2024 RECAP

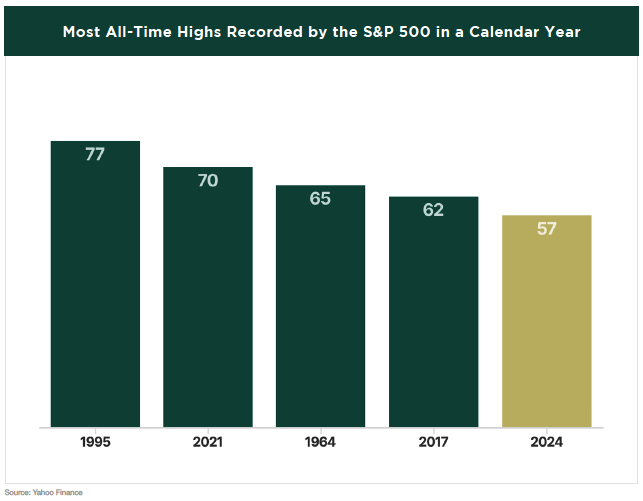

IT WAS A RECORD-SETTING YEAR on Wall Street, with the S&P 500 securing 57 records to land in the top five years for most all-time highs recorded by the benchmark index.

The year started off strong, with the S&P 500 Index finishing the first quarter on a high note, driven by a strong U.S. economic backdrop, easing inflation, improving profit conditions, and expectations of rate cuts from the U.S. Federal Reserve. Investor enthusiasm around artificial intelligence (AI) also played a significant role, boosting both Big Tech and smaller companies associated with the theme.

That momentum carried into the second quarter, with the S&P 500 Index posting its best three-quarter performance since mid-2021. By the end of June, stock volatility had dropped to some of its lowest levels since January 2020. Once again, the AI boom fueled significant gains across the information technology and communication services sectors.

However, high interest rates and the Federal Reserve on pause kept broader market gains in check.

Within fixed income, the 10-year U.S. Treasury yield increased during the first half of the year, while performance across major bond indexes varied. Over the initial six months, the U.S. experienced steady economic and profit growth, a decline in core consumer inflation, and a labor market which remained solid.

Despite periods of volatility in July and August, the S&P 500 delivered its strongest performance for the first nine months of an election year since 1950. Notably, the concentrated dominance of Big Tech in the first half of the year began to broaden in the third quarter, with increased momentum in cyclical and defensive sectors such as utilities, real estate, industrials, and financials.

In September, the Federal Reserve reduced its policy rate for the first time since 2020, marking the end of an aggressive rate-hiking cycle aimed at combatting inflation pressures and signaling a shift toward a new policy stance more supportive of economic growth and the labor market. Since this rate cut, the Fed has continued to lower rates and indicated that it will adopt a gradual approach to normalizing monetary policy moving forward.

In November, U.S. voters re-elected former President Donald Trump to the White House, securing full Republican control of Congress. Since the election, investors have responded with cautious optimism about the potential for lower taxes and reduced regulation, while expressing concerns about the future of tariffs, immigration policies, and fiscal spending priorities.

YEAR OF SURPRISES

The year 2024 was full of unexpected developments, challenging many of the forecasts made by economists and strategists a year ago. One standout surprise was the impressive 25% gain in the S&P 500 Index, significantly outperforming the predictions of Wall Street analysts. The market demonstrated remarkable resilience in addressing several concerns that these analysts had anticipated at the start of the year.

Higher interest rates had minimal impact on the U.S. economy.

- Despite the Federal Reserve enacting one of the most aggressive rate-hiking cycles in 45 years, the economy proved resilient, achieving approximately 9% growth, driven by strong consumer spending.

Rising unemployment had little effect on consumer spending.

- Historically, a significant increase in the unemployment rate signals a decline in consumer spending and economic However, in 2024, despite unemployment rising from 3.7% to 4.2%, consumer spending remained robust.

Traditional economic indicators proved less reliable.

- Despite consistently signaling contraction, the economy continued to grow, fueled in part by the strength of the dominant S. services sector.

Easy financial conditions persisted, even amid monetary tightening.

