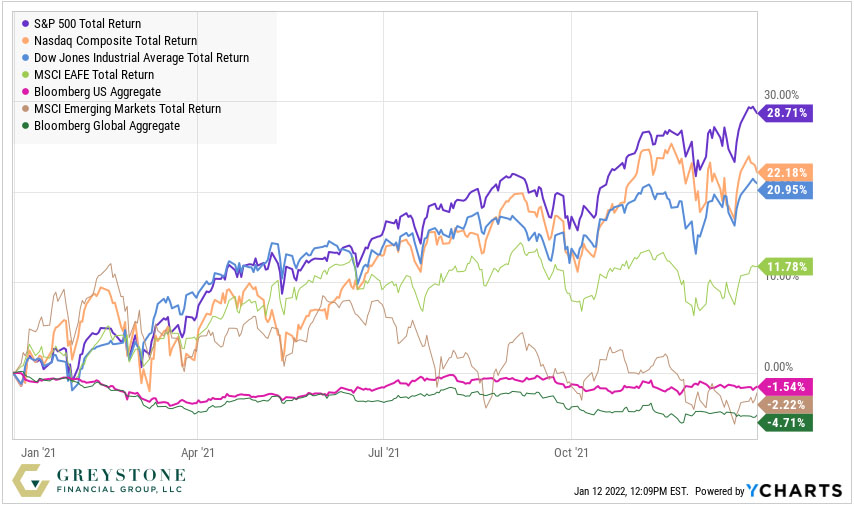

In 2021, the S&P 500 logged a return of 28.7%, the largest of the three major U.S. equity indices. The NASDAQ took second place with 22.2%, while the Dow Jones Industrial Average finished nearly 21% higher. Around the world, MSCI’s International Developed Markets index, the MSCI EAFE, rose 11.8%, while the MSCI’s Emerging Markets index finished down 2.2%.

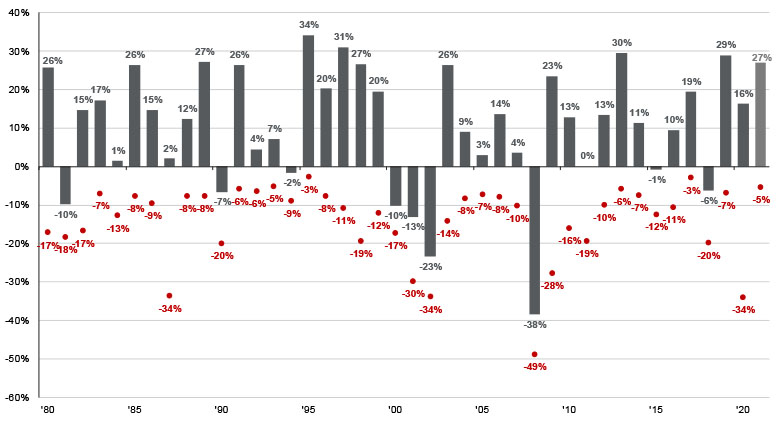

2021 unquestionably brought more positives than negatives for stocks. The U.S. stock market as a whole was basically devoid of volatility, as the three major indices had minimal drawdowns during the year. The S&P 500’s largest drawdown was 5.1%, the Dow’s was 6.3%, and the NASDAQ’s was 10.5%, the last of which narrowly qualified as correction territory. Out of the past 94 years of data, 2021 ranks as the 9th lowest peak-to-trough drawdown in a calendar year for the

S&P 500.

S&P 500 intra-year declines vs. calendar year returns

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management

However, the favorable economic backdrop for stocks in 2021 was bad news for bond investors. Surging inflation sent bond prices lower, leading key bond market indexes to post their first losses since 2013. A common benchmark for U.S. bonds, the Bloomberg U.S. Aggregate Bond Market Index, finished the year with a -1.54% return. This was just the fourth down year recorded by the index since its inception 45 years ago.

It’s rare for global stock returns to be positive and bonds negative in any one calendar year. Why did this happen in 2021? The economic restart resulted in supply bottlenecks and harsh inflation pressures. Real yields stayed low even as growth surged, and inflation climbed. In a glaring departure from past practice of pre-emptive tightening, most developed market central banks did not respond. The market started to price in higher inflation absent a central bank response, driving nominal bond prices down. However, real yields stayed historically low, and corporate earnings soared in the restart. This resulted in significant stocks gains.