- Despite the Fed’s rate hikes and “quantitative tightening” aimed at reducing the money supply, financial conditions surprisingly

Equity valuations continued to rise, even in the face of higher interest rates.

- The excitement surrounding generative AI and other innovations resulted in a notable concentration of market gains within a few mega-cap tech companies, driving their valuation multiples higher. Normally, higher interest rates would make such highly valued stocks more vulnerable, as they raise the expectations for future profits needed to justify their However, despite a delayed start to the expected rate-cutting cycle and an upward adjustment in the Fed’s estimated “neutral rate”—which neither stimulates nor hinders the economy—these companies’ valuations continued to grow, propelling the S&P 500 to surprising new heights.

STOCK MARKET THEMES OF 2024

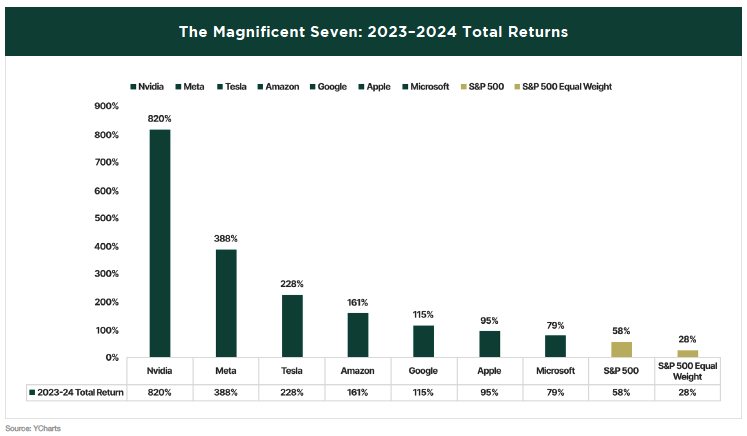

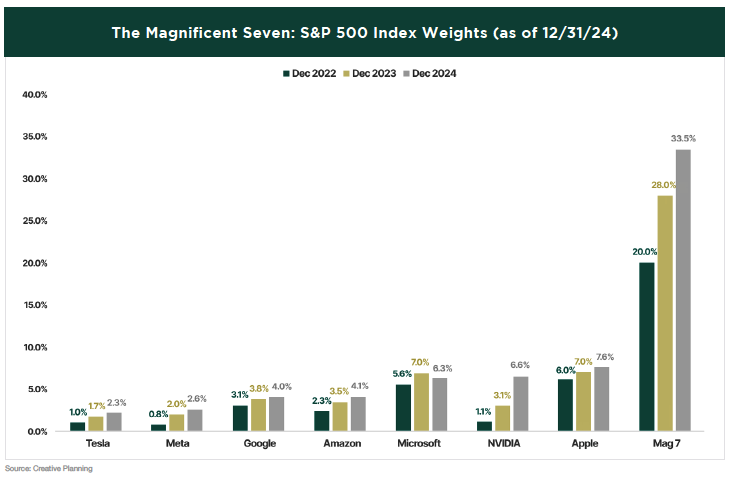

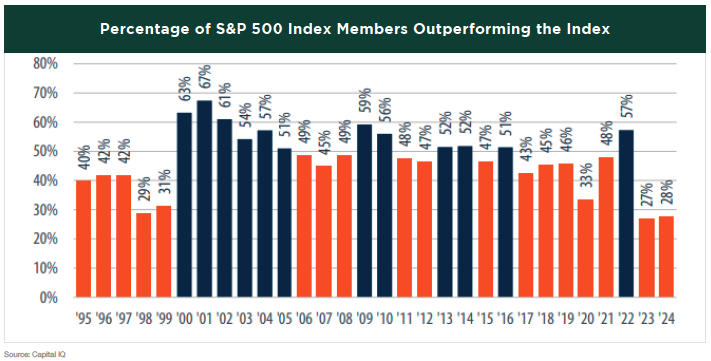

Although a broadening of the stock market rally was a theme for parts of the year, the “Magnificent Seven”—the largest stocks by market capitalization—continued to shine with another exceptional year of performance. Over the past two years, these seven companies have significantly outpaced the majority of other S&P 500 constituents.

This has increased their prominence within the index, with the “Magnificent Seven” stocks now accounting for over a third of the S&P 500, up from a fifth just two years ago. This marks the highest concentration of any seven companies in the index’s history.

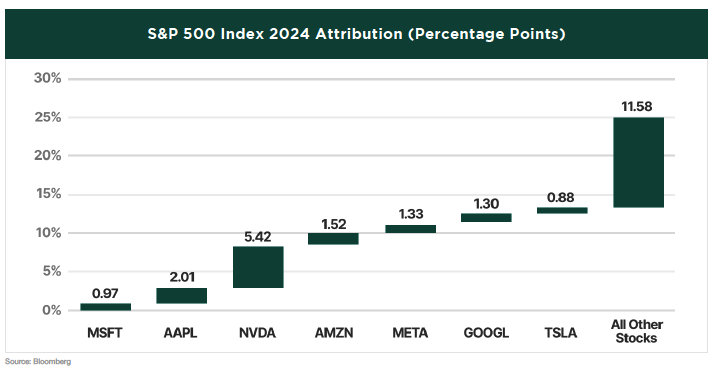

While the stock market had an impressive year, with the S&P 500 delivering a total return of 25%, it’s significant to note that the “Magnificent Seven” stocks contributed 53.7% of that return, reflecting the historic level of concentration currently seen in the market.

This doesn’t mean the other 493 stocks in the index performed poorly—many actually delivered strong results. However, most S&P 500 constituents underperformed the index for the second year in a row, making this the narrowest market we’ve experienced since the late 1990s.

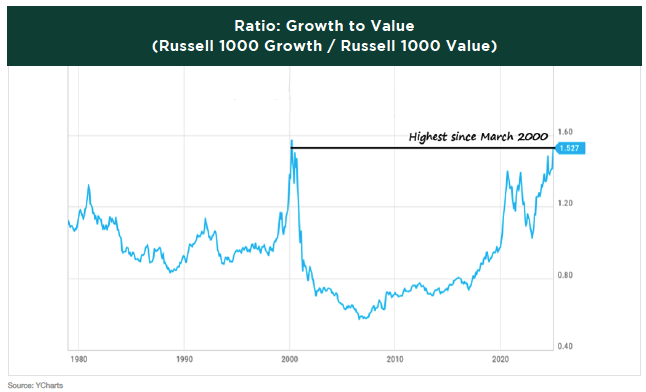

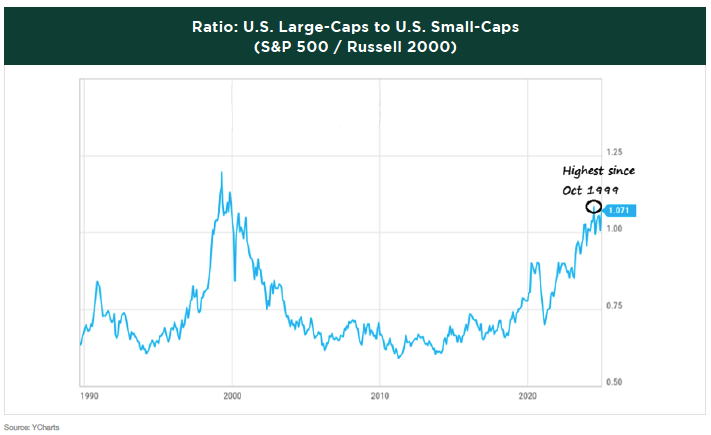

Given the outperformance of these mega-cap growth stocks, it’s not surprising that the market experienced another year of extremes, with growth stocks outpacing value stocks and large-cap stocks outperforming small-caps.

Growth stocks outperformed value stocks by 19% in 2024, following a 31% outperformance in 2023. This marked the largest two-year outperformance of growth over value in history, surpassing the previous record set in 1998-1999. By the end of the year, the growth-to-value ratio reached its highest level since March 2000.

Large-cap stocks outperformed small-cap stocks by 13% in 2024, following a 9% outperformance in 2023. This represented the largest two-year outperformance of large-caps over small-caps since 1997-1998. During the year, the ratio of large-caps to small-caps reached its highest level since October 1999.

Will these trends persist for a third consecutive year? The answer remains uncertain, and only time will reveal the outcome. However, we anticipate the market to broaden more than it has over the past couple of years, with increased participation from sectors that have faced challenges of late.