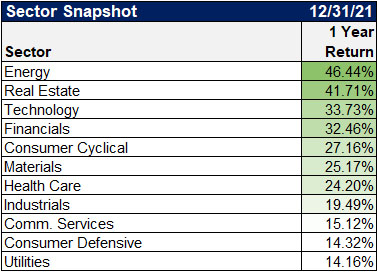

At the sector level, the year saw wide disparities in U.S. equity performance. As the economic recovery broadened out through the year, sectors that were hard hit in 2020 recovered. Most dramatically, as oil prices rose 58% in 2021, energy stocks rebounded strongly, rising 46% after a 36% loss in 2020. Similarly, real estate stocks recovered from a poor 2020 as the struggling hotel and retail real estate industries benefited from mass vaccination and the economy reopening, and property values rose across

the country.

Select Sector SPDR ETF Price % Change

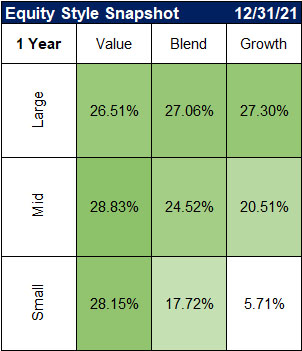

When looking at how the different equity styles compared in 2021, technology names bolstered large-cap growth, which gave it the slight edge over large-cap value for the fifth consecutive year. Although growth stocks outperformed their value counterparts at the large-cap level, it was the opposite for small caps, where the margin of outperformance for value stocks was huge. The struggling biotech industry was a contributing factor to the lagging performance of small-cap growth stocks.

CRSP U.S. Total Return Indexes

The COVID-19 pandemic continued to dominate the global headlines in 2021, and markets faced challenges on several fronts because of it. But even with the supply chain bottlenecks, inflation worries, and interest rate uncertainty, the market continued to climb the wall of worry and finished the year strong. This has left many investors wondering…can 2022 maintain the momentum?

Greystone believes the economic recovery is far from finished. Although the fastest pace of that recovery lies behind us, we expect strong global growth in the coming quarters. We will still face challenges caused by the virus as new strains appear, but we believe this will only delay, not derail, the progress toward the full reopening of the economy. Increasing global access to vaccinations, booster shots, and other medical improvements should result in fewer infections, and especially hospitalizations and deaths.

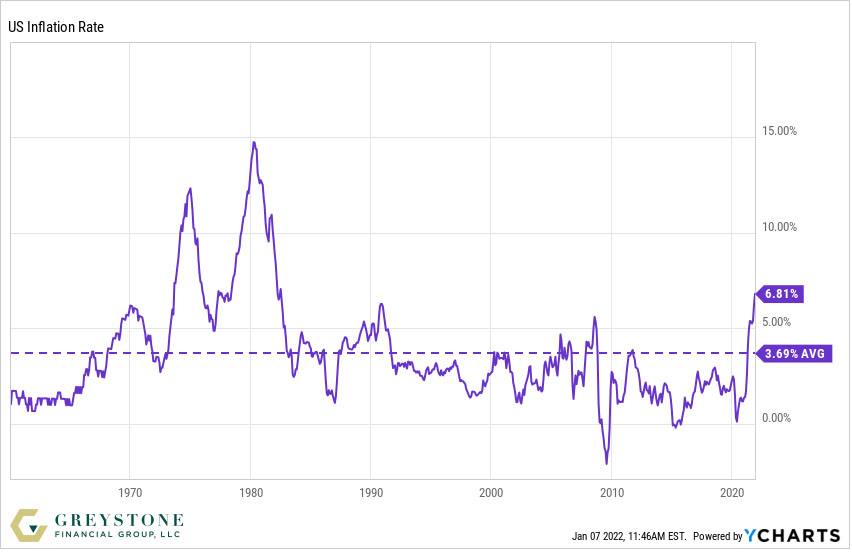

Inflation is the hot topic right now, as it should be, as it has spiked to the highest rate in decades as seen in the chart below. And while we think inflation will remain persistently higher than its pre-pandemic level, we expect it to start coming down from the current level as supply constraints ease and consumer spending rebalances away from goods and toward services. As supply catches up with demand, the unwinding of price spikes in durable goods and energy, which are contributing to the bulk of U.S. inflation, should drive large deflationary pressure. Even if supply constraints drag on longer than expected, we believe the Fed is able and willing to tame any persistent inflationary pressure.