2025 OUTLOOK

Looking ahead, we see a favorable backdrop in 2025, though it may call for a more patient and disciplined investment approach. Firm economic conditions, normalizing inflation, expanding profit growth, strong secular themes across technology, and growth-oriented fiscal policies create a promising outlook for investors.

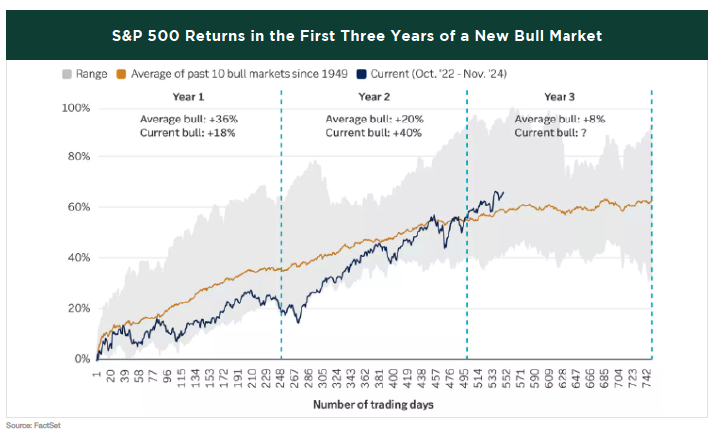

In 2024, the stock market achieved its second consecutive year of gains exceeding 20%, a milestone last seen in 1998. This impressive performance was driven by a resilient consumer, rising corporate profits, and Fed easing— factors we anticipate will likely remain in place for 2025. However, returns are likely to moderate and volatility to increase, but overall, we think there is a decent chance that the rise in stocks will continue for a third year.

Despite strong fundamentals, the third year of this bull market may not be as smooth as the previous couple of years. There is significant policy uncertainty surrounding trade, immigration, and tariffs, as well as heightened expectations for pro-growth initiatives. While the right mix of policies could boost the economy, it also carries potential implications for inflation and interest rates.

TARIFFS

The potential impact of tariffs from the Trump administration is currently a major focus for investors. The Federal Reserve is closely monitoring the situation as well, with Chair Powell citing the possible inflationary effects of tariffs as one reason why some FOMC members may have raised their inflation forecasts for this year and increased the perceived upside risks to prices.

First, let’s define what a tariff is: it’s a tax imposed on foreign-made goods, paid by the importing business to its home country’s government. Tariffs serve several purposes. Like all taxes, they generate government revenue. They can also be used to protect emerging domestic industries by shielding them from foreign competition. Additionally, some tariffs are aimed at addressing unfair practices used by other countries to make their exports artificially cheap.

Tariffs are a contentious issue, with both critics and supporters of their implementation. Most economists argue that the majority of tariff costs are passed on to consumers, especially in industries with thin profit margins, such as retail. By raising the cost of goods, tariffs can contribute to inflationary pressures. In response, central banks may need to raise interest rates, which could slow economic growth and increase borrowing costs for both businesses and consumers.

Tariffs can also disrupt supply chains, as modern industries rely heavily on global networks, and tariffs threaten this delicate balance. Higher costs and logistical challenges could impact production in sectors like technology, automotive, and retail. Many believe the most significant risk is the potential for a trade war, where countries affected by tariffs retaliate with their own measures, escalating tensions and leading to further economic damage.

Proponents of tariffs argue that they help protect domestic industries from foreign competition. By taxing imports, tariffs encourage consumers to purchase domestically produced goods, potentially preserving jobs in critical sectors. Additionally, tariffs generate extra revenue for the government, as importers pay duties on foreign goods, providing a short-term economic boost. Supporters also contend that tariffs incentivize companies to manufacture goods domestically. By making imported goods more expensive, businesses may find it more cost-effective to keep production domestic, strengthening supply chain resilience and enhancing national security.

At the same time, tariffs can negatively impact exporters who may need to lower prices to maintain market share.

If they don’t reduce prices, their products can become relatively more expensive, leading to a decline in sales. Both lowering and keeping prices unchanged can reduce profits, potentially harming the exporting country’s economy. This is particularly concerning for countries whose economies are heavily reliant on exports, such as many in Asia. China, for example, became the world’s largest exporter in 2009. Countries that depend on exports for growth may lose customers due to tariffs, facing significant economic challenges as a result.

As of this writing, it’s unclear what tariffs the new administration will impose on other countries, so it’s difficult to speculate on their potential impacts. Some of Trump’s rhetoric may be part of a tough negotiating strategy aimed at securing concessions from trade partners. We will need to wait and see how the situation unfolds.

Many are concerned about the U.S. entering a trade war with China. If that occurs, China’s economy would likely feel a much greater impact than ours. Looking at China’s trade balance with the world, which measures the net difference between what two countries buy from each other, one clear standout is the United States. The U.S. purchases far more goods from China than it exports to China. Specifically, China’s exports to the U.S. account for about 3%-4% of its GDP, while U.S. exports to China make up only 0.5% of China’s GDP. China’s exports to the U.S. are vital for many of its industries, giving the U.S. significant negotiating leverage with China.

It’s still too early to assess the full impact of future tariff announcements and threats, which will likely continue to be a prominent theme in 2025 and will undoubtedly cause market volatility. However, we can reflect on the lessons learned from the “Trade War 1.0” of 2018 and 2019. One key takeaway from that period is that there was far more tariff talk than tariff action. While markets may react negatively in the short term, it’s important for investors to distinguish between signal and noise. Market downturns caused by tariff concerns may present investment opportunities. After a tough 2018, when tariff policies were at the forefront, global equities rebounded strongly in 2019, with the U.S. rising +32%, Europe +26%, and emerging markets +19%.

INVESTING AT RECORD HIGHS

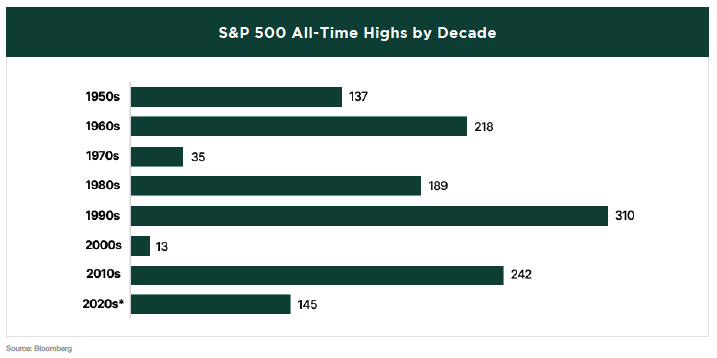

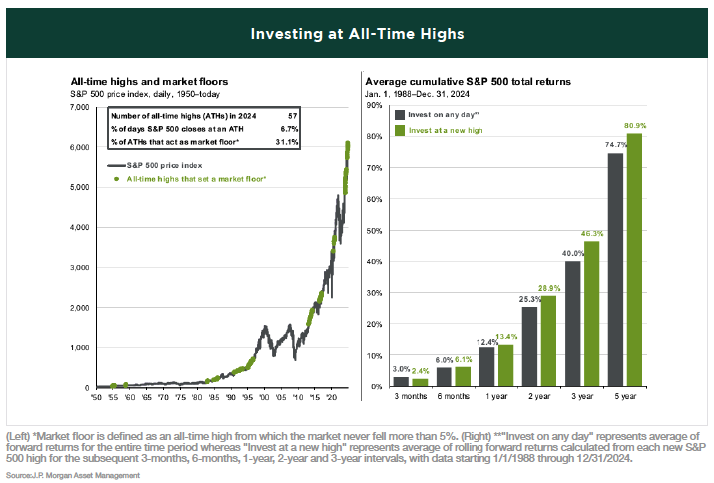

As of this writing, the S&P 500 is sitting at a record high. In situations like this, investors may face what are often called “psychological barriers to entry.” They may question whether it’s the best time to put new money into the market. This type of thinking is tied to attempts to time the market—where investors try to avoid buying at market highs and wait for market lows. However, timing the market is almost impossible to get right. And all-time highs are not uncommon—so you would be missing out on a lot of opportunity if you tried to avoid them. In fact, since 1950 the broad U.S. equity market has set more than 1,250 all-time highs on its way to the current level, averaging more than 16 new highs each year.