The Federal Reserve announced back in November that it will begin reducing its purchase of assets, also known as tapering. At the start of the pandemic the Fed started the process of quantitative easing, in which it buys massive quantities of government bonds and mortgage-backed securities to increase the money supply, encourage lending, and lower interest rates in order to stimulate a lagging economy. The Fed now believes the goals of the stimulus have been met, and therefore is beginning to unwind the purchases and will eventually raise interest rates to allow the economy to restabilize. The key question is…when exactly are they going to start increasing interest rates?

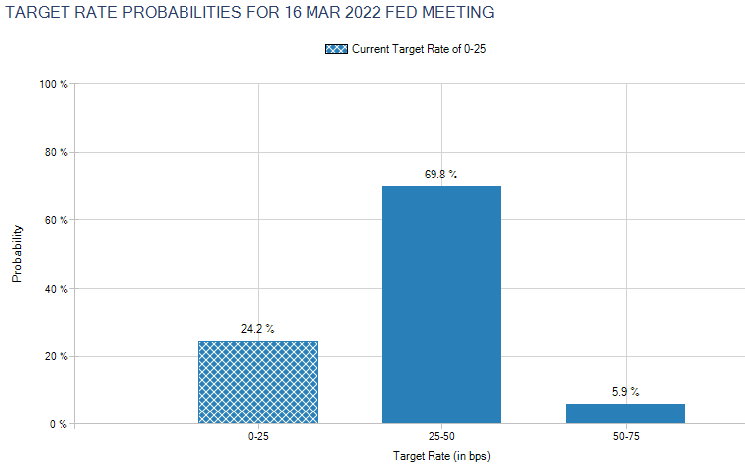

The answer to that question is what investors have been anticipating and trying to predict over the past year. The reason is that rising interest rates have a material impact on both the equity and fixed income market. The Fed has been very forthcoming in their plan and have stated they don’t plan to begin raising rates until the tapering process is complete, which is currently on pace for March 2022. So, what are the chances of the first rate hike being announced when the Fed meets in March? The leading probability is a 70% chance of a 25-basis point increase.

Target rate probabilities for March 2022 Fed meeting

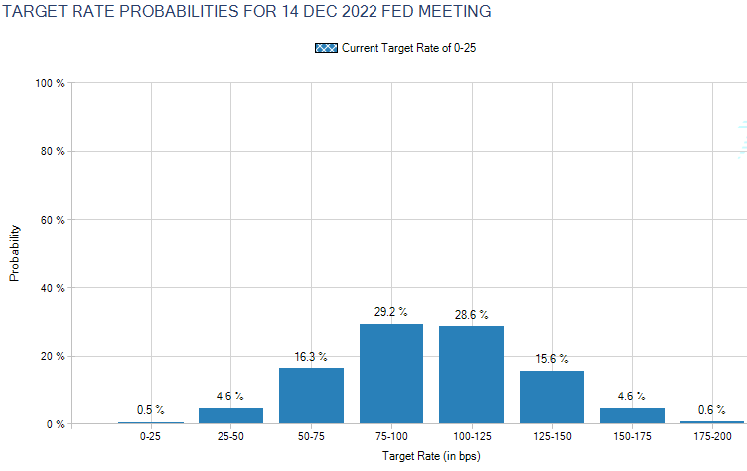

The consensus opinion is that 3-4 rate hikes will occur in 2022. Based on current projections, there is about a 79% chance rates will be at least 75 basis points between now and the December meeting.

Target rate probabilities for December 2022 Fed meeting

Source: CME Group

Inflation doesn’t tank markets; high interest rates do. To be more specific, high inflation typically leads to high interest rates, which slows the economy, and often leads to recession, thereby tanking the markets. The Greystone investment team believes the timing and extent of rate hikes will be the most critical investment factor throughout 2022. The Fed needs to strike a balance between slowing inflation and avoiding recession. As of now, their plan is to take a slow and low approach to raising rates in order to avoid actions that could trigger a recession, turn stock markets volatile, and prolong high inflation.