For many investors, market pullbacks feel almost inevitable when markets reach all-time highs. This sentiment is particularly strong in today’s environment, where a significant portion of the S&P 500’s return has been driven by concentrated gains and multiple expansion. However, stocks can remain attractive even at all-time highs. Since 1950, the S&P 500 has reached an all-time high on about 7% of trading days, and nearly a third of these highs became new market “floors”—levels from which investors never had the chance for a “second bite of the apple.”

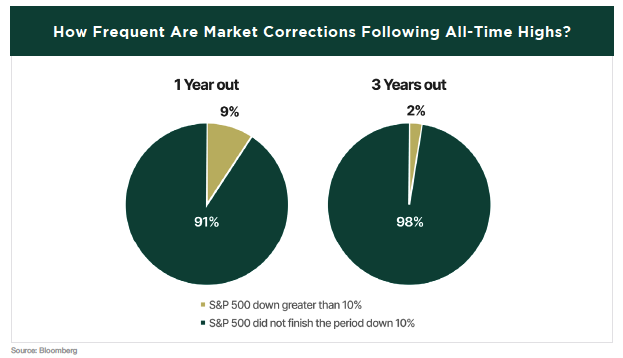

Some investors choose to stay in cash, waiting for a significant correction before they invest. However, often a major correction never materializes, leaving the investor with the regret of missing out on potential returns. In fact, since 1950, when we look where the S&P 500 was trading one year after hitting each all-time high, only 9% of the time has there been a correction greater than 10%. When we extend the time horizon, market corrections become even rarer. At the end of a three-year period following an all-time high, the market was down by more than 10% only 2% of the time.

KEY INVESTING PRINCIPLES

In the previous quarter’s The Viewpoint, we outlined four key principles that we consider essential for every investor. These principles were:

- PLAY THE LONG GAME

- NEVER INTERRUPT COMPOUNDING UNNECESSARILY

- DIVERSIFY, DIVERSIFY, DIVERSIFY

- EMBRACE RISK

This quarter, we will discuss two more important rules for successful investing.

- LEARN TO BE GOOD AT SUFFERING

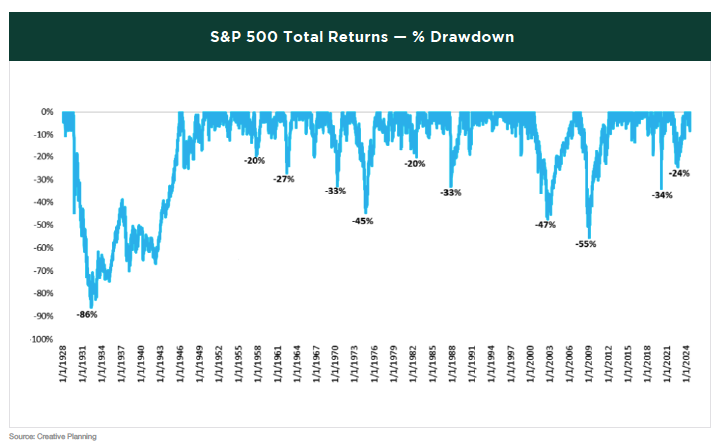

Since 1928, the U.S. equity market has achieved a cumulative total return of over 1,000,000%, assuming dividends were reinvested.

What’s the catch? It wasn’t a smooth, straight line higher—far from it. An investor in U.S. equities would have been in a drawdown over 90% of the time.

Many people think that there must be a better way—one that allows them to capture the upside without experiencing the downside.

We all wish for that. The only problem is that by trying to time the market or hedge your exposure, you’re likely to miss out on a significant portion of the gains.

To reap the greatest rewards, you must be able to endure the painful setbacks and keep moving forward. Which is why the ultimate superpower in investing is the ability to handle suffering.

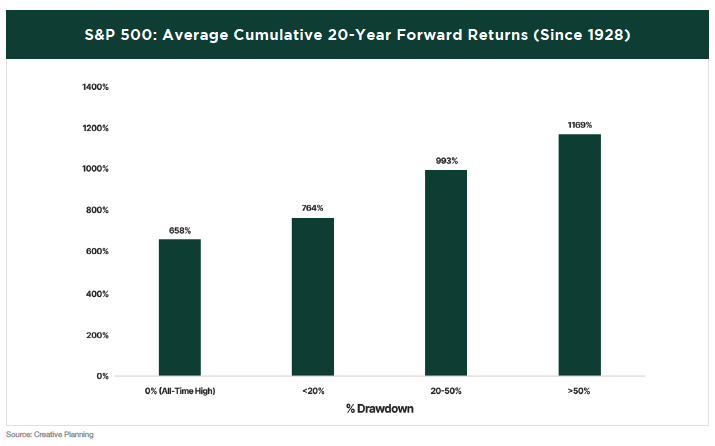

The following chart illustrates the average cumulative 20-year forward return of the S&P 500 at various levels of market drawdowns. For example, when the market is at an all-time high, the average cumulative return 20 years later is 658%. In contrast, when the market is down more than 20%, the average cumulative return 20 years later rises to 993%.

The question is: How many investors would be willing to invest during those challenging times, and how many would be rushing to hold cash instead?

- FOCUS ON SAVING BEFORE INVESTING

Investment returns often steal the spotlight, but for most people, how much they save is far more important. This is because many people don’t save enough, and without savings, there’s nothing to invest. That holds true whether you earn $50,000 a year or $500,000 a year—if you spend everything you make, there’s nothing left to invest.

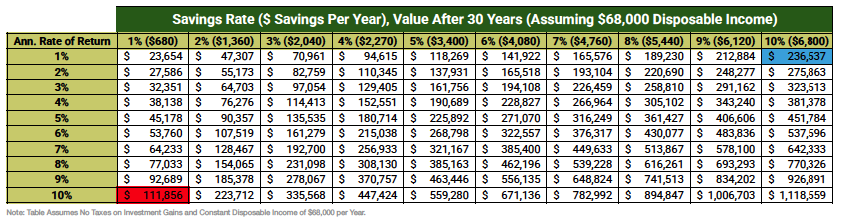

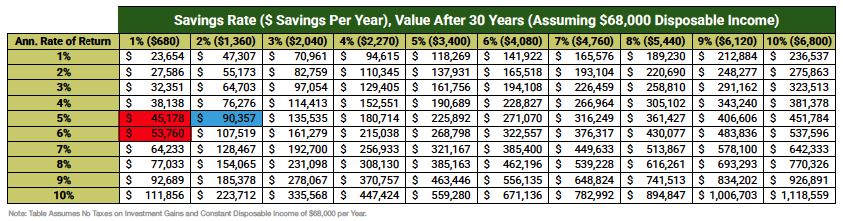

Over the course of 30 years, saving 10% of your income with a 1% rate of return easily outperforms a 10% return with a 1% savings rate.

If you’re saving very little today, your primary focus should be on saving more. Why? Because the long-term benefits of a higher savings rate will far outweigh the gains from earning higher returns.

For instance, if a household with a disposable income of $68,000 saved only 1% per year and earned a 5% return, after 30 years they would have $45,178. If they earned a 6% return instead, that amount would rise to $53,760—a 19% increase.

In comparison, if their returns stayed at 5% but they increased their savings rate by just 1% (to a 2% savings rate), they would end up with $90,357 after 30 years. That’s a 100% increase in the ending balance simply by saving 1% more, compared to a 19% increase from earning a 1% higher return.

Clearly, saving has a greater impact than investment returns for the average household. This is good news because saving more is within your control, whereas achieving a higher rate of return is much more challenging and less predictable.

PLEASE SPEAK WITH YOUR WEALTH ADVISOR IF YOU HAVE ANY QUESTIONS OR WANT TO REVIEW YOUR PORTFOLIO TO BE SURE THAT YOU ARE IN THE MOST APPROPRIATE STRATEGY TO HELP YOU ACCOMPLISH YOUR LONG-TERM GOALS.

SINCERELY,

THE INVESTMENT TEAM AT GREYSTONE FINANCIAL GROUP

DISCLOSURES

There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

All expressions of opinion are subject to change. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investors should talk to their Wealth Advisor prior to making any investment decision.