Over the last 50 years, there has never been a recession (aside from 2020’s pandemic anomaly), when the Fed Funds rate was under 4%. So, at quarter-point moves or even half-point moves, it will literally take years to get anywhere near 4%. Even if 3% is the “new 4%,” which could very well be the case, we at Greystone are optimistic that 2022 and years beyond are going to reward investors that stay invested. After all, based on historical averages, we still probably have at least 4-6 years left in the current secular bull market we are in.

S&P Historical Composite: 1871-Present Inflation adjusted secular highs and lows

Source: Advisorperspectives.com

The investment team at Greystone believes it’s going to be another rough year for the bond market. While the Fed is tapering, demand is decreasing for treasuries and mortgage-backed securities. Less demand creates lower prices, in turn pushing yields higher. After the tapering is finished, and rates start to raise, this will also drive bond rates up, and bond prices down. Bonds will still serve a role however, as investors who primarily seek yield from the bond portfolios will be happy. Bonds also provide a diversification benefit as they are a ballast against potential stock market turbulence. Greystone’s tactical strategies were underweighted in fixed income during 2021 and we anticipate keeping an underweight position for the foreseeable future.

On the other hand, we believe stocks are poised to deliver positive returns in 2022, but not to the extent they did last year, as earnings growth slows and the Fed tightens. We anticipate slower growth for two reasons. First, earnings growth is likely peaking now, and second, the Fed is starting to remove liquidity from the system at the same time. The consensus estimate is that earnings will grow at 8%, compared to 45% in 2021. Even so, 8% is a solid figure and we are bullish on equity against the backdrop of low interest rates.

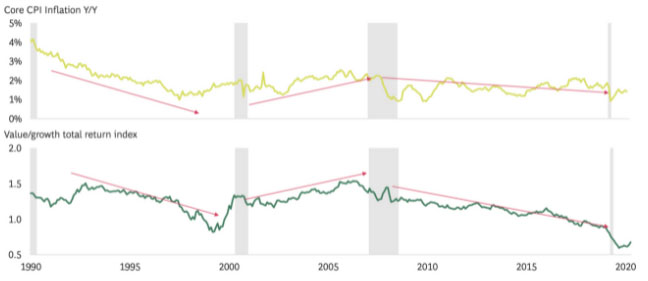

We mentioned earlier that it’s rare for global stock returns to be positive and bonds negative in any one calendar year. Greystone predicts we will see another year with the same result, which will be the first time in over nearly five decades that has happened in back-to-back years. With that being said, stock picking will be crucial in 2022. Historically, as inflation increases, value outperforms growth as shown on the chart below.

Source: Bloomberg, BCG Center for Macroeconomics

Remember, high inflation leads to rising interest rates. For many growth companies, especially younger technology companies, they are still years away from turning a profit and having positive cash flow. A stock is worth the present value of a stream of cash flows that it will produce in the future. This value is calculated by projecting out future free cash flows and discounting them back to the present. The key variables, therefore, are the future free cash flows and the discount rate used in the calculation. If interest rates rise, so too should the discount rate since an investor will have more opportunities with their money elsewhere. And since discount rates and present values are inversely related, value will decline, all else equal, as the result of a rise in interest rates. Since many growth stocks have valuations based on future profits, higher rates mean that earnings years from now are worth less today. This will have a negative impact on the stock price.

The investment team at Greystone started scaling back our growth exposure the second half of last year in anticipation of what we expected to happen going into this year. However, we are not abandoning growth stocks altogether, but most of the growth positions we want to hold are companies that have already established years of consistent net income and cash flow.

We hope you continue to trust Greystone to navigate the ever-changing market and make investment decisions in your best interest. Investors with a long time horizon may find some comfort in the fact that there is a 50% chance the market will go up on any given day. But if you extend that time horizon to 5 years, historically the market has gone up 80% of the time. Over 10 years, it has historically gone up 90% of the time. We have high hopes going into 2022 and encourage our clients to stay invested and have confidence in us to make the right decisions.

We’ve mentioned the Fed a lot in this quarter’s newsletter, and we’ll end with their own words. “The economy remains really strong, the labor market is rapidly improving, consumer demand is very strong, and incomes are very strong.” These important economic drivers are reasons that we believe there is still more upside to go in 2022.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